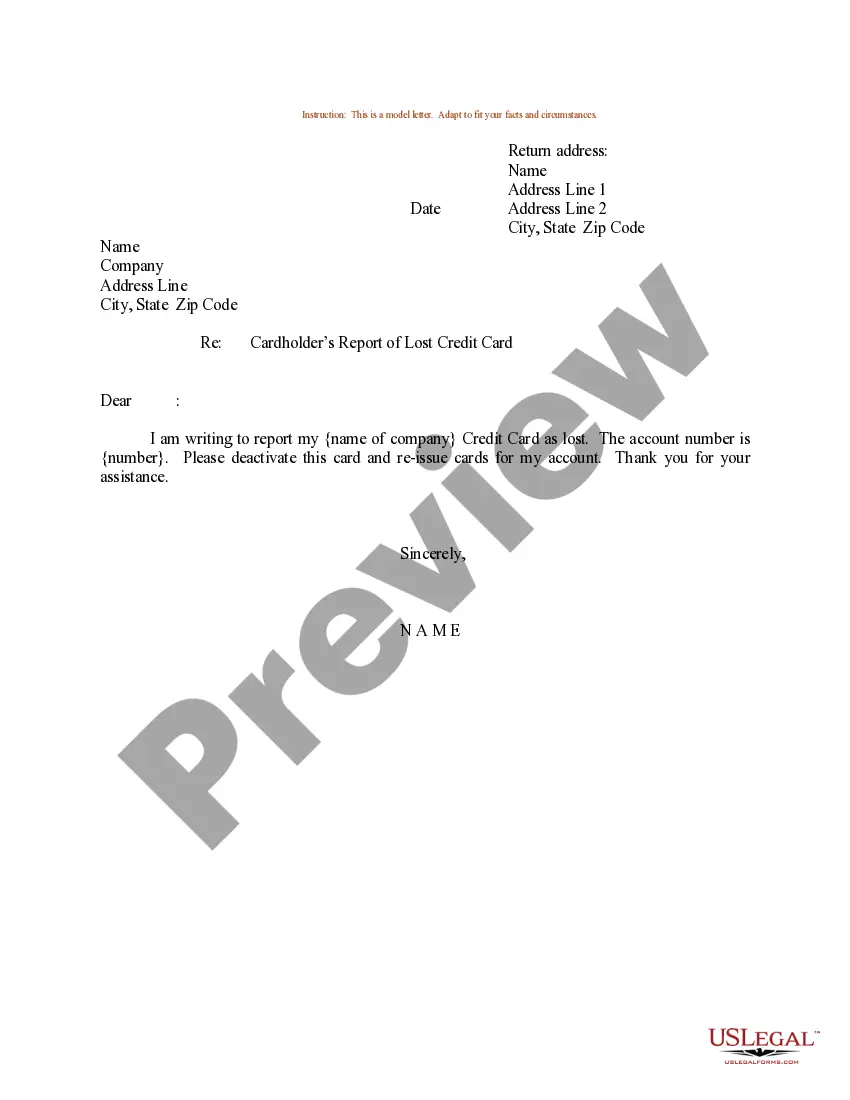

Virginia Sample Letter for Cardholder's Report of Lost Credit Card

Description

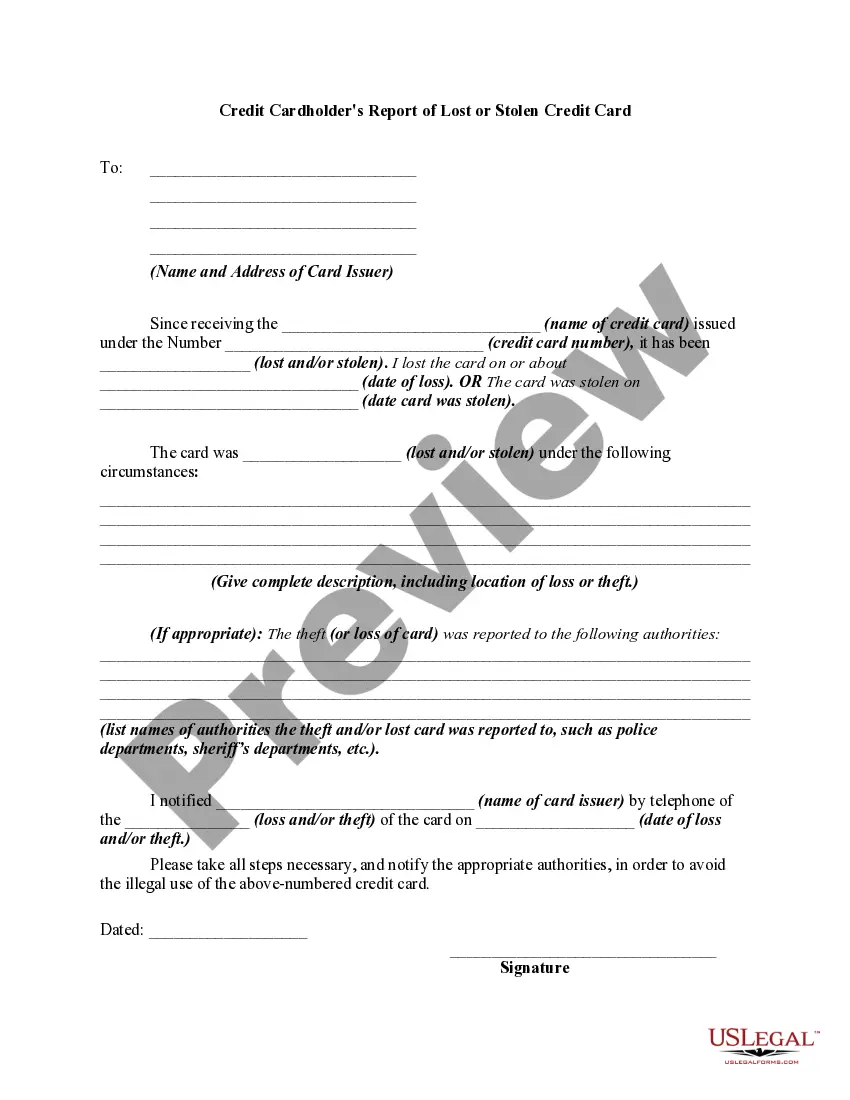

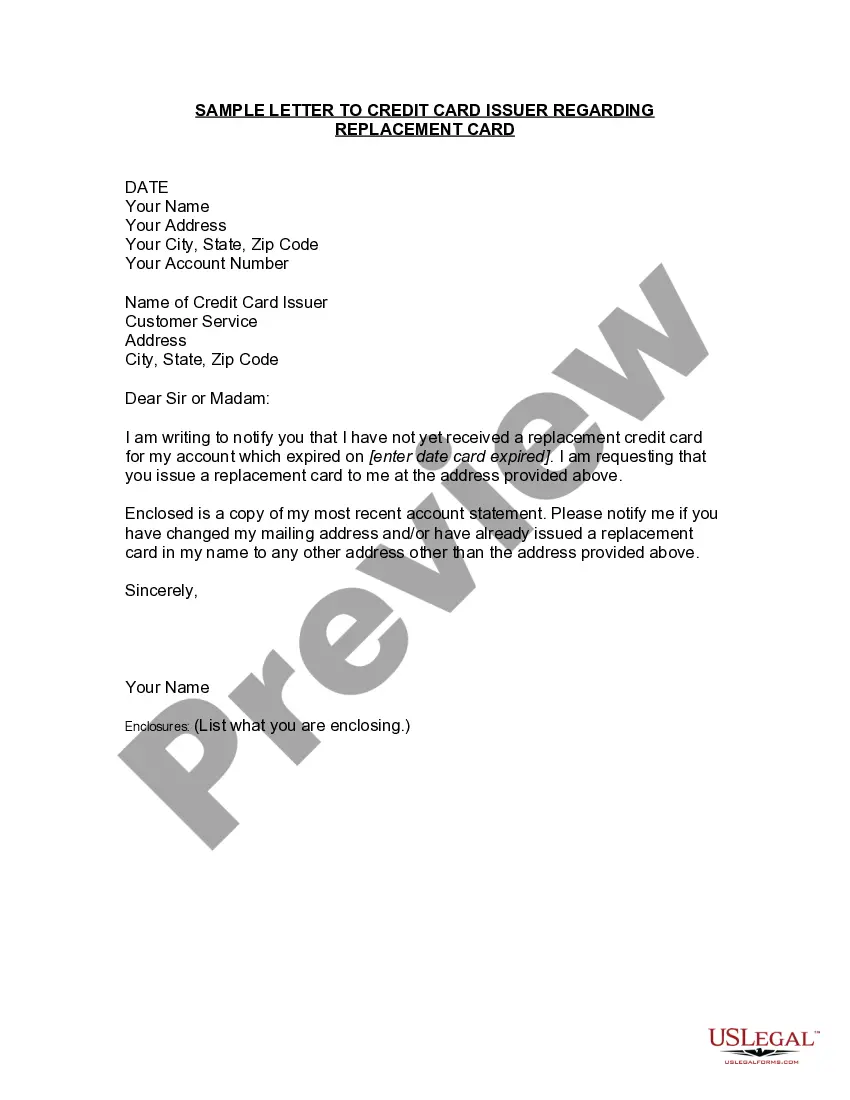

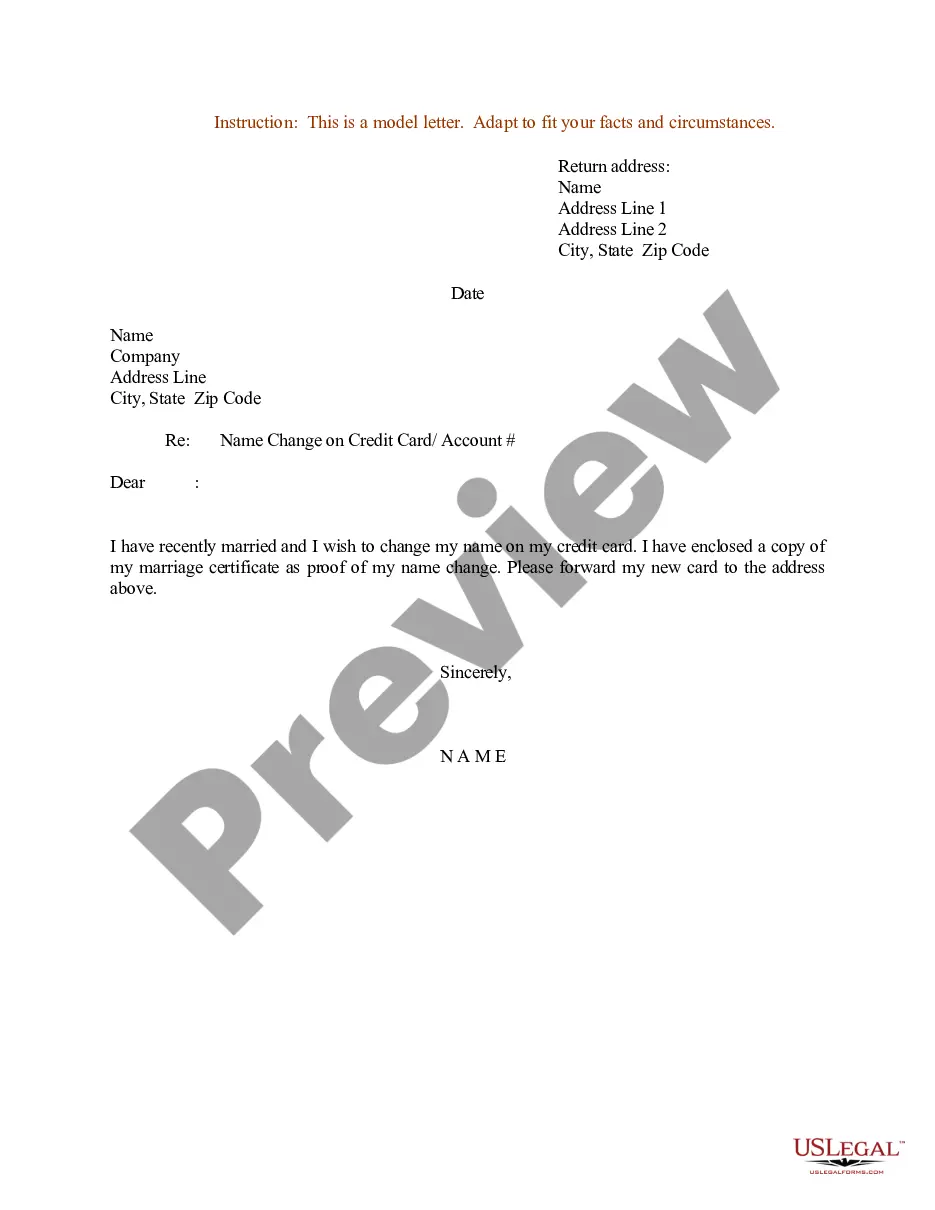

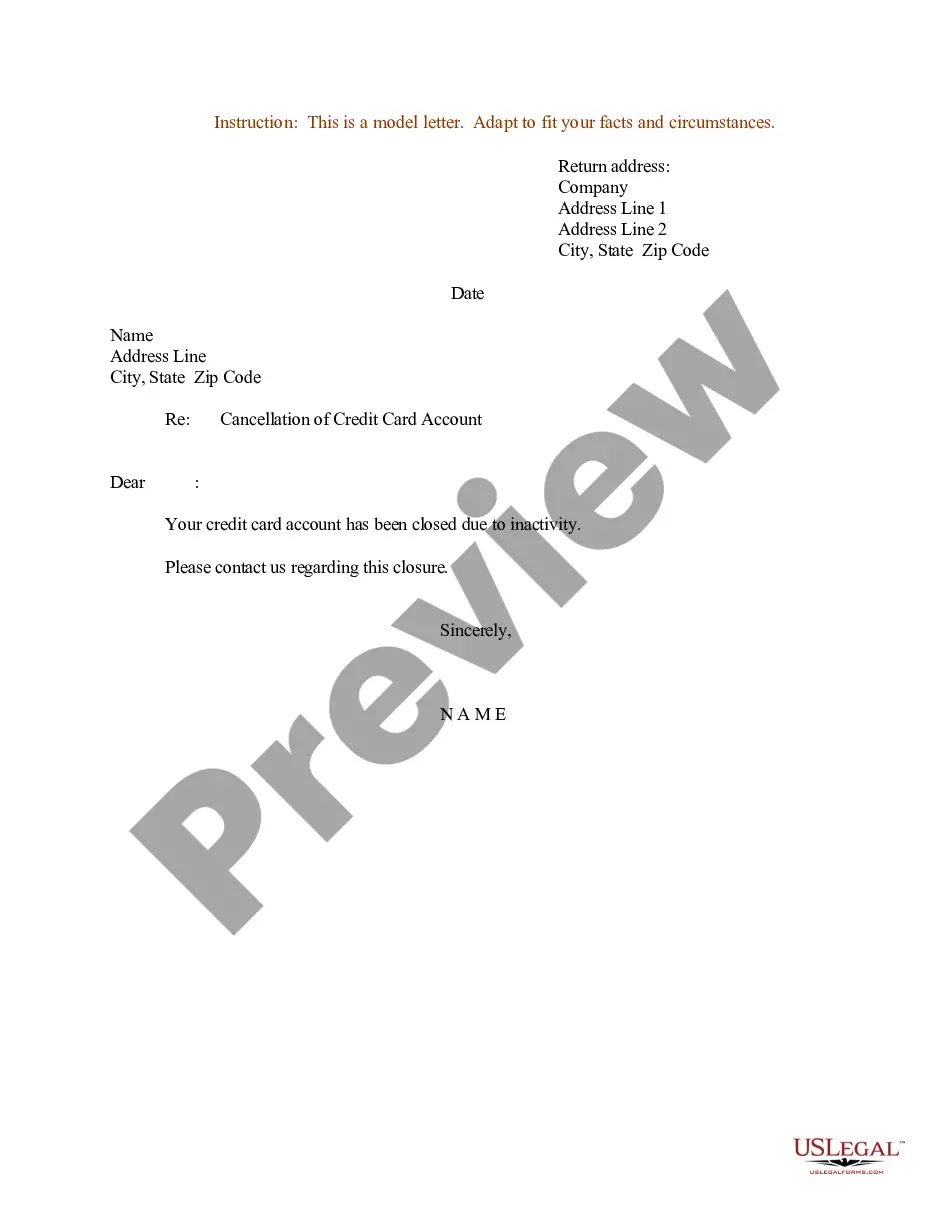

How to fill out Sample Letter For Cardholder's Report Of Lost Credit Card?

If you need to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Choose your preferred pricing plan and enter your information to create an account.

Step 5. Complete the payment. You can utilize your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to obtain the Virginia Sample Letter for Cardholder's Report of Lost Credit Card with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Download button to retrieve the Virginia Sample Letter for Cardholder's Report of Lost Credit Card.

- You can also access templates you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the details of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Dear Sir or Madam: I am writing to dispute a fraudulent charge on my account in the amount of $....Sample LetterThe charge be removed.Any finance and/or other charges related to the fraudulent charge be credited to my account.I receive an accurate statement ASAP.16-Aug-2015

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

There are some tips to consider before you write your letter:Communicate directly with the original creditor.Be kind and respectful.Explain why they should remove the charge-off, whether it be a mistake or you plan to pay an amount.Do not make excuses as to why you didn't pay the account in the first place.More items...?

Police rarely investigate credit card theft. One reason is that the majority of credit card theft victims will not bother to report the crime to the police.

Tips. Credit card companies can track where your stolen credit card was last used, in most cases, only once the card is used by the person who took it. The credit card authorization process helps bank's track this. However, by the time law enforcement arrives, the person may be long gone.

If you have a few minutes, call the credit card company Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.

This is to inform you that I (Name) having a (name of credit card) credit card with your bank has lost the credit card bearing number (credit card number). I request you to kindly deactivate the card and stop all the transactions through the card to avoid misuse.

In general, he says a person who finds a card should either drop the card off in person at a bank or destroy it. Both options would prevent anyone else from getting their hands on the debit card and spending someone's hard-earned dollars.

The primary cardholder has to add an authorized user. This can be done by calling the credit card issuer or logging onto the online account. Many issuers will issue a second card for the authorized user, but it will generally be mailed to the primary cardholder, who can choose to give it to the authorized user or not.

Respected Sir/Madam, I beg to state that my name is (Name) and I am a (Name of credit card) credit card holder of your bank having credit card number (Credit card number). I am writing this letter to complain about the charges being levied on my credit card.