Virginia Electronic Software Distribution Agreement

Description

How to fill out Electronic Software Distribution Agreement?

If you want to aggregate, retrieve, or produce authentic document templates, utilize US Legal Forms, the most extensive variety of authentic forms available online.

Take advantage of the website's simple and convenient search feature to locate the documents you require.

Many templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Virginia Electronic Software Distribution Agreement with just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to all forms you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Virginia Electronic Software Distribution Agreement with US Legal Forms. There are countless professional and state-specific forms you can use for your personal or business needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Virginia Electronic Software Distribution Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

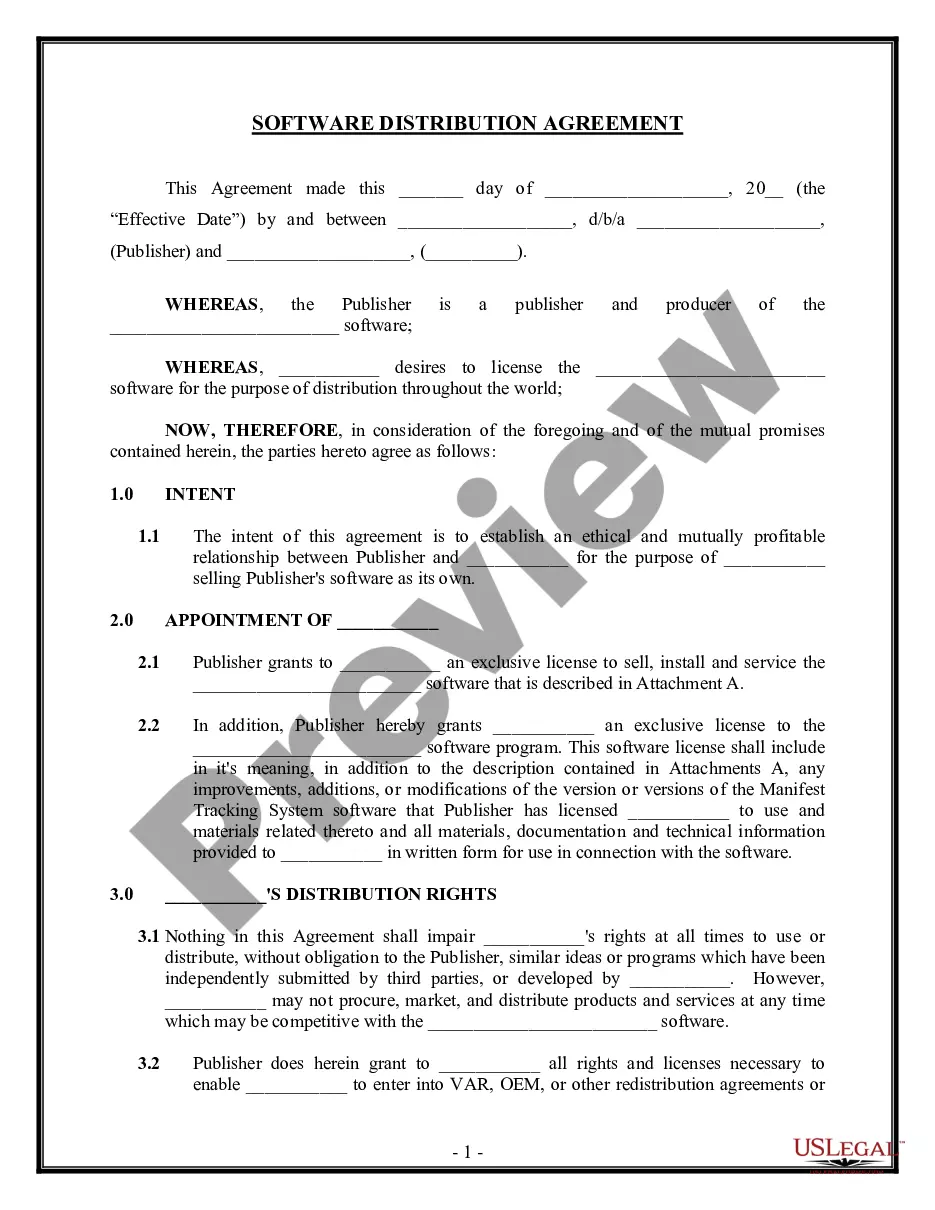

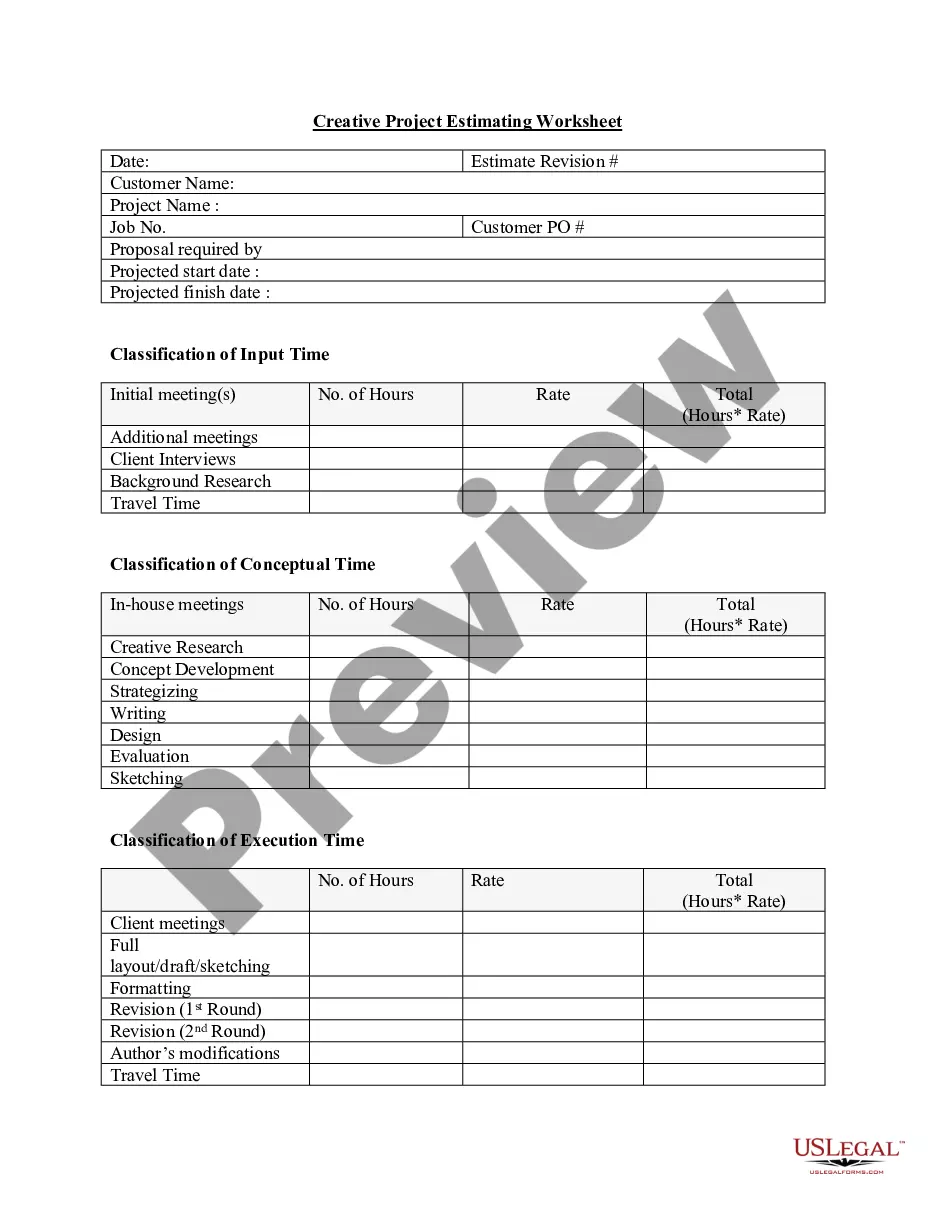

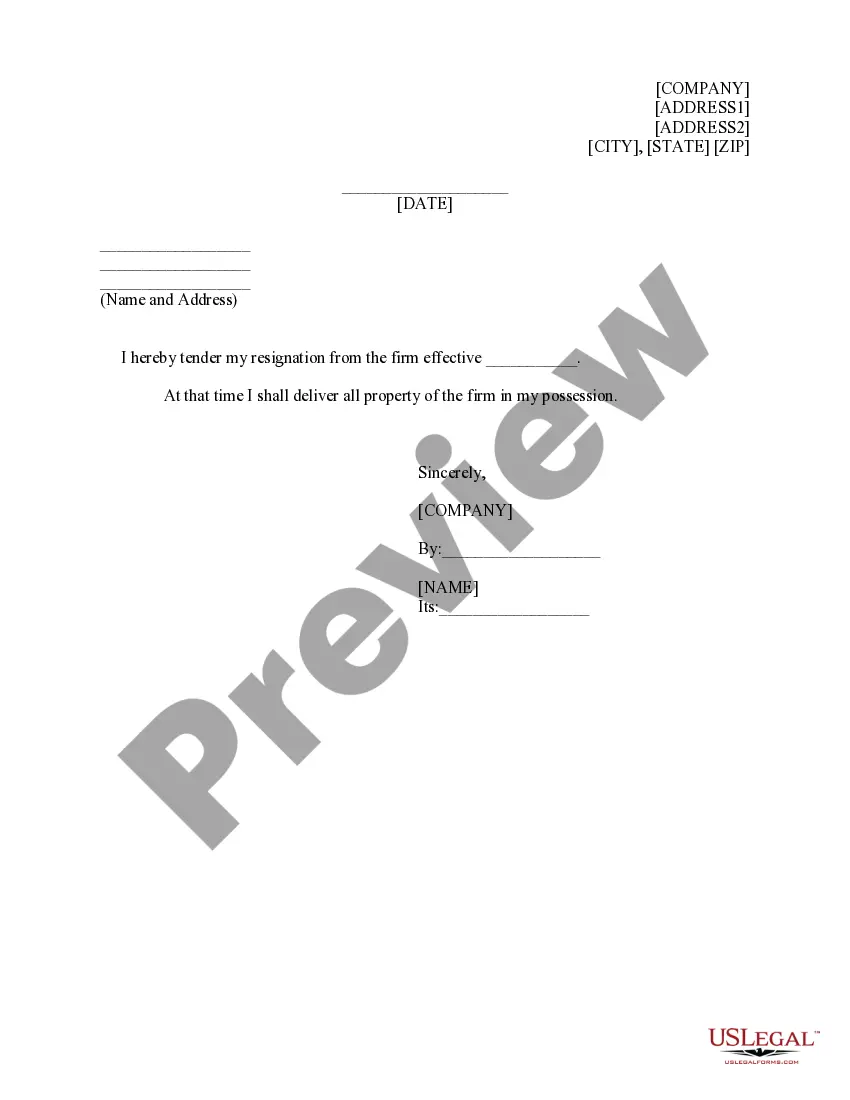

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. After you have found the form you need, click the Buy Now button. Select the payment option you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Complete, edit, and print or sign the Virginia Electronic Software Distribution Agreement.

Form popularity

FAQ

Sales of digital products are exempt from the sales tax in Virginia.

Virginia does not usually collect sales taxes on services. However, services which considered part of the physical merchandise purchased, as valued is money or in (such as setup of a purchased piece of machinery)seen as being taxable. Some services are entirely taxable.

Subscriptions to use online-hosted software are not taxable. Charges for maintenance or upgrades to online hosting software are not taxable, even if separately stated. Digital products are products provided to a customer electronically.

The Taxpayer is correct that the sale of software delivered electronically to customers does not constitute the sale of tangible personal property and is generally not subject to Virginia sales and use taxation.

Electronically Delivered Software The Virginia Department of Revenue has maintained a long-standing policy, which is referenced in Virginia Public Document Ruling No. 05-44 , that sales of software delivered electronically do not constitute the sale of tangible personal property and are not subject to sales tax.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Because downloadable prewritten software is not identified as tax-exempt, it is treated as generally taxable regardless of how it is transferred or delivered to the purchaser.

In the state of Virginia, any maintenance contracts that provide only repair labor are considered to be exempt. Any contracts that provide both parts and labor are definitely subject to tax on one-half the total charge for the contract. Contracts which provide only parts are considered to be taxable.

Charges for services generally are exempt from the retail sales and use tax. However, services provided in connection with sales of tangible personal property are taxable.

Charges for services generally are exempt from the retail sales and use tax. However, services provided in connection with sales of tangible personal property are taxable.