Virginia Loan Agreement for Personal Loan

Description

How to fill out Loan Agreement For Personal Loan?

Choosing the right legal papers design can be quite a have difficulties. Naturally, there are a variety of web templates available on the Internet, but how do you discover the legal type you need? Use the US Legal Forms site. The assistance delivers thousands of web templates, such as the Virginia Loan Agreement for Personal Loan, that you can use for company and personal requires. All of the forms are examined by specialists and meet state and federal requirements.

Should you be previously registered, log in to the accounts and then click the Obtain key to have the Virginia Loan Agreement for Personal Loan. Make use of your accounts to look throughout the legal forms you may have acquired in the past. Go to the My Forms tab of your respective accounts and have one more backup of your papers you need.

Should you be a brand new customer of US Legal Forms, here are basic directions for you to adhere to:

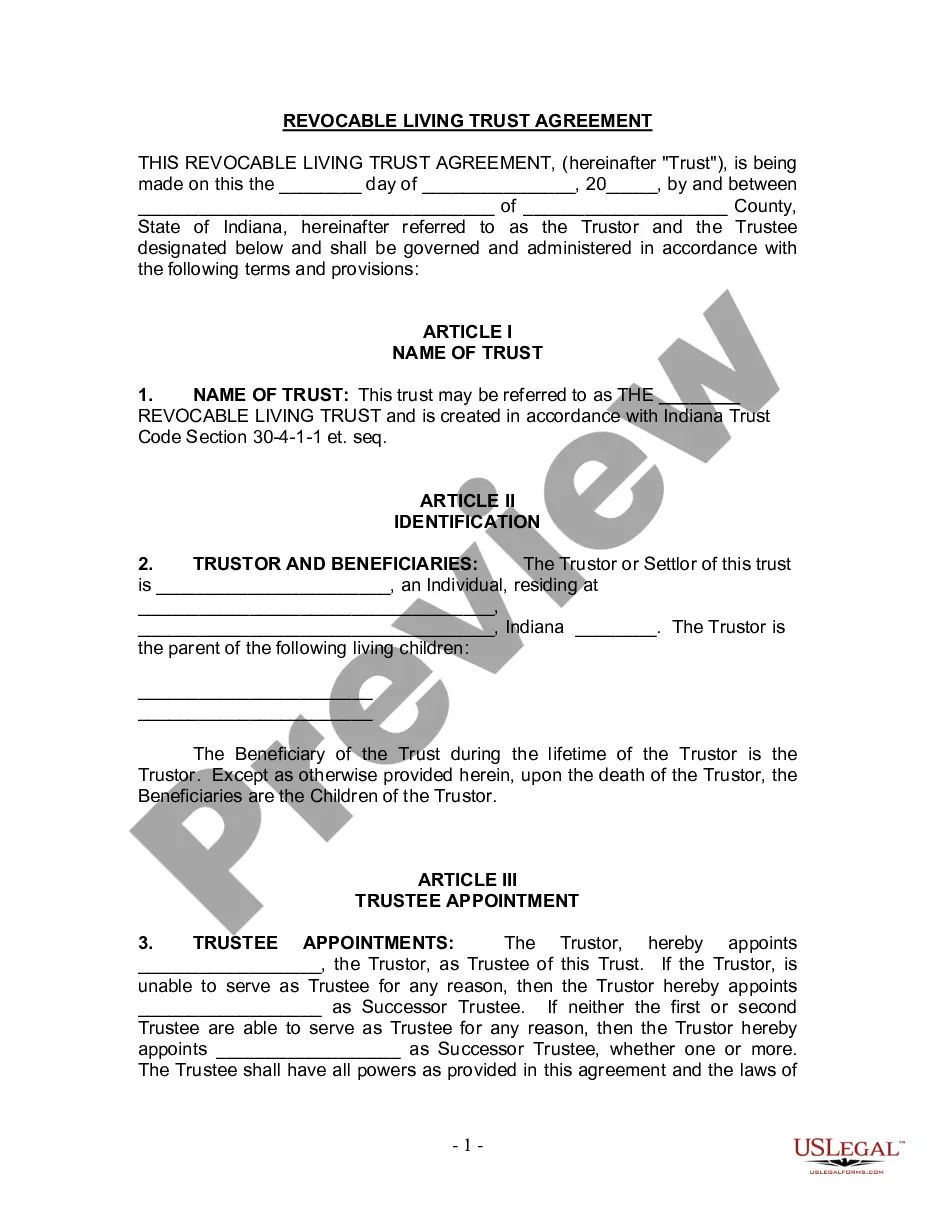

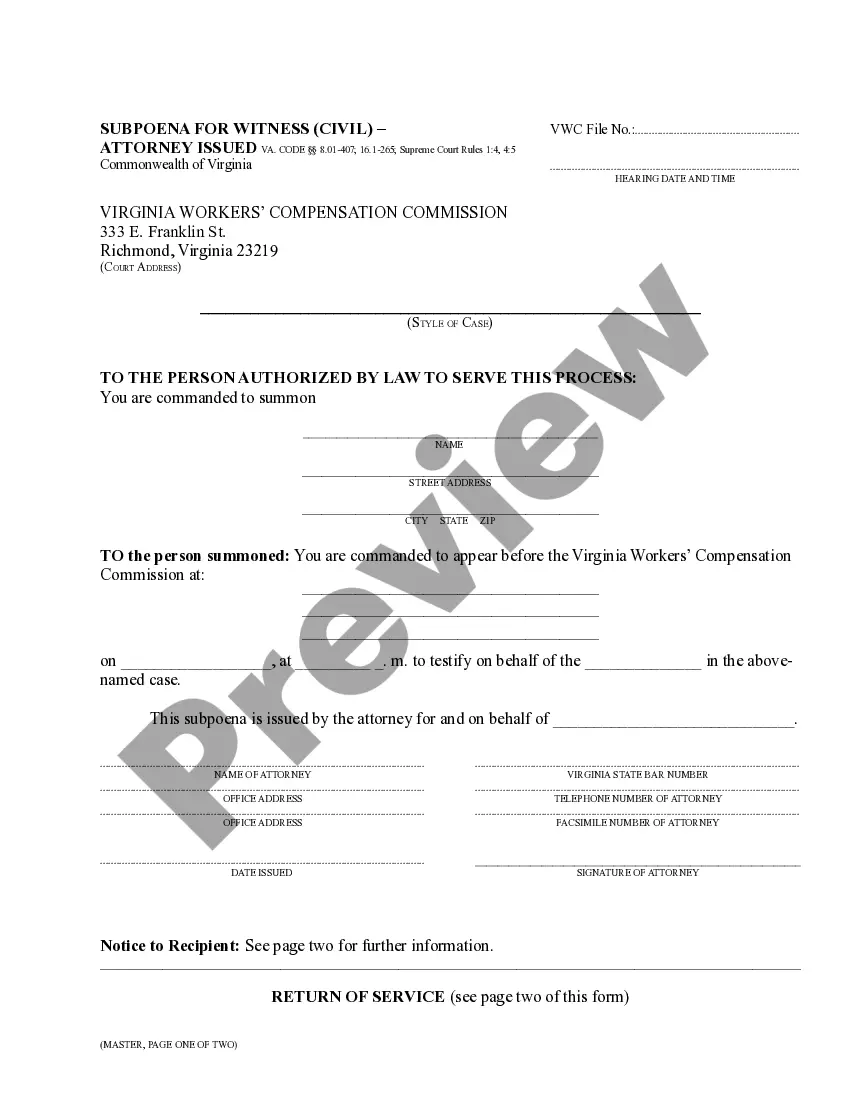

- Initial, ensure you have chosen the right type for the metropolis/county. You may examine the form using the Review key and look at the form description to ensure this is the best for you.

- If the type will not meet your preferences, utilize the Seach area to find the right type.

- When you are certain the form is acceptable, go through the Buy now key to have the type.

- Select the costs program you desire and enter in the essential info. Create your accounts and purchase an order with your PayPal accounts or Visa or Mastercard.

- Choose the file formatting and down load the legal papers design to the system.

- Complete, change and print and signal the obtained Virginia Loan Agreement for Personal Loan.

US Legal Forms is definitely the most significant library of legal forms that you can discover various papers web templates. Use the company to down load skillfully-created paperwork that adhere to condition requirements.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

The minimum duration of the loan is four months and the maximum duration of the loan is 24 months; however, the minimum duration of the loan may be less than four months if the total monthly payment on the loan does not exceed the greater of (i) an amount that is five percent of the borrower's verified gross monthly ...

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.