Virginia Price Setting Worksheet

Description

How to fill out Price Setting Worksheet?

If you wish to finish, acquire, or generate legal documents topics, utilize US Legal Forms, the largest assortment of legal templates, which can be accessed online.

Employ the site’s straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are categorized by types and claims, or keywords.

Step 4. Once you have found the form you want, click the Get now option. Choose your preferred pricing plan and enter your information to sign up for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.Step 6. Select the format of your legal form and download it to your device.Step 7. Fill out, edit and print or sign the Virginia Price Setting Worksheet. Each legal document template you acquire is yours forever. You have access to all forms you've saved in your account. Click on the My documents section and select a form to print or download again. Reap and retrieve, and print the Virginia Price Setting Worksheet with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal requirements.

- Use US Legal Forms to find the Virginia Price Setting Worksheet in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download option to retrieve the Virginia Price Setting Worksheet.

- You can also access templates you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these guidelines.

- Step 1. Ensure you've selected the form for the appropriate jurisdiction.

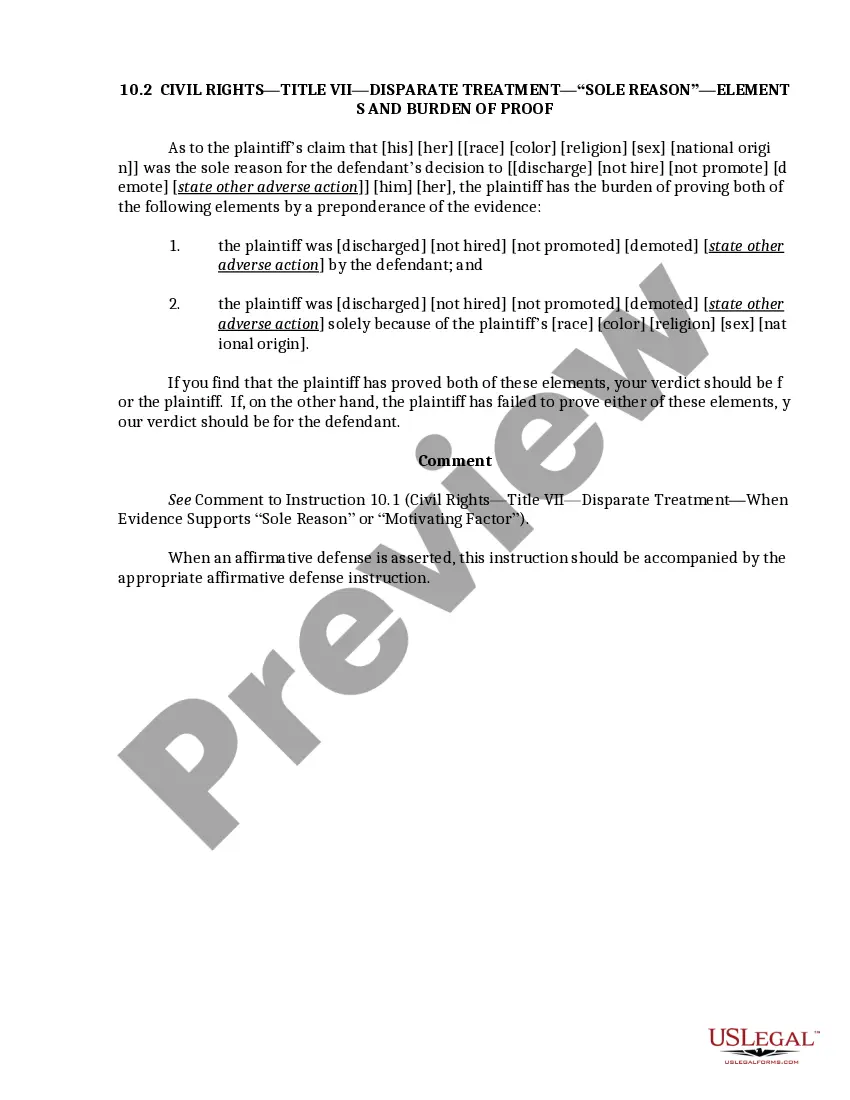

- Step 2. Use the Review option to examine the form’s content. Don't forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form template.

Form popularity

FAQ

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

Family Virginia adjusted gross income includes the total Virginia adjusted gross income for you, your spouse, and your dependents, even if they do not file their own Virginia returns.

How to calculate adjusted gross income (AGI)Start with your gross income. Income is on lines 7-22 of Form 1040.Add these together to arrive at your total earned income.Subtract your adjustments from your total income (also called "above-the-line deductions")You have your AGI.

The tax is based on the Federal Adjusted Gross Income. In most cases, your federal adjusted gross income (line 21 on form 1040A; and line 37 on form 1040) plus any Virginia additions and minus any Virginia subtractions computed on Schedule ADJ, is called Virginia Adjusted Gross Income.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

The starting point for computing Virginia taxable income is federal adjusted gross income.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.