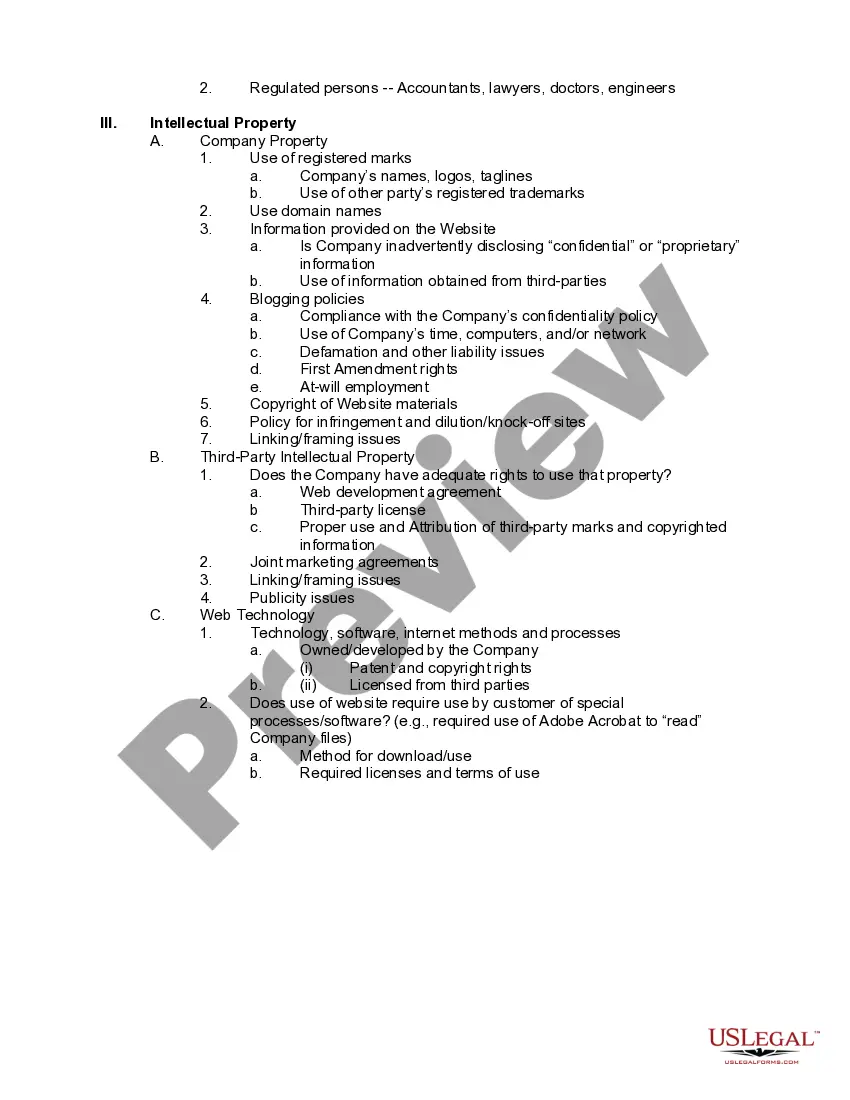

Virginia Compliance Checklist For Company Websites

Description

How to fill out Compliance Checklist For Company Websites?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms such as the Virginia Compliance Checklist For Business Websites within moments.

If you already have an account, Log In and obtain the Virginia Compliance Checklist For Business Websites from the US Legal Forms catalog. The Download button will be visible on every form you access. You can find all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a Visa, Mastercard, or PayPal account to finalize the purchase.

Select the format and download the form to your device.

- Ensure you have selected the appropriate form for your city/region.

- Click on the Review button to review the form's contents.

- Check the form details to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find the suitable one.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your desired pricing plan and provide your details to register for an account.

Form popularity

FAQ

In Virginia, you do not need to renew your LLC every year, but you must file an annual report. This filing is crucial to keep your LLC in good standing with the state. Following the Virginia Compliance Checklist For Company Websites can assist you in staying on track with these requirements.

Yes, Virginia LLCs must file an annual report to remain compliant with state laws. This report contains essential information about your business and helps the state maintain accurate records. Use the Virginia Compliance Checklist For Company Websites to ensure that you meet all reporting obligations.

Yes, registering your business with the State Corporation Commission (SCC) in Virginia is necessary for most business types. This registration provides legal protections and is a requirement for operating lawfully in the state. The Virginia Compliance Checklist For Company Websites can help you navigate the SCC's requirements effectively.

Yes, Virginia LLCs are required to file annual reports. This requirement helps maintain your LLC's active status and ensures compliance with state regulations. By adhering to the Virginia Compliance Checklist For Company Websites, you can streamline this process and avoid penalties.

Yes, if you operate an online business in Virginia, you must register it with the state. This registration is necessary for tax purposes and legal recognition. Following the Virginia Compliance Checklist For Company Websites will guide you through the registration process smoothly.

Many states require annual reports for LLCs, including Virginia, Delaware, and California. Each state has its own rules and deadlines, making it vital to check your specific requirements. Utilizing the Virginia Compliance Checklist For Company Websites can help ensure your business stays compliant across various states.

Yes, Virginia requires certain businesses to file an annual report with the state. This report keeps your business compliant and ensures that your information remains up to date. For companies like LLCs, adhering to the Virginia Compliance Checklist For Company Websites is essential to maintain good standing.