Virginia Aging of Accounts Receivable

Description

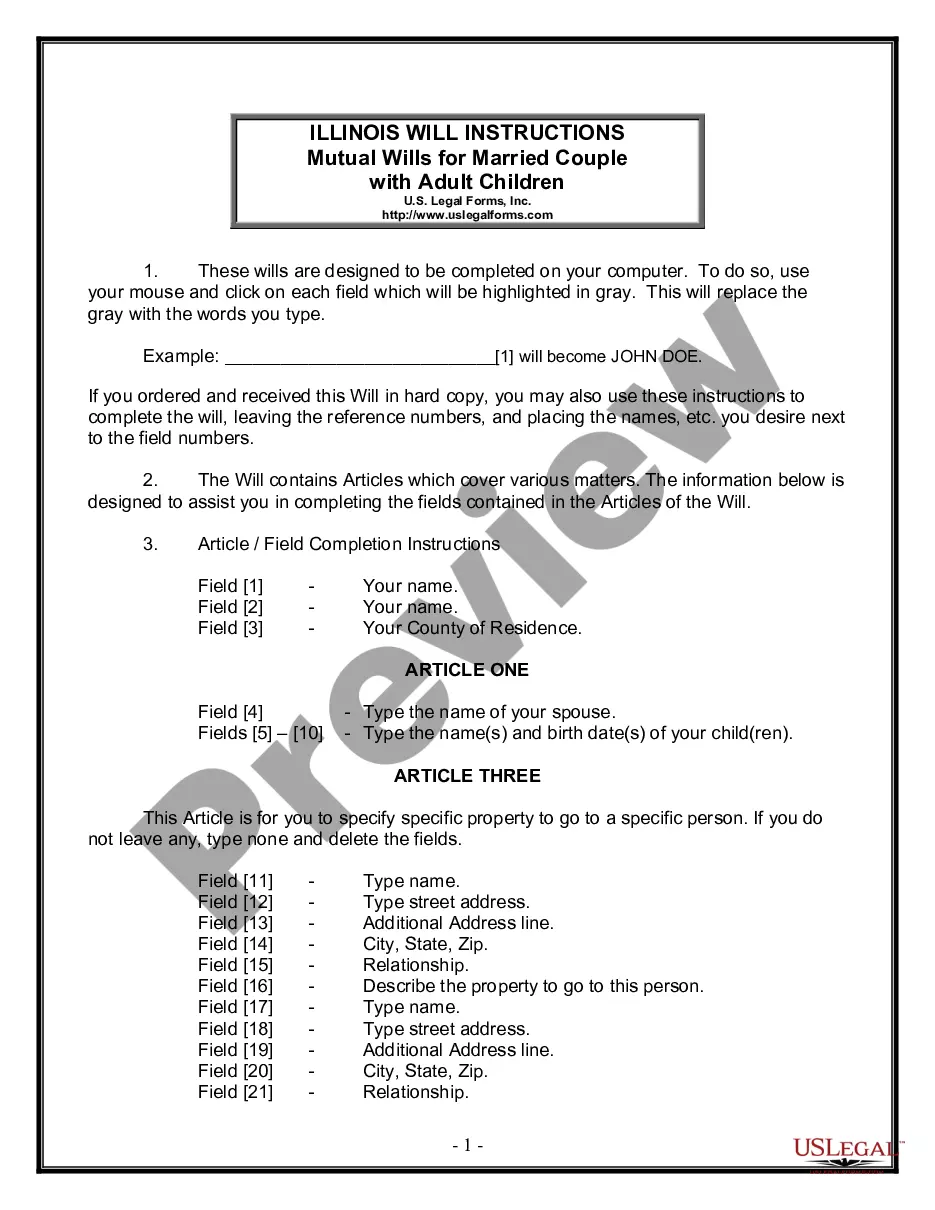

How to fill out Aging Of Accounts Receivable?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive selection of legal document templates that you can download or print.

By utilizing the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of forms like the Virginia Aging of Accounts Receivable within seconds.

Read the form information to confirm that you have chosen the right form.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does. Once you are satisfied with the form, affirm your choice by clicking the Download now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finish the transaction. Choose the format and download the form to your device. Make changes. Fill out, modify, and print and sign the saved Virginia Aging of Accounts Receivable. Every template you have added to your account has no expiration date and is your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Virginia Aging of Accounts Receivable with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you have a subscription, Log In and download the Virginia Aging of Accounts Receivable from the US Legal Forms library.

- The Download button will be displayed on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the correct form for your area/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

The Virginia Aging of Accounts Receivable is based on the time that your invoices remain unpaid. This process categorizes accounts based on how long they have been outstanding, typically ranging from current (0-30 days) to overdue categories. By analyzing this data, you can identify trends in customer payments and improve collection strategies. To effectively manage your accounts receivable, consider utilizing resources like USLegalForms, which can help you simplify your invoicing and tracking processes.

To report accounts receivable aging in QuickBooks, start by accessing the Reports menu. Select 'Customers & Receivables,' then choose 'Aging Summary' or 'Aging Detail.' This report will illustrate how long your receivables have been outstanding, helping you understand your Virginia aging of accounts receivable and manage collections more effectively.

Preparing an accounts receivable aging schedule starts with listing all your outstanding customer invoices. Group these invoices based on their due dates into defined age categories. Finally, include totals for each category to track customers' payment histories, ultimately helping you analyze your Virginia aging of accounts receivable.

To find the average age of accounts receivable, you need to divide the total number of days that accounts receivable remain outstanding by the number of invoices. This formula gives you a clear view of how long it takes to collect payments. Understanding the average age of your accounts will enhance your approach to managing the Virginia aging of accounts receivable.

The formula for aging accounts receivable involves categorizing your invoices and then tallying the total amounts in each category. You can find the percentage of each category by dividing the total amount by the overall accounts receivable balance. This method will clarify your Virginia aging of accounts receivable, making it easier to manage outstanding debts.

To run an accounts receivable aging report, gather your outstanding invoices and organize them by due date. By using accounting software, you can generate this report with a few clicks, giving you a clear overview of outstanding debt. This report is crucial for prioritizing which accounts need immediate attention. For effective management, utilize the Virginia Aging of Accounts Receivable to ensure timely collections.

Calculating receivables aging in Excel involves setting up a spreadsheet with columns for invoice dates, amounts, and due dates. You can create formulas to categorize invoices into aging brackets, using functions like IF or SUMIF. Excel provides a straightforward way to visualize your aging accounts, enhancing your financial reports. Incorporating Virginia Aging of Accounts Receivable into your Excel processes can simplify this evaluation.

To calculate the average age of accounts receivable, sum the number of days each account has been overdue, then divide by the number of accounts. This average helps you assess the overall efficiency of your collections process. By focusing on the average age, you can identify trends and make informed decisions regarding your credit policies. The Virginia Aging of Accounts Receivable empowers businesses to streamline their collection efforts.

To calculate the aging of accounts receivable, you assign each invoice a time frame based on its due date. Typically, invoices are grouped into time ranges, such as current, 30 days overdue, 60 days overdue, and so on. By determining how long each invoice has been outstanding, you gain insight into collection effectiveness. Using the Virginia Aging of Accounts Receivable allows businesses to take proactive steps in managing collections.