Virginia General Letter of Credit with Account of Shipment

Description

How to fill out General Letter Of Credit With Account Of Shipment?

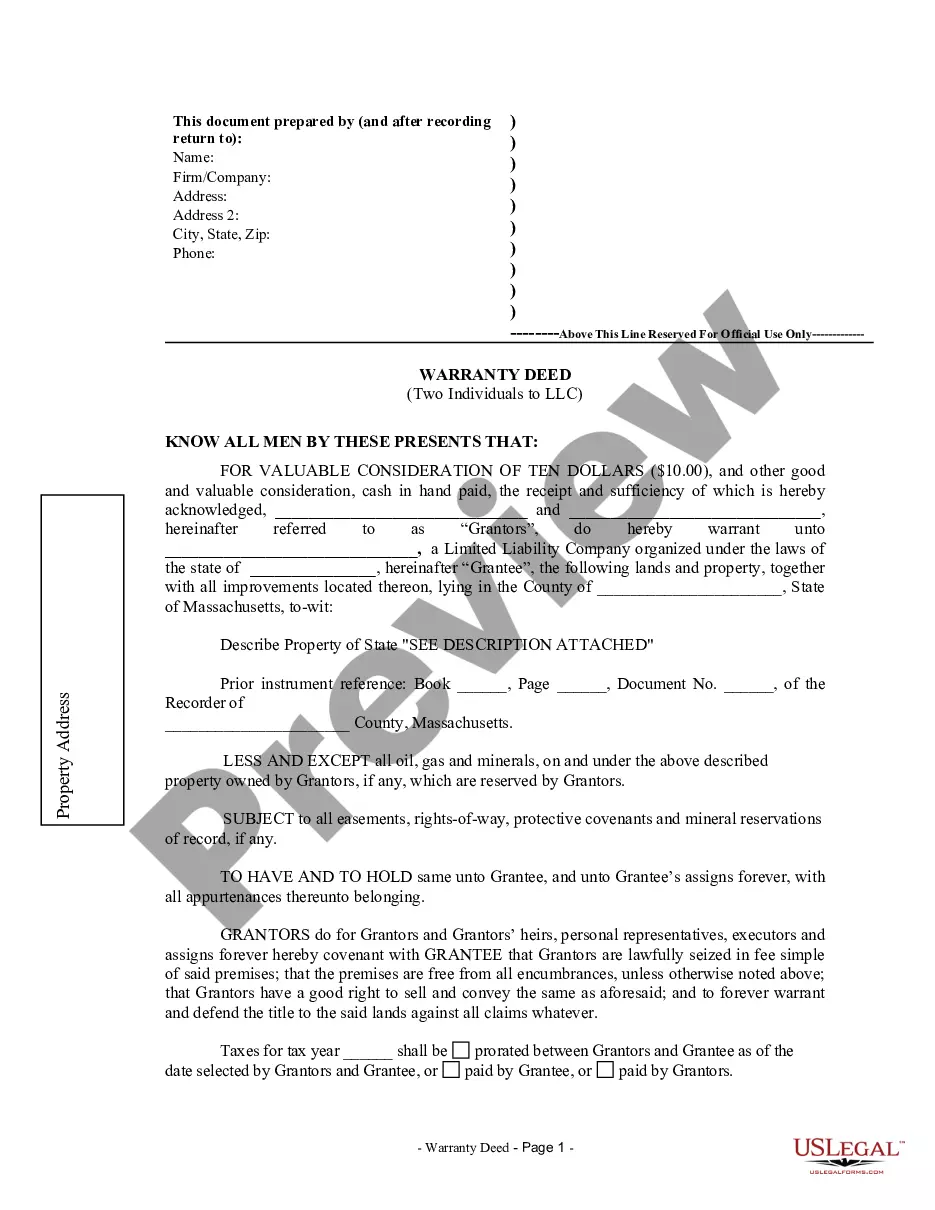

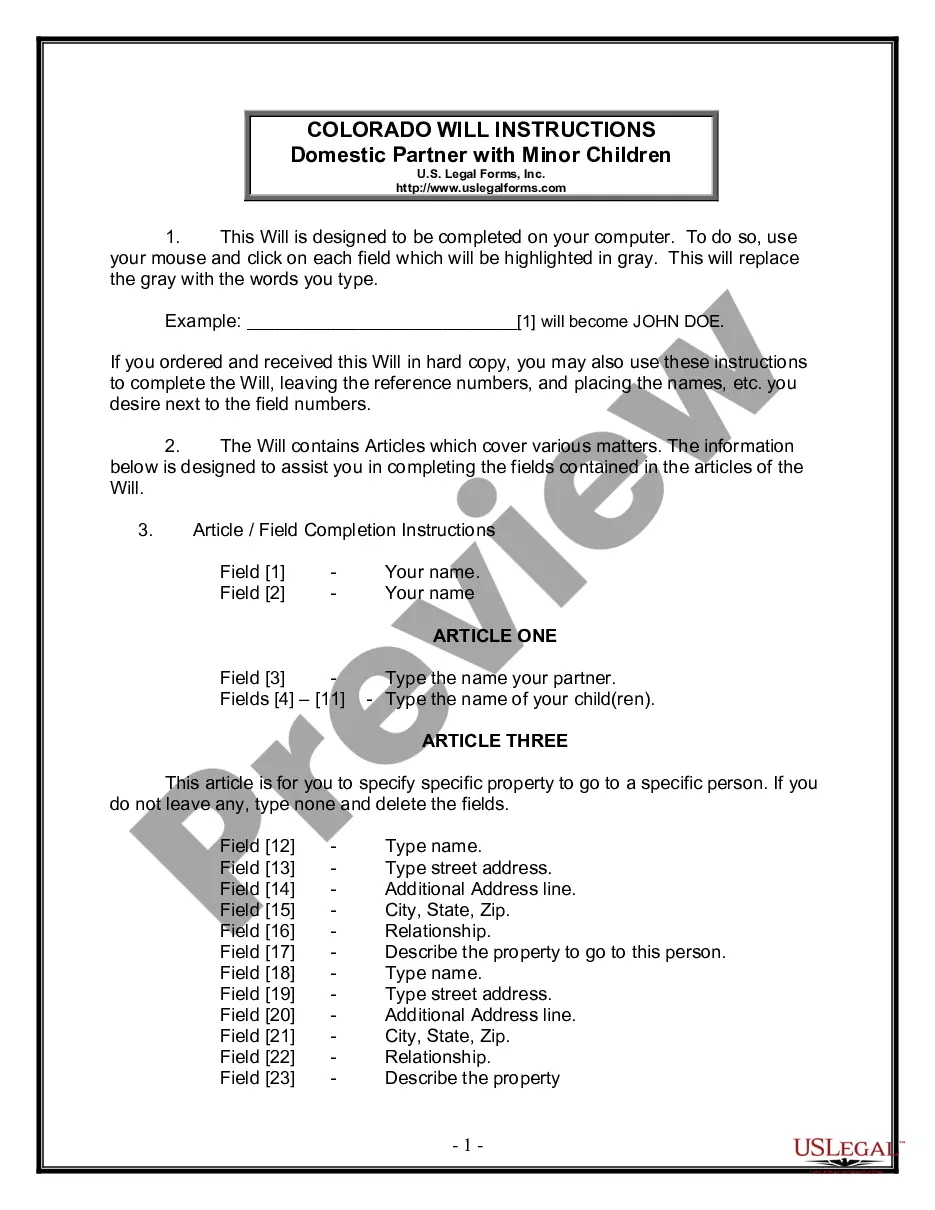

Have you been in the position that you need to have documents for both company or individual reasons virtually every day time? There are a variety of authorized document themes available on the Internet, but getting kinds you can rely is not effortless. US Legal Forms provides a huge number of kind themes, such as the Virginia General Letter of Credit with Account of Shipment, which can be written to meet state and federal requirements.

Should you be presently familiar with US Legal Forms site and also have an account, merely log in. Next, you may acquire the Virginia General Letter of Credit with Account of Shipment template.

Should you not have an bank account and need to start using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is for your correct metropolis/county.

- Make use of the Review button to review the form.

- Browse the explanation to ensure that you have selected the correct kind.

- When the kind is not what you are trying to find, use the Lookup discipline to obtain the kind that meets your requirements and requirements.

- When you get the correct kind, click Buy now.

- Opt for the costs prepare you desire, submit the specified details to make your account, and purchase an order with your PayPal or charge card.

- Decide on a hassle-free file formatting and acquire your duplicate.

Discover every one of the document themes you have bought in the My Forms menus. You can obtain a additional duplicate of Virginia General Letter of Credit with Account of Shipment whenever, if required. Just select the essential kind to acquire or print out the document template.

Use US Legal Forms, probably the most substantial variety of authorized forms, to save efforts and stay away from blunders. The service provides skillfully produced authorized document themes which you can use for a range of reasons. Create an account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

A letter of credit or LC is a written document issued by the importer's bank (opening bank) on importer's behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Example: An Indian exporter receives an export LC from his overseas client in the Netherlands. The Indian exporter approaches his banker with a request to issue an LC in favour of his local supplier of raw materials. The bank issues an LC backed by the export LC.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

Documents Required For LC Opening A signed copy of the proforma invoice or SPA of your trade deal. Company's Registration / Trade License Copy and MOU between partners (if any) Authorized Signatory's Passport photocopy. Utility Bills proving the Authorized Signatory's Residence & Company Address.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.