Virginia Revocable Trust for House

Description

How to fill out Revocable Trust For House?

If you wish to aggregate, obtain, or print legal document templates, use US Legal Forms, the foremost collection of legal forms, accessible online.

Utilize the site’s intuitive and convenient search to find the documents you require.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Employ US Legal Forms to locate the Virginia Revocable Trust for House in just a couple of clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Virginia Revocable Trust for House.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternative versions of the legal form template.

Form popularity

FAQ

A Virginia Revocable Trust for House offers several advantages for estate planning. First, it allows you to manage your assets during your lifetime while ensuring a smooth transition of ownership after your passing. Additionally, it helps you avoid the lengthy probate process, saving your family time and expenses. Lastly, this trust provides flexibility, allowing you to modify or revoke it as your circumstances change.

A family trust, such as a Virginia Revocable Trust for House, can sometimes lead to family disputes if not clearly defined. Conflicts may arise over asset distribution, especially if expectations vary among family members. Furthermore, while a trust offers flexibility, it may lack some tax benefits that other estate planning tools can provide. It's crucial to have transparent discussions among family members and consult with a legal expert to ensure the trust serves everyone's best interests.

One notable downfall of a Virginia Revocable Trust for House is that it can become outdated if not properly maintained. As family dynamics and financial situations change, failing to update the trust can lead to unintended consequences. Moreover, transferring assets into the trust requires work and attention, which some people may overlook. Regularly reviewing the trust with a professional helps avoid these pitfalls.

Your parents may benefit from placing their assets in a Virginia Revocable Trust for House, especially if they want to avoid probate. A trust allows for a smoother transfer of property upon their passing, providing significant peace of mind. Moreover, it can keep their financial matters private, unlike wills which go through public probate. Ultimately, discussing options with a legal expert can guide them toward the best decision.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund it properly. When you create a Virginia Revocable Trust for House but do not transfer assets into it, the trust cannot fulfill its purpose. Be sure to review and consistently update asset portfolios to ensure your trust fully aligns with your estate planning goals.

Yes, you can certainly place your VA home into a Virginia Revocable Trust for House. This action can help you manage your property during your lifetime and simplify the transfer of ownership after you pass. It's a strategic move that allows your heirs to avoid the probate process, ensuring your wishes regarding the property are followed.

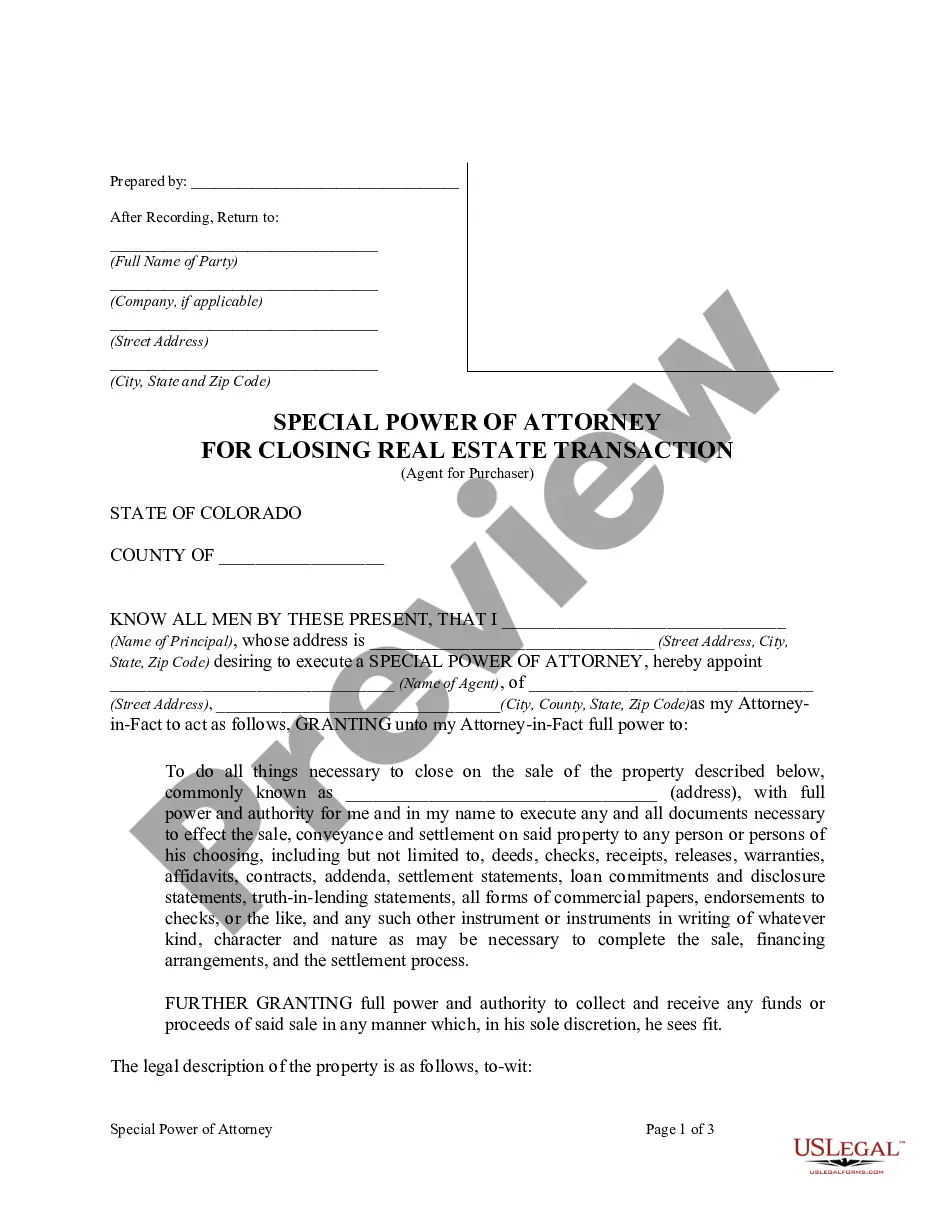

Transferring property into a Virginia Revocable Trust for House involves a few steps. First, you will need to prepare a deed that transfers ownership of the property to the trust. Once the deed is executed, you must record it with the county clerk's office to ensure the transfer is legal and effective. This process can secure your home’s estate management seamlessly.

While there are benefits to a Virginia Revocable Trust for House, there are also some disadvantages to consider. One potential downside is that you may still need to manage the property and ensure that the trust remains in compliance with state laws. Additionally, establishing a trust may involve legal fees, and if not properly set up, it can lead to complications during your estate planning.

Filing taxes for a Virginia Revocable Trust for House is relatively straightforward. The IRS treats a revocable trust as a disregarded entity, meaning that any income generated by the trust is reported on your individual tax return. You will continue to use your Social Security number for tax purposes, and any income or deductions related to the trust will be included on your Form 1040.

To put your house in a Virginia Revocable Trust, begin by creating the trust document, which outlines your wishes and identifies your beneficiaries. Next, you will need to transfer the title of your house into the trust, which typically involves filling out and filing a deed. It's advisable to consult with a professional, like those at uslegalforms, to ensure you complete this process correctly and avoid potential pitfalls associated with estate planning. A Virginia Revocable Trust for House can be an effective tool when done right.