Virginia Oil, Gas and Mineral Lease

Description

How to fill out Oil, Gas And Mineral Lease?

You can spend hours online looking for the legal document template that fulfills the federal and state requirements you need. US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

It is easy to download or print the Virginia Oil, Gas and Mineral Lease from our service. If you already have a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the Virginia Oil, Gas and Mineral Lease. Every legal document template you purchase is yours indefinitely.

To obtain an additional copy of the purchased form, go to the My documents section and click the corresponding button. If you are using the US Legal Forms site for the first time, follow these simple instructions below: First, ensure that you have chosen the correct document template for the area/town of your choice. Read the form description to confirm you have selected the right template. If available, use the Review button to inspect the document template as well.

- If you wish to obtain another version of the form, use the Search field to find the template that matches your needs and specifications.

- Once you have located the template you want, click on Purchase now to proceed.

- Select the pricing plan you desire, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your system.

- Make modifications to the document if possible. You can complete, edit, sign, and print the Virginia Oil, Gas and Mineral Lease.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

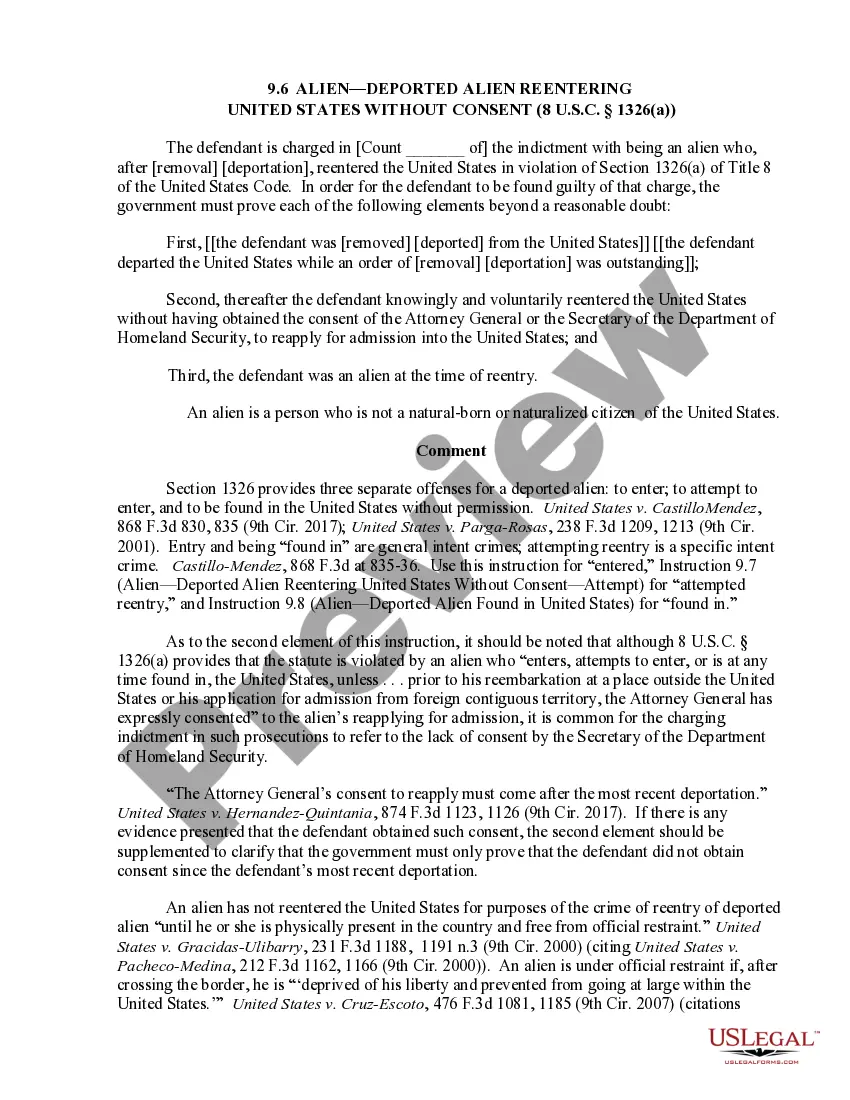

The default is that the rights to minerals ? including diamonds (like the 23-carat diamond found in Richmond in 1855!)* ? that exist under a piece of property convey with the land itself. In Virginia, owners can separate mineral rights from other property rights.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

: a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.

An oil & gas lease where all payments to keep the lease in effect during the primary term, typically a cash bonus, are paid up front when the lease is acquired. This type of lease generally does not contain a delay rental clause.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

A mineral lease is a contract between a mineral owner (the lessor) and a company or working interest owner (the lessee) in which the lessor grants the lessee the right to explore, drill, and produce oil, gas, and other minerals for a specified period of time.

Although they can be bought outright, more commonly, interests are sold in the form of royalties, leases, or production payments. Auction. Auctions sell mineral rights for both producing and non-producing properties. ... Government Auctions. ... Brokers. ... Private Placement. ... Negotiated Sale. ... Tax Sales. ... Direct From Mineral Owners.

Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease. Most leases that are offered to the owner of the oil and gas rights are surface use leases under which the land to which the oil and gas rights have been leased is used to develop the oil and gas.