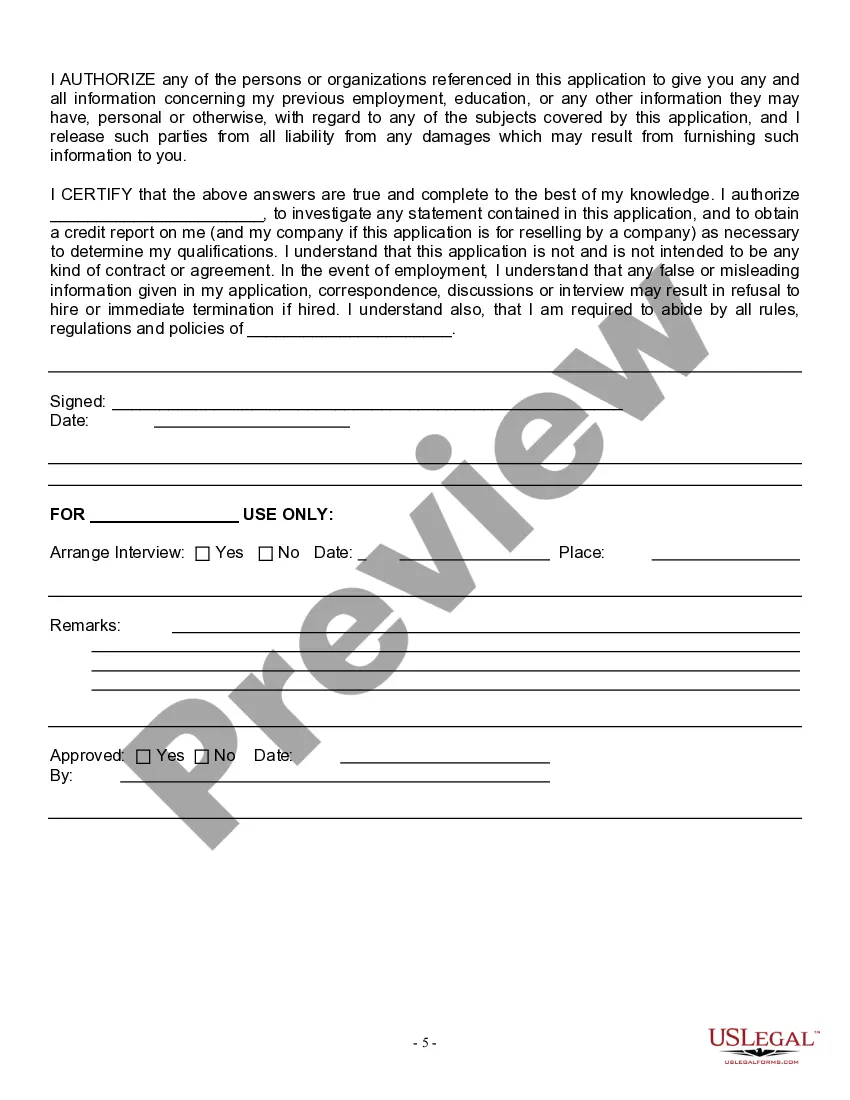

Virginia Employment Application for Event Vendor

Description

How to fill out Employment Application For Event Vendor?

You can dedicate time online attempting to locate the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that can be reviewed by experts.

You can conveniently obtain or print the Virginia Employment Application for Event Vendor from the platform.

To find another version of the document, use the Search field to locate a template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and then select the Obtain option.

- After that, you can fill out, edit, print, or sign the Virginia Employment Application for Event Vendor.

- Every valid document template you purchase belongs to you permanently.

- To obtain another copy of any acquired template, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for your county/town of choice.

- Read the document description to confirm that you have selected the appropriate form.

Form popularity

FAQ

Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits. RICHMOND, Va. The Virginia Employment Commission said it has an application available for self-employed workers to receive unemployment benefits during the COVID-19 outbreak.

You should call 866-832-2363 (Available am to pm, Monday - Friday. Closed Saturday, Sunday and state holidays.) to obtain more detail and provide information that relates the issue.

Sometimes you just have to talk to a live person to get answers to your questions. In that case, you can call the VA Unemployment Phone Number: Toll Free: 1-866-832-2363.

Currently the maximum weekly benefit amount is $378 and the minimum is $60. Individuals must have earned at least $18,900.01 in two quarters during the base period to qualify for the maximum weekly benefit amount. Benefit duration varies from 12 to 26 weeks, also depending on wages earned in the base period.

Freelancers, self-employed workers now eligible for unemployment benefits in Virginia. Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits.

Filing Your Initial Claim To file by using the telephone, please call 1-866-832-2363. Call volume in our contact centers is exceedingly high. If you experience delays, please use the online portal to file your initial claim for UI benefits.

Steps to Hiring your First Employee in VirginiaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

There are numerous provisions that affect the Unemployment Insurance Program. Workers who are not eligible under current state law such as gig economy workers, self-employed individuals, or workers paid by 1099 may be eligible for unemployment insurance benefits under the CARES Act.

Contacting the VECVEC Customer Contact Center.Voice Response system. 1-800-897-5630.VEC Administrative Office Location. 6606 West Broad Street.Correspondence mailing address. Virginia Employment Commission.Virginia Relay. (Telecommunications Relay Service) Press "711"Toll free access. 800-828-1140 (voice)