Virginia Employment Application for Farmer

Description

How to fill out Employment Application For Farmer?

You can dedicate time online searching for the valid document format that meets the federal and state requirements you desire.

US Legal Forms offers thousands of valid forms that are assessed by experts.

You can indeed obtain or create the Virginia Employment Application for Farmer through the service.

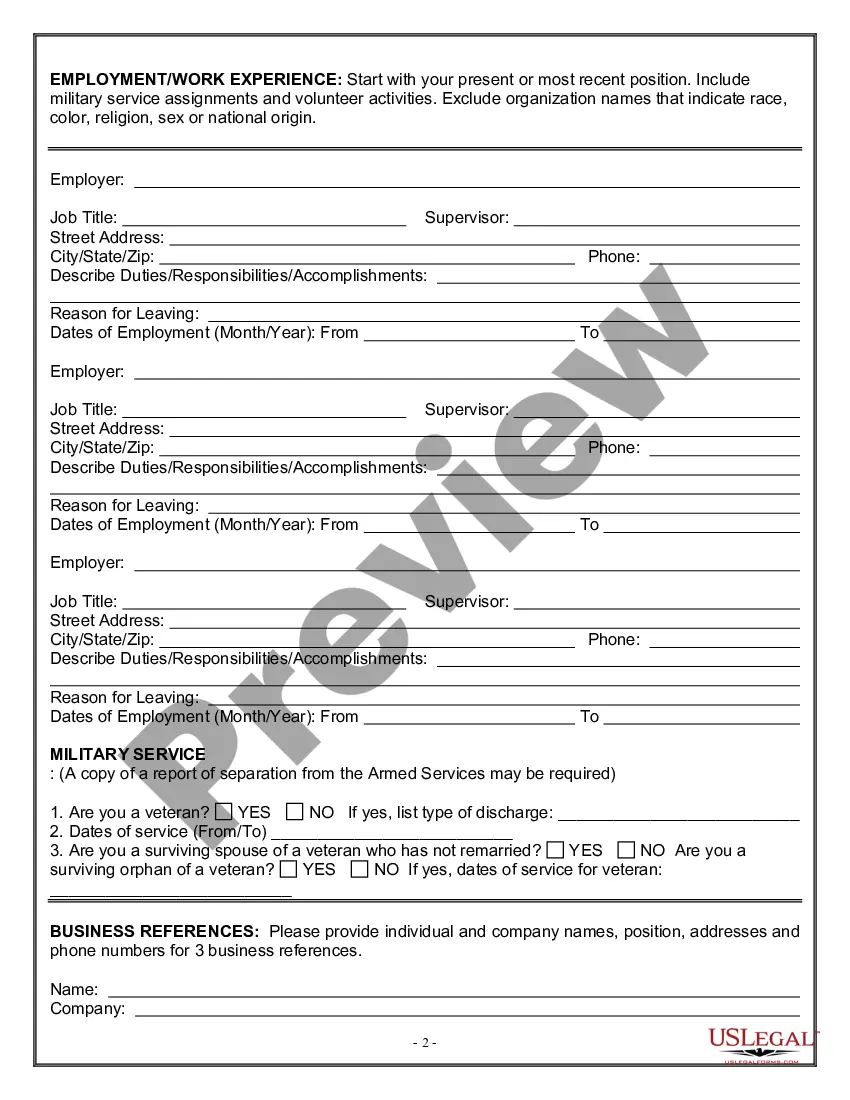

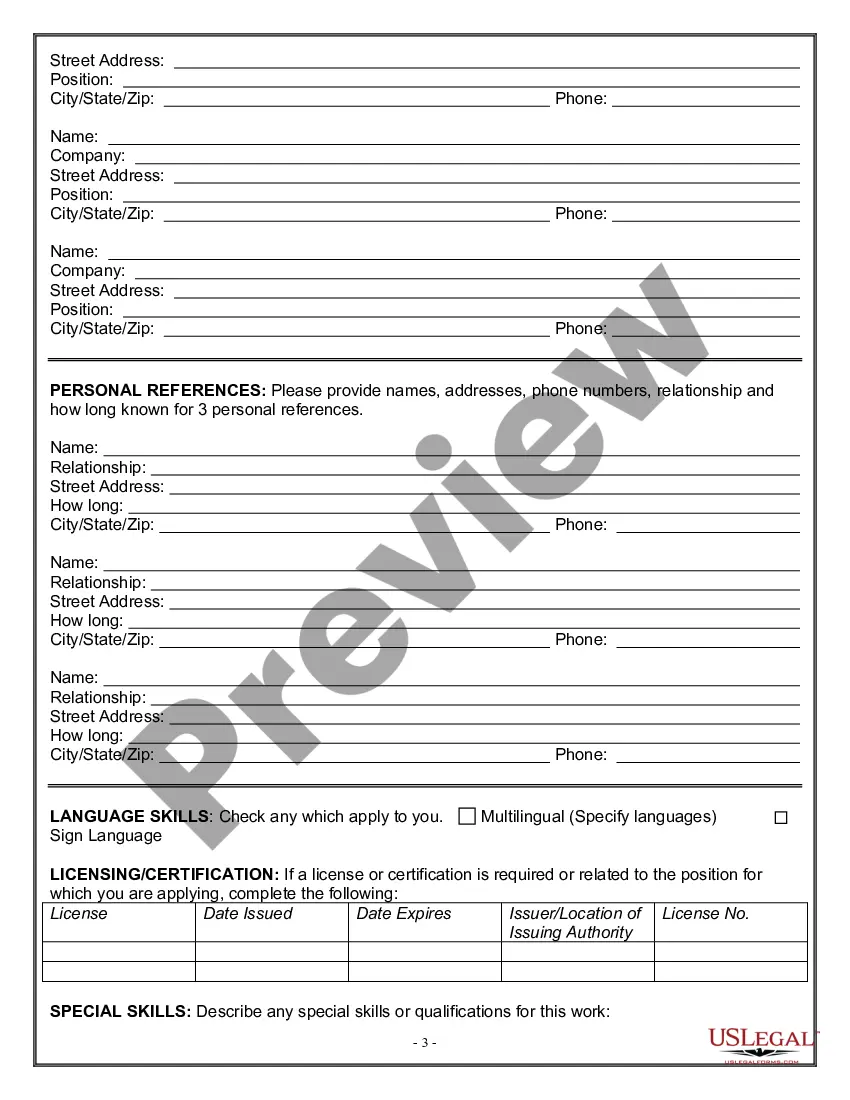

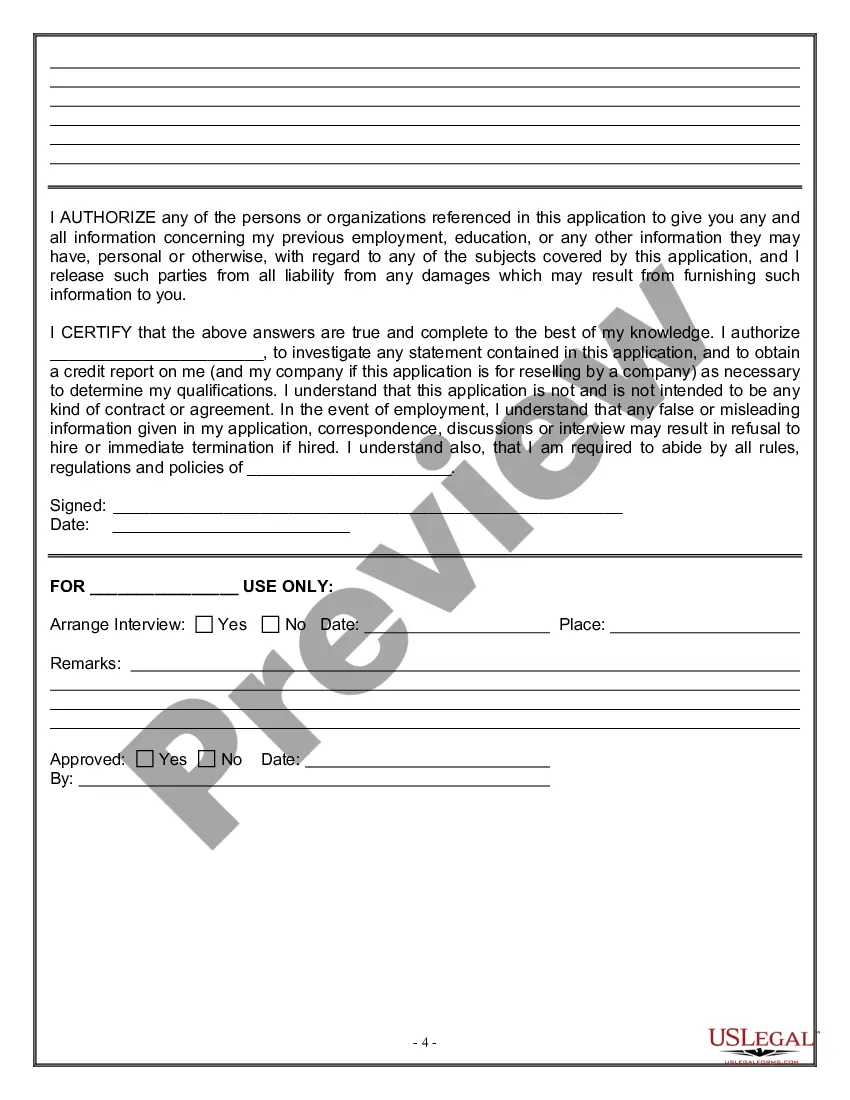

If available, utilize the Review option to verify the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain option.

- After that, you can fill out, amend, generate, or sign the Virginia Employment Application for Farmer.

- Every valid document format you purchase is yours permanently.

- To retrieve another copy of a purchased form, navigate to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your location/city of preference.

- Review the form description to ensure you have selected the right one.

Form popularity

FAQ

The federal programs authorizing benefits under the Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC), Federal Pandemic Emergency Compensation (FPUC) and Mixed Employment Unemployment Compensation (MEUC) will end with the week covering August 29, 2021 through September 4, 2021.

This can be done by traditional UI claimants calling the interactive voice response line at 1-800-897-5630 or through your online account at or . Weekly filing for PUA claimants can be done through your Gov2Go account.

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

The VEC will begin making an initial payment of PUA benefits in approximately two weeks, following the acceptance of the PUA application. The VEC may require additional documentation to validate your claim, reprocess your monetary determination, or to investigate fraud.

Proof of Employment Documentation Requirement for PUA Claimants - Unemployment Insurancestate or Federal employer identification numbers,business licenses,tax returns or 1099s,business receipts, and.signed affidavits from persons verifying the individual's self-employment.

This can be done by traditional UI claimants calling the interactive voice response line at 1-800-897-5630 or through your online account at or . Weekly filing for PUA claimants can be done through your Gov2Go account.

Benefits under the PUA and FPUC programs are federally funded and are no longer authorized after September 4, 2021. There would be no additional compensation available to you at this time.

Currently the maximum weekly benefit amount is $378 and the minimum is $60. Individuals must have earned at least $18,900.01 in two quarters during the base period to qualify for the maximum weekly benefit amount. Benefit duration varies from 12 to 26 weeks, also depending on wages earned in the base period.

If you applied for PUA in 2020 and are still collecting in 2021, you just need a single document that shows you were working at some point between January 2019 and your application for PUA. It could be pay stubs, tax documents, contracts, business licenses, letters, etc.

Examples of acceptable documents self-employed individuals may submit to show proof of employment and earnings Federal or state income tax returns for the 2019 calendar year.Business financial statements/records.