Virginia Lease Form for Car

Description

How to fill out Lease Form For Car?

It is feasible to spend hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a wide variety of legal forms that have been reviewed by professionals.

You can easily download or print the Virginia Lease Form for Vehicle from my platform.

Initially, ensure that you have selected the correct document template for the state/city of your choice. Review the form description to confirm that you have chosen the appropriate template. If possible, utilize the Review option to examine the document template as well. If you wish to find another version of your form, use the Lookup field to locate the template that suits you and your needs. Once you have identified the template you require, click Buy now to proceed. Choose the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to purchase the legal form. Select the format of your document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Virginia Lease Form for Vehicle. Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Use professional and state-specific templates to meet your business or personal needs.

- In case you possess a US Legal Forms account, you may Log In and then select the Obtain option.

- Subsequently, you can complete, modify, print, or sign the Virginia Lease Form for Vehicle.

- Every legal document template you receive is yours permanently.

- To obtain an additional copy of the downloaded form, go to the My documents section and click the relevant option.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

The vehicle can be registered in the lessor's (owner) name or the lessee's name. If the lessor permits DMV to include the lessee name and address in the registration address field on the title record at DMV, the lessee has the ability to handle all vehicle registration transactions for the leased vehicle.

What You'll Need to Register your Vehicle in VirginiaRegistration fee (varies based on vehicle weight and length of time) Complete fee chart.$10 title fee.4.15% motor vehicle sales and use tax OR proof of sales tax paid out-of-state. $64 surcharge assessed for electric vehicles.

Vehicle Personal Property TaxThe tax rate for most vehicles is $4.57 per $100 of assessed value.For properties included in a special subclass, the tax rate is $0.01 per $100 of assessed value.No Plate Tax: $100 is assessed annually on vehicles that do not display current Virginia license plates as required by law. (More items...

Who taxes a leased car? People often get confused about who pays for the tax on a leased car technically these vehicles don't belong to the person leasing but to the finance company. This is why for most leases, the tax will be covered within your monthly rental so you don't need to worry about it.

7 Steps to Getting a Great Auto Lease DealChoose cars that hold their value. When you lease a vehicle you are paying for its depreciation, plus interest, tax and some fees.Check leasing specials.Price the car.Get quotes from dealers.Spot your best deal.Ask for lease payments.Close the deal.

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

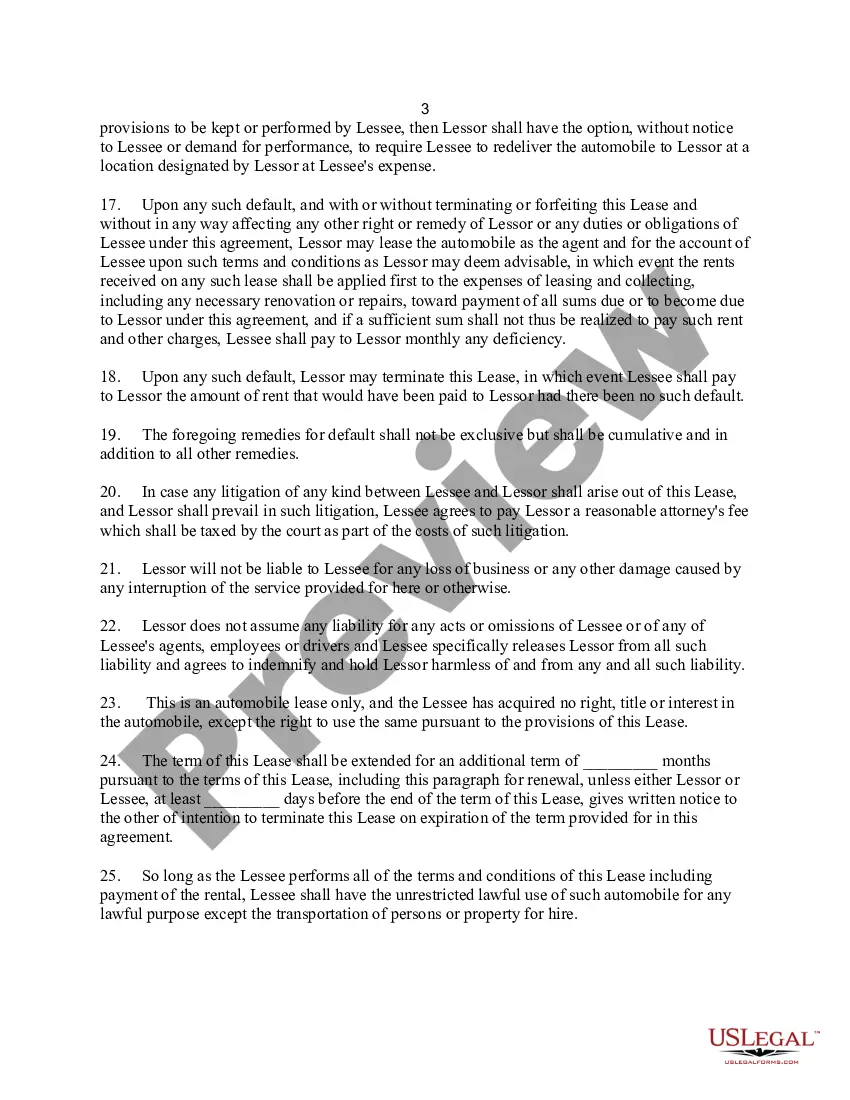

A car lease lets you drive a new vehicle without paying a large sum of cash or taking out a loan. To lease a car, you simply make a small down payment -- less than the typical 20% of a car's value you'd pay to buy-- followed by monthly payments for the term of the lease. When the term expires, you return the car.

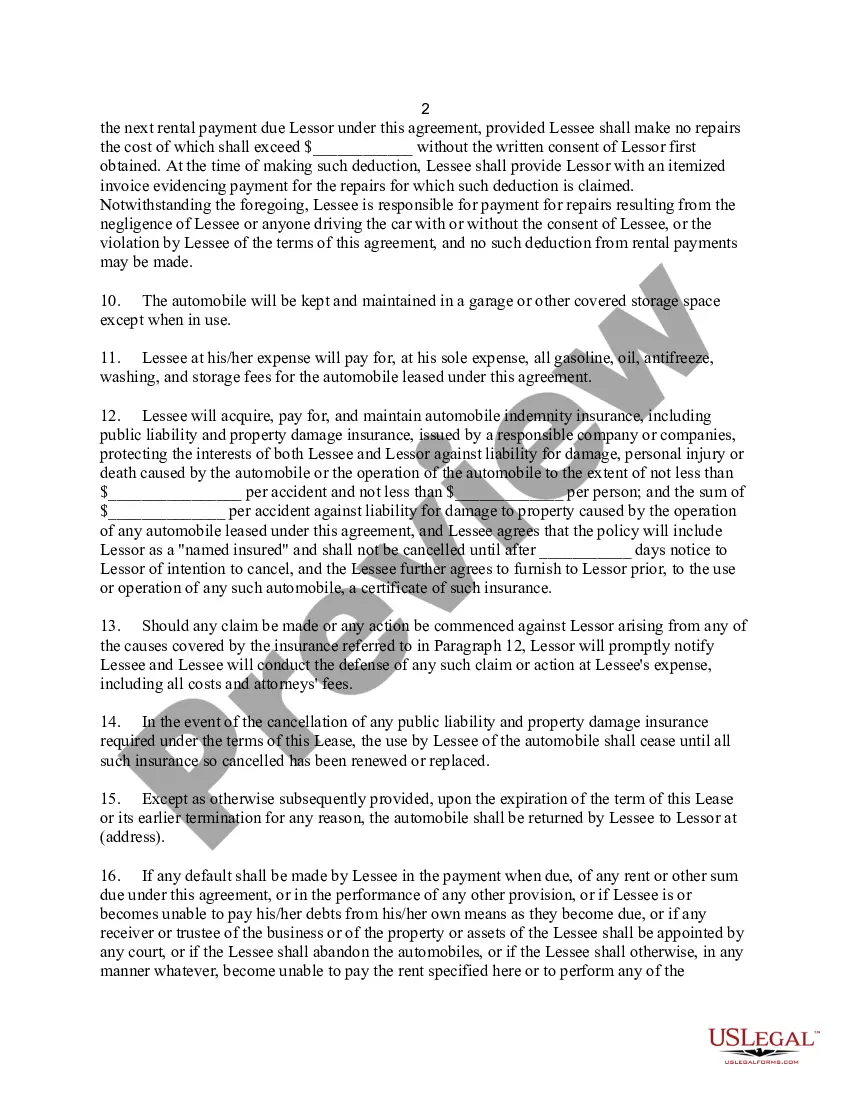

What information is necessary to include in a Vehicle Lease Agreement template?A description of the vehicle.The vehicle manufacturer's suggested retail price.The residual value of the car (the anticipated price of the car at the end of the lease term)The lessee's contact information.More items...?

The leased vehicle will be titled in the name of the lessor (owner). All applicable fees are due at the time of titling by the lessor, such as the $15 title fee and the motor vehicle sales and use tax. NOTE: The leasing agreement may require the lessee to make these payments.

The current tax rate for most all vehicles is $4.20 per $100 of assessed value.