Virginia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What is this form?

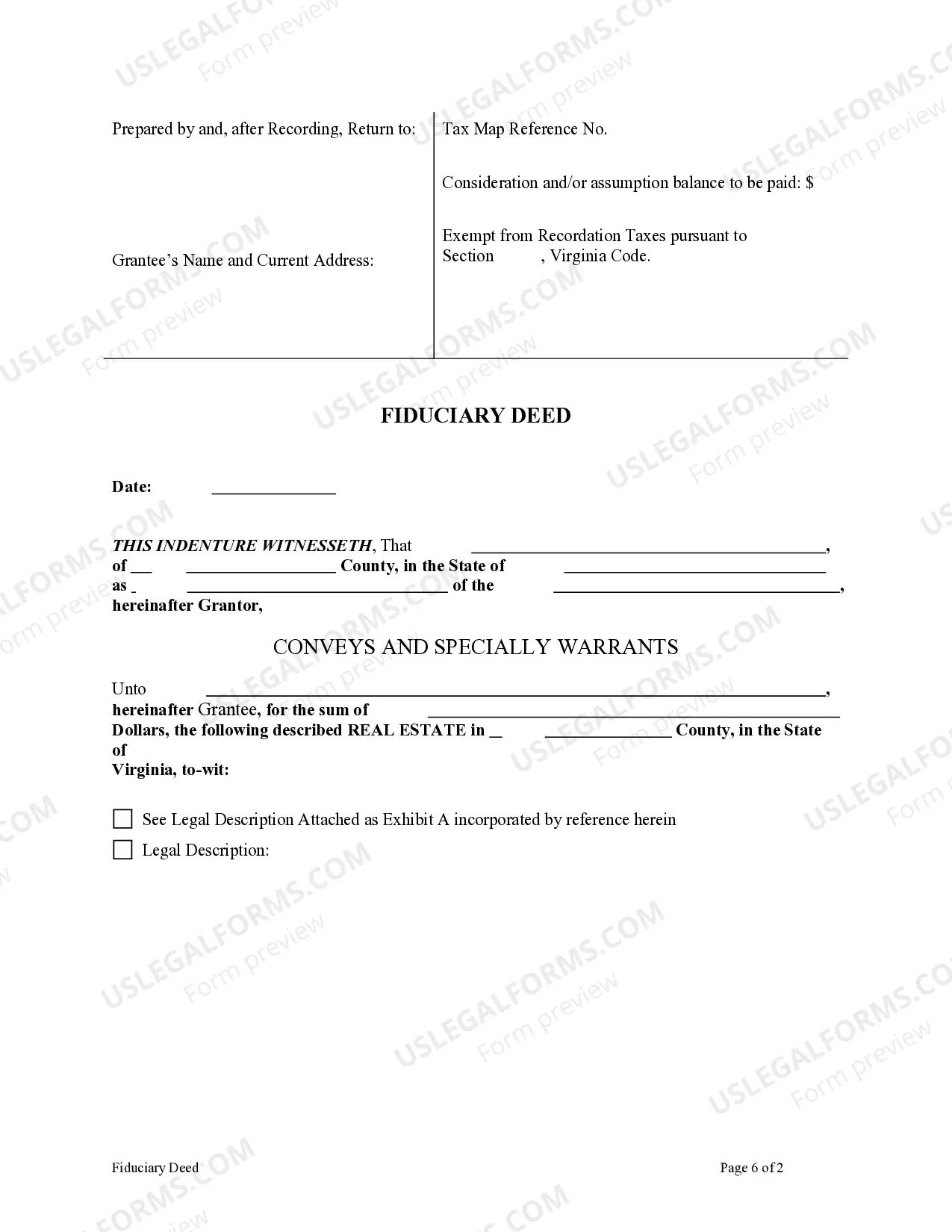

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer real estate or property on behalf of another party. This form is essential for ensuring that the intentions of the decedent or trustor are honored, differentiating it from other types of deeds by its use in fiduciary capacity. It provides clear legal authority to execute property transfers under specific circumstances, ensuring compliance with relevant laws and regulations.

Key components of this form

- Identification of the grantor and grantee, including their roles as fiduciaries.

- Legal description of the property being transferred.

- Statement of the authority under which the grantor acts (e.g., as executor or trustee).

- Indication of any encumbrances or restrictions on the property.

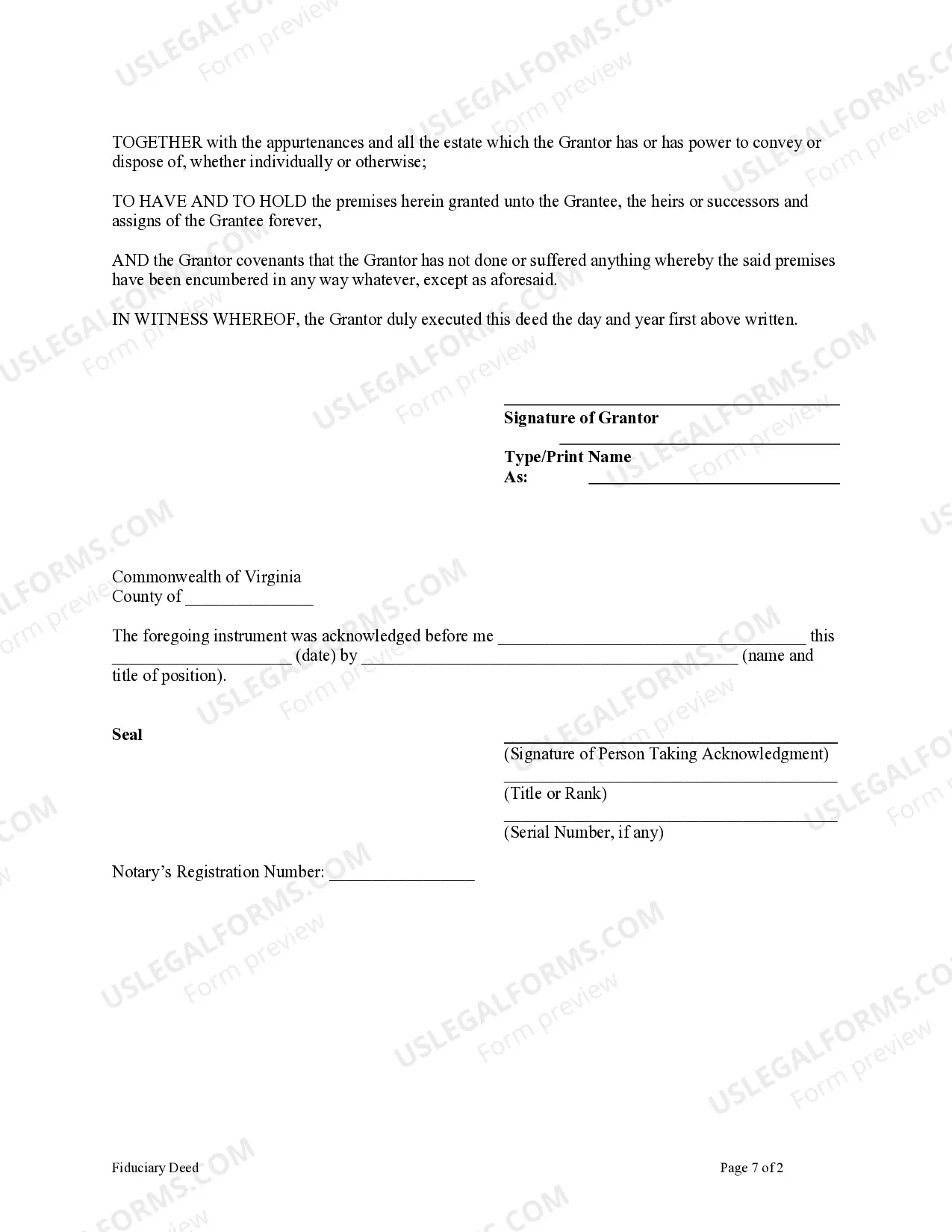

- Notary section for legal acknowledgment of the signatures.

When to use this form

This form should be used when a fiduciary, such as an executor or trustee, is required to transfer property to beneficiaries as outlined in a will or trust. Common scenarios include executing a property transfer after a person's death, managing a trust's assets, or fulfilling the obligations of a guardian or conservator related to property management.

Who this form is for

This form is intended for:

- Executors managing the estate of a deceased individual.

- Trustees responsible for administering a trust.

- Administrators managing an estate without a will.

- Guardians or conservators acting on behalf of others, particularly minors or incapacitated individuals.

How to prepare this document

- Identify the grantor (the fiduciary) and the grantee (the beneficiary).

- Provide a detailed legal description of the property being transferred.

- Fill in the specific authority being exercised, such as the citation of the will or trust.

- Review and confirm any encumbrances or liens on the property.

- Sign the form in the presence of a notary public.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately describe the property, leading to potential disputes.

- Not obtaining the necessary signatures from all required parties.

- Neglecting to provide the correct legal authority for the transaction.

- Overlooking the notary requirement, which can invalidate the document.

Why complete this form online

- Convenient access to legal templates while saving time compared to manual drafting.

- Editability allows users to customize sections as needed securely.

- Reliability from professionally drafted forms that ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

The probate of the will can usually wait until a week or so after the funeral. It is recommended that the initial steps in the estate process start within 30 days after death. If any questions exist, call your attorney or your local Circuit Court Clerk's Office.

This form contains personal information about the party which files the divorce including name, date of birth, information about previous marriages and children, etc. This data is used for statistical purposes by the state of Virginia.

Effective July 1, 2020, the pendente lite spousal support guidelines in Virginia are: Cases With Minor Children: 26% x Payor's Income 58% x Payee's Income. Cases With No Minor Children: 27% x Payor's Income 50% x Payee's Income.

To qualify as the executor of an estate in Virginia, the individual must contact the clerk's office in the deceased's county of residence and schedule a meeting with the probate clerk. The potential executor brings all necessary paperwork to the meeting.

The list of heirs is given under oath on a form provided by the Clerk of Court. The heirs identified on the list are the heirs of the decedent as provided under Virginia law for a person who dies without a will. The form requires the name, address, relationship to the decedent, and age of each heir.

Assets of an estate when the total value of the entire personal probate estate as of the decedent's death does not exceed, under current law, $50,000, if certain requirements are met, including an affidavit stating certain facts.

The way to fill out the Vs4 form online: Enter your official identification and contact details. Apply a check mark to point the answer wherever expected. Double check all the fillable fields to ensure complete accuracy. Make use of the Sign Tool to add and create your electronic signature to signNow the Vs4 form.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

To file this lawsuit, you must go to the General District Court Clerk's office. Ask for the proper court form. To sue for return of property, fill out a "Warrant in Detinue." Even though this court form is called a "warrant," it is not used in a criminal case. It is used in a civil (non-criminal) case.