This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

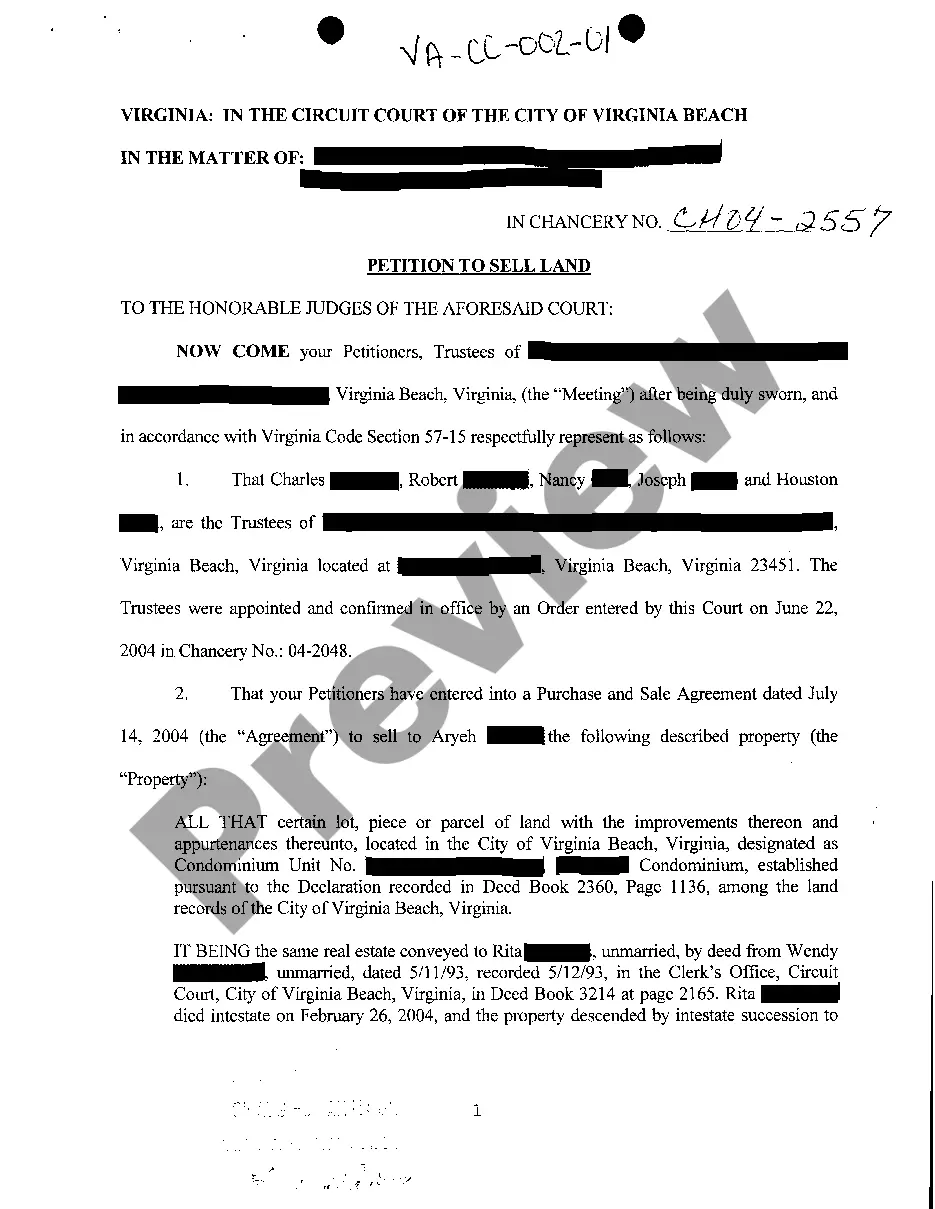

Virginia Petition And Order For Sale Of Property

Description

How to fill out Virginia Petition And Order For Sale Of Property?

Looking for a Virginia Petition and Order for Sale of Property on the internet can be stressful. All too often, you see files that you just think are ok to use, but discover afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any document you’re searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added in to the My Forms section. In case you do not have an account, you have to sign-up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Petition and Order for Sale of Property from the website:

- See the document description and press Preview (if available) to verify whether the form meets your requirements or not.

- In case the form is not what you need, get others using the Search field or the provided recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, users can also be supported with step-by-step instructions on how to get, download, and fill out forms.

Form popularity

FAQ

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

The short answer is no. You don't own the property until the probate process finishes. That means you don't have a right to sell the property until the entire probate process gets finished.

When your creditor has been granted a final charging order, they can apply for an order for sale. This is a court order that forces you to sell your property and use the money you make from the sale to pay your charging order debt. There will be another court hearing and it's very important for you to go.

An Order for sale is a way to enforce a Charging Order. It is an order granting the chargeholder the right to take possession of the property and then to sell it in order to recover the monies secured by their charge.

The Administrator of an intestate estate does not have power to sell real estate under Virginia law, only the power to sell and dispose of personal property. The Administrator can petition the Court for power to sell the real estate, if necessary for the administration of the estate.

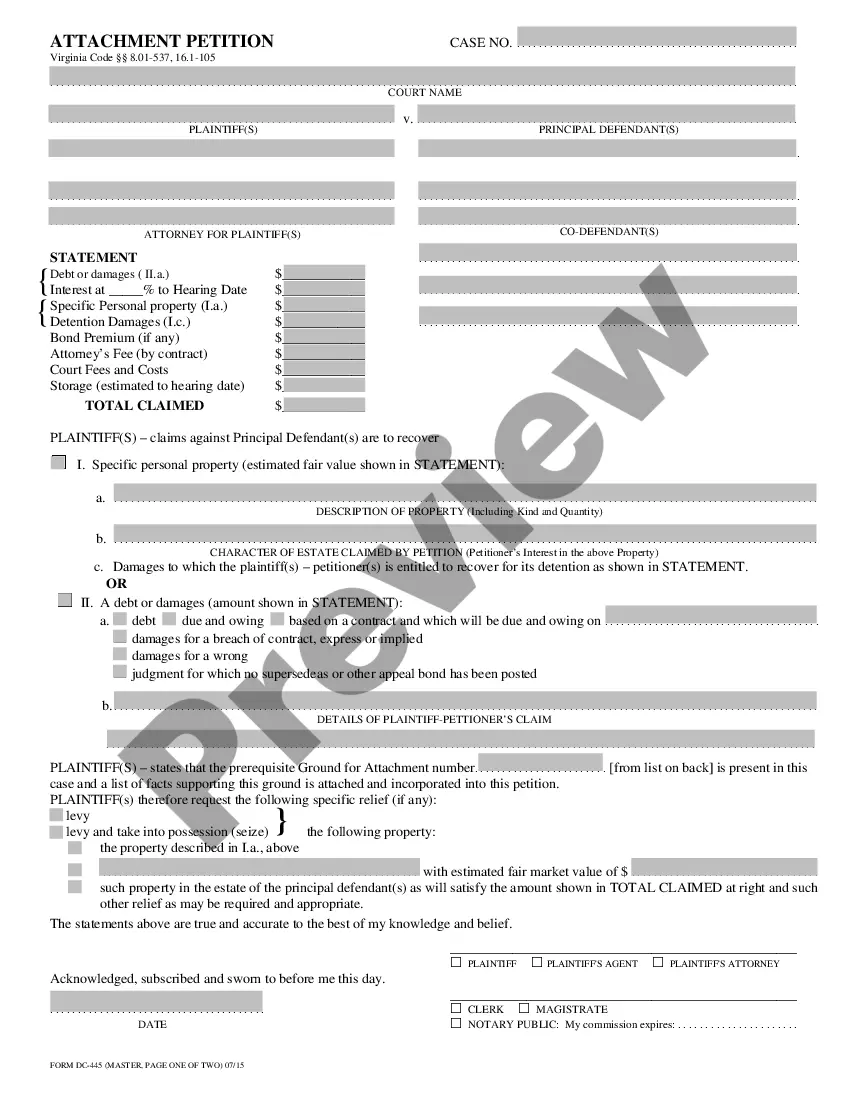

To file this lawsuit, you must go to the General District Court Clerk's office. Ask for the proper court form. To sue for return of property, fill out a "Warrant in Detinue." Even though this court form is called a "warrant," it is not used in a criminal case. It is used in a civil (non-criminal) case.

The terms of the Independent Administration of Estates Act do not avoid probate, but they do allow an executor to sell an estate's real estate without probate court approval under some circumstances.

Buy Out the Other Owners. Your first solution is to purchase the other's share of the property. Partition the Land. Your next option is to partition the land. Split the Cash on a Sale. Another popular option when selling inherited property is to sell the home for cash.

Executor compensation for VA estates is primarily calculated as a percentage of the qualified estate gross value (see limitations below): 5.0% on the first $400K. 4.0% on the next $300K. 3.0% on the next $300K.