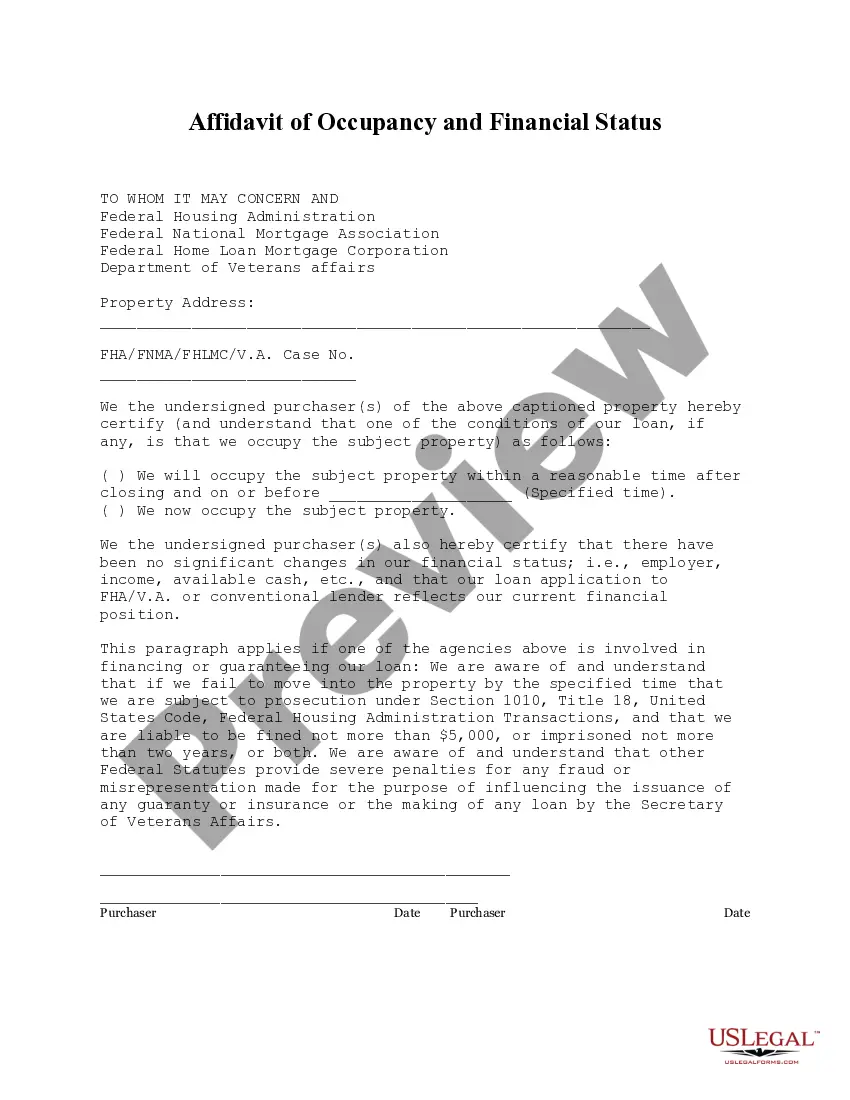

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

Virginia Affidavit of Occupancy and Financial Status

Description

How to fill out Virginia Affidavit Of Occupancy And Financial Status?

Looking for a Virginia Affidavit of Occupancy and Financial Status online might be stressful. All too often, you find documents that you just think are alright to use, but find out later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any form you’re looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be added in to the My Forms section. In case you don’t have an account, you must register and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Affidavit of Occupancy and Financial Status from our website:

- Read the form description and hit Preview (if available) to verify whether the template suits your requirements or not.

- In case the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms catalogue. In addition to professionally drafted templates, users may also be supported with step-by-step instructions on how to get, download, and fill out forms.

Form popularity

FAQ

VA loans are for primary residences and borrowers are expected to live in the properties they purchase. To ensure this, the VA developed occupancy requirements that make certain homeownership is the borrower's intended purpose essentially ruling out the ability to purchase an investment property or vacation home.

An affidavit is used for the purpose of proving in court that a claim is true, and is typically used in conjunction with witness statements and other corroborating evidence. Through an affidavit, an individual swears that the information contained within is true to the best of their knowledge.

Generally, for a property to be owner-occupied, the owner must move into the residence within 60 days of closing and live there for at least one year. Buyers purchasing property in the name of a trust, as a vacation or second home, or as the part-time home or for a child or relative do not qualify as owner-occupants.

Signature Affidavit document is generally combined with the Name Affidavit & is a document in which a person certifies that the signature provided is the true and correct signature used by the person; Name Affidavit allows a person to give a declaration that they are the same person as another name.

Part of your loan paperwork will include signing two forms that certify your intent, as the borrower, to occupy the home as your main address. They are VA Form 26-1802a, HUD/VA Addendum to the Uniform Residential Loan Application, and VA Form 26-1820, Report and Certification of Loan Disbursement.

The short answer is yes. The VA official site reminds borrowers, The lender may accept the occupancy certification at face value unless there is specific information indicating the veteran will not occupy the property as a home or does not intend to occupy within a reasonable time after loan closing.

An affiant is someone who files an affidavit, which is a written statement used as evidence in court. In order to be admissible, affidavits must be notarized by a notary public.

Verification. Lenders usually stipulate that homeowners have 30 days after closing to occupy a primary residence. To verify the person moving in is actually the owner, the lender may call the house and ask to speak to the homeowner.The lender may also drive past the house looking for a rental sign in the yard.

An affidavit is a sworn or affirmed statement made before a notary public or any public official who has the authority to administer oaths. It is made under penalty of perjury.A notarized affidavit is one in which you swear the content is true before a notary public.