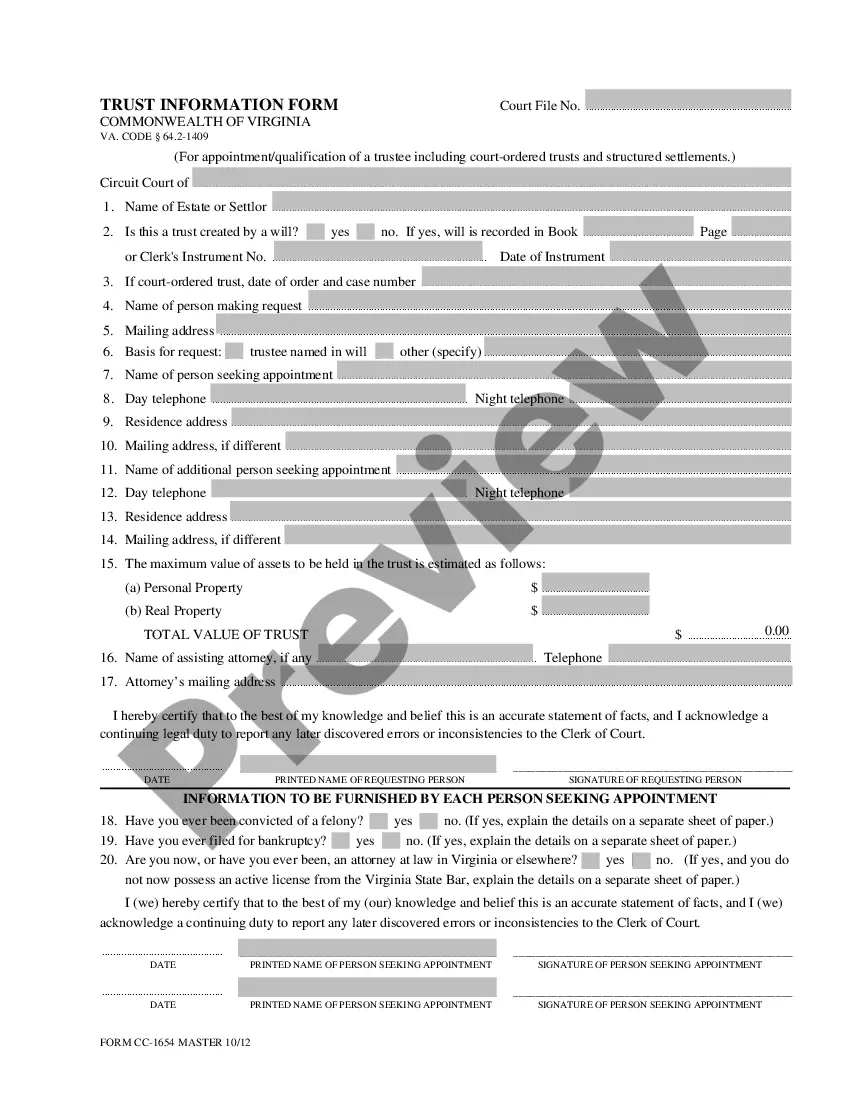

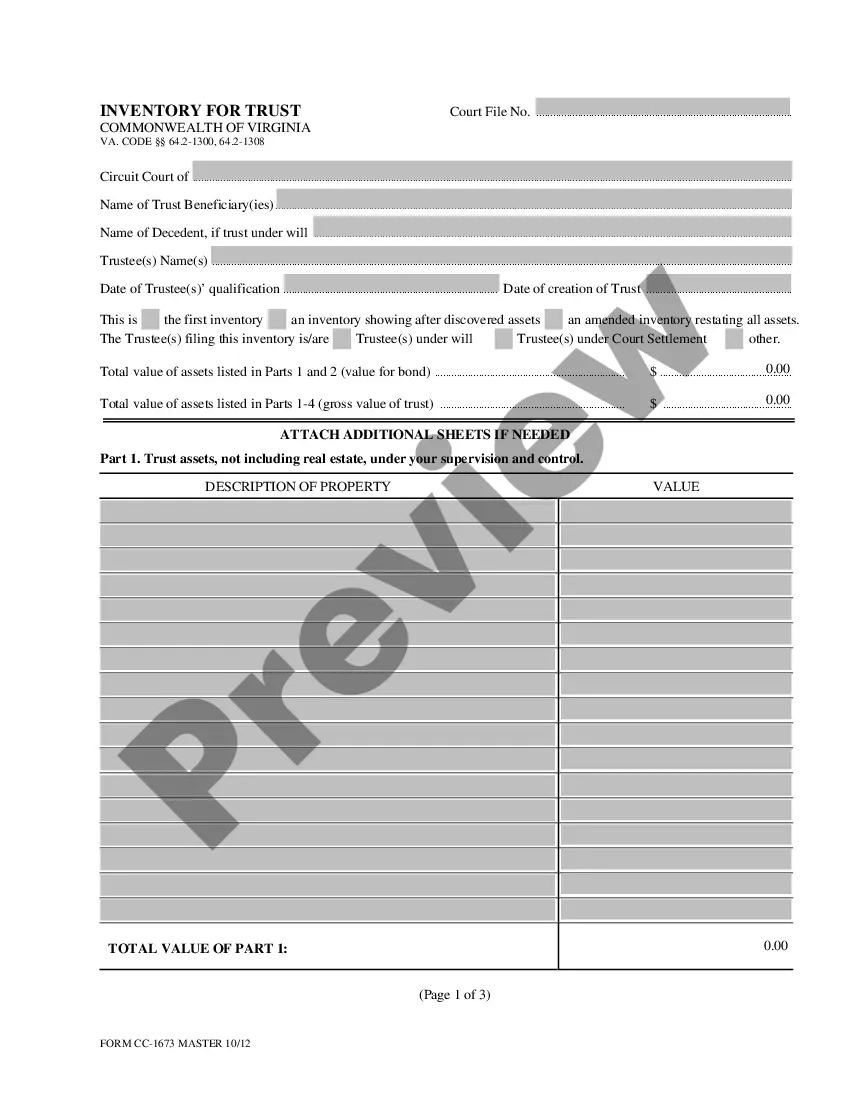

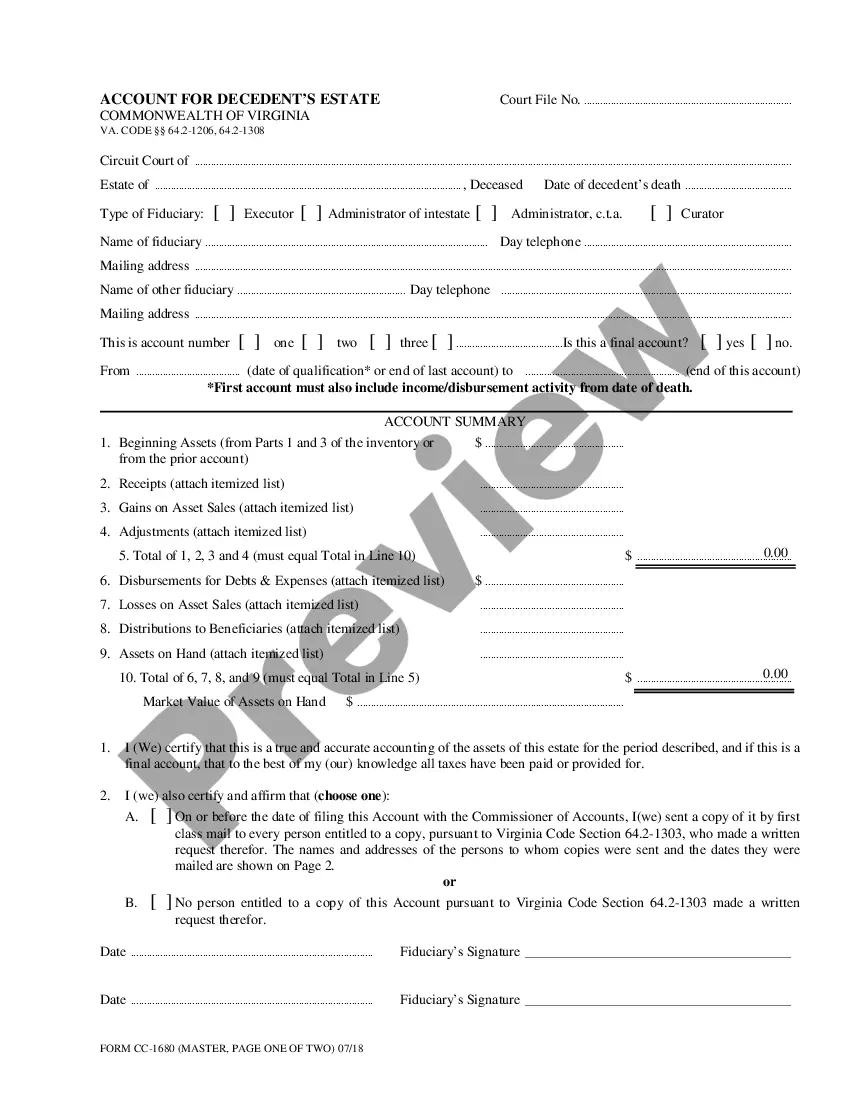

This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

Virginia Account for Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Account For Trust?

Looking for a Virginia Account for Trust online can be stressful. All too often, you see documents that you just think are fine to use, but discover afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Have any document you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be added to your My Forms section. If you do not have an account, you have to sign up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Account for Trust from our website:

- Read the document description and hit Preview (if available) to check if the template suits your expectations or not.

- If the form is not what you need, get others using the Search field or the provided recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted samples, customers are also supported with step-by-step instructions on how to get, download, and complete forms.

Form popularity

FAQ

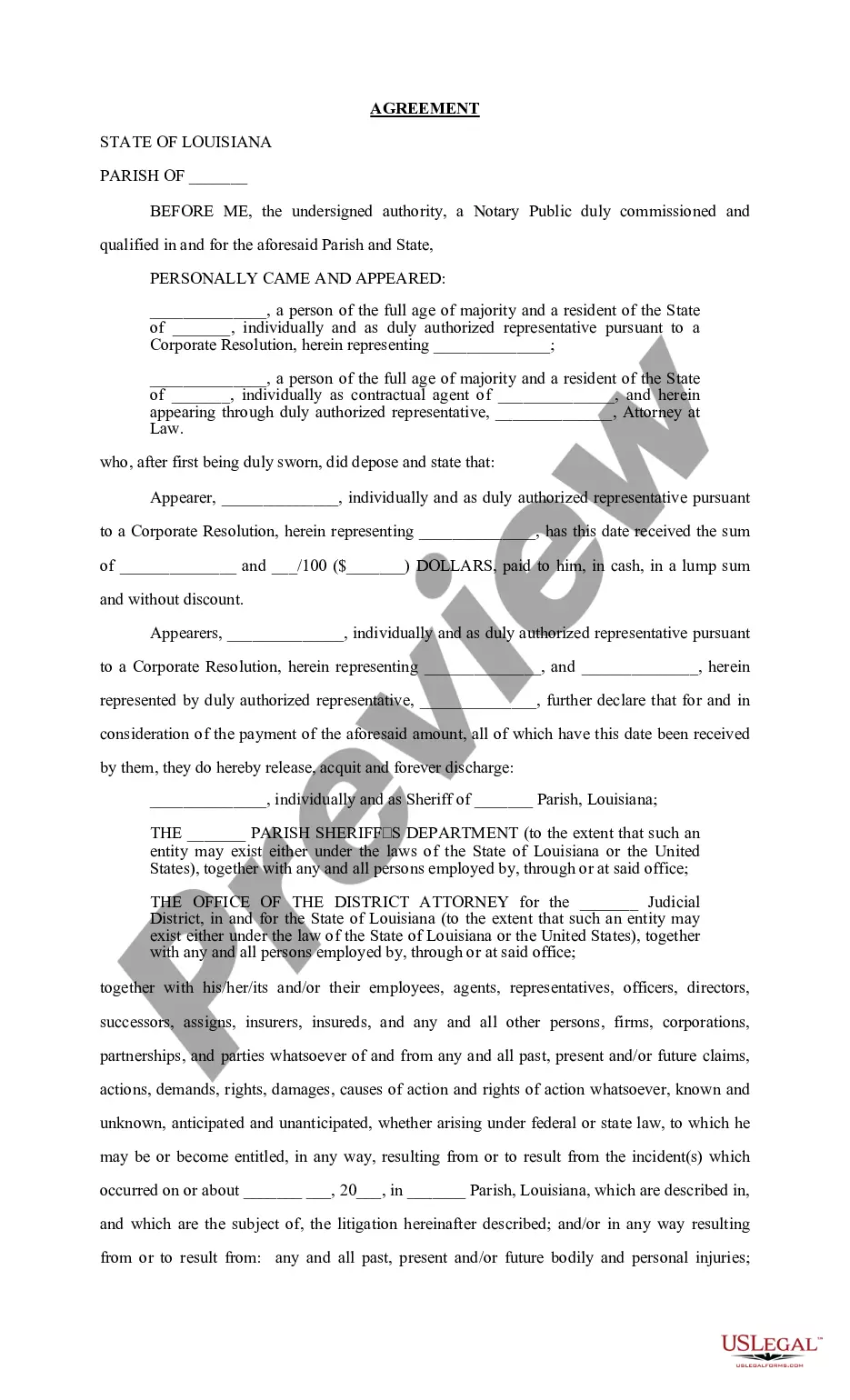

Write a letter to the trustee of the trust and have it delivered certified mail. Keep the receipt. Identify yourself as a beneficiary and request a copy of the trust if you do not yet have one. Once you have reviewed the trust, ask for an accounting...

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

For services as trustee in the ongoing administration of a trust, our annual fee will be based upon a percentage of the fair market value of assets of the trust. Our current fees are determined as set forth below: 0.30% on first $1,000,000. 0.25% over $1,000,000.

The irrevocable trust may be terminated by the consent of all beneficiaries and the court finds the termination is not inconsistent with a material purpose of the trust. Once the termination is approved by the court, the trustee is required to distribute the remaining assets as agreed by the beneficiaries.

Trusts set up in New Zealand What we need: The Trust Deed and any subsequent deeds of appointment or retirement. Proof of physical address of the Trust. If there's no documentation in the Trust's name to verify the address, we accept one of the Trustees' addresses.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request. Include supporting documentation. For example, if you are requesting money to pay medical bills, enclose copies of the bills.

Read the Documents Carefully. Some agreements contain language that allows a trustee to dissolve the trust if its purpose is no longer feasible. Petition the Court. In some cases, a court agrees to break an irrevocable trust if the trustee or beneficiaries petition for assistance. Dispose of the Trust's Assets.

You will need to bring your Certification of Trust and or the trust agreement itself. The bank will have you complete a new signature card for the account, and the account will be held in your name "as trustee," for the trust. The bank will also require a tax identification number for the trust.