This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

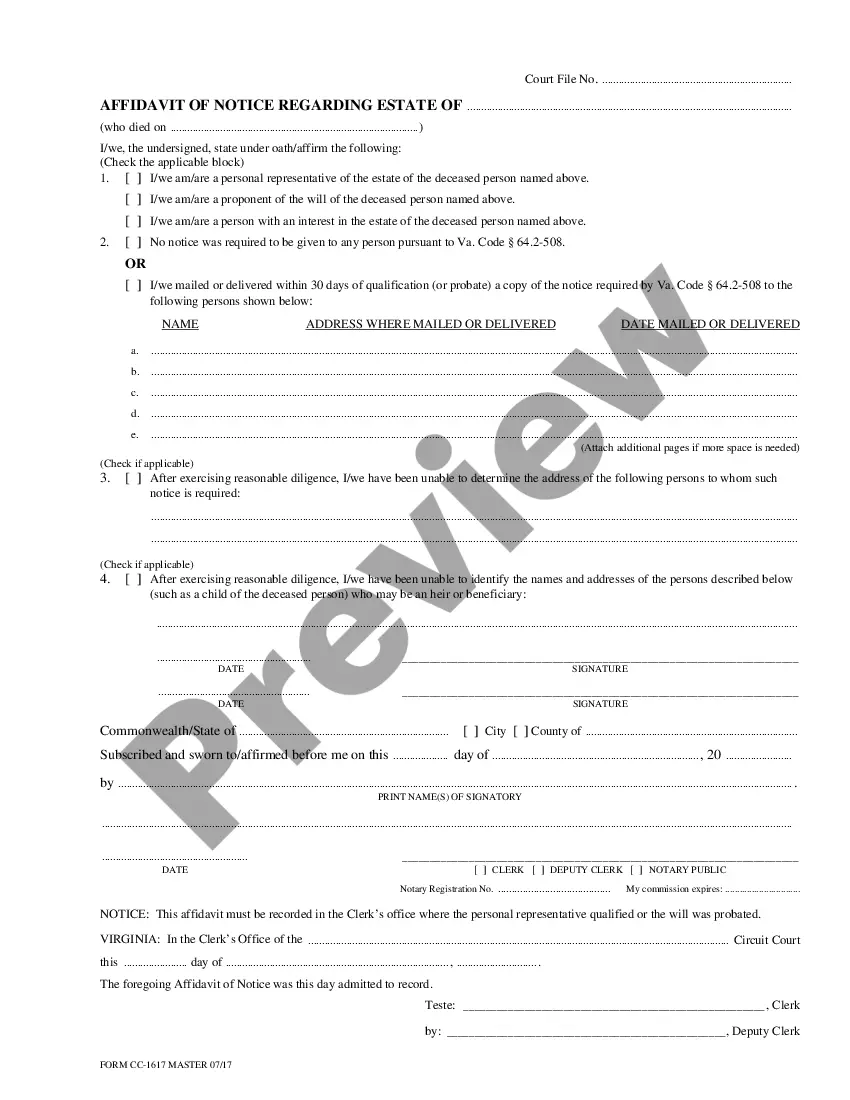

Virginia Notice Regarding Estate of

Description

How to fill out Virginia Notice Regarding Estate Of?

Looking for a Virginia Notice Regarding Estate on the internet can be stressful. All too often, you see papers that you simply believe are fine to use, but discover later they’re not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Have any form you are looking for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will immediately be added in to the My Forms section. If you do not have an account, you must sign-up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Notice Regarding Estate from our website:

- Read the document description and press Preview (if available) to verify whether the template suits your requirements or not.

- If the form is not what you need, get others using the Search field or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. Besides professionally drafted samples, users can also be supported with step-by-step guidelines concerning how to find, download, and fill out templates.

Form popularity

FAQ

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

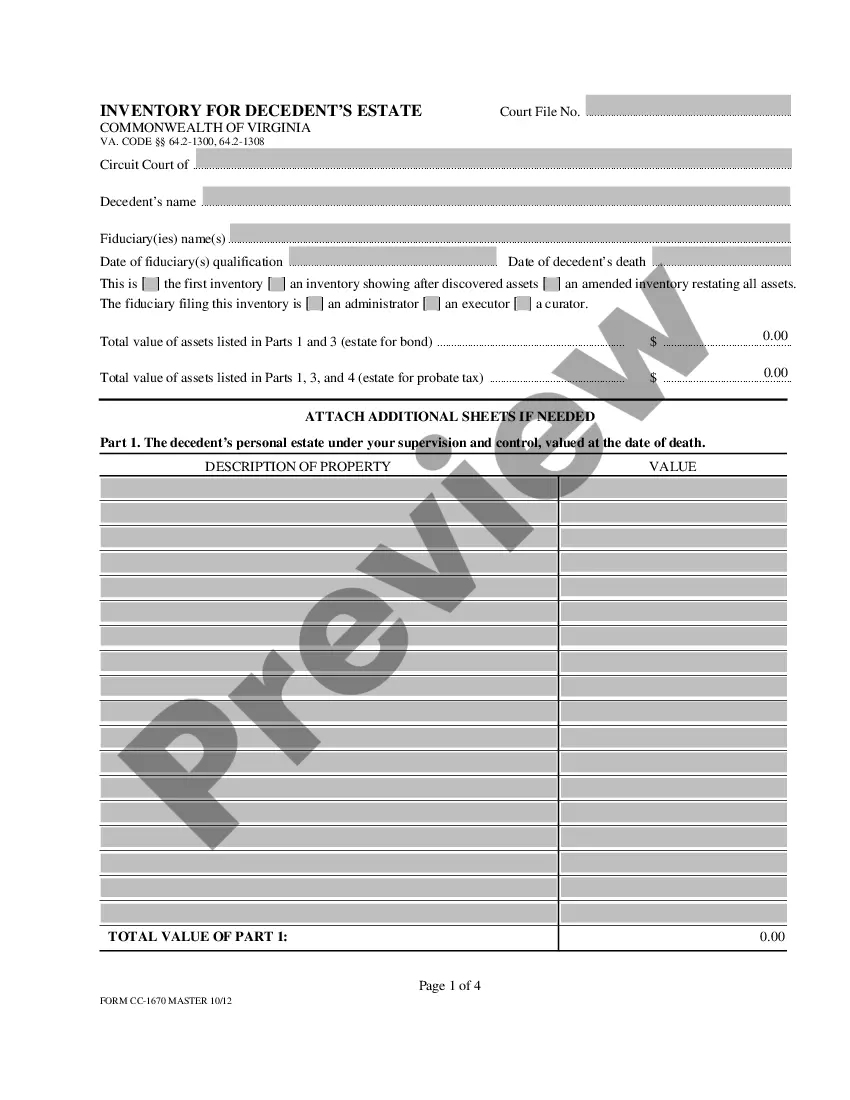

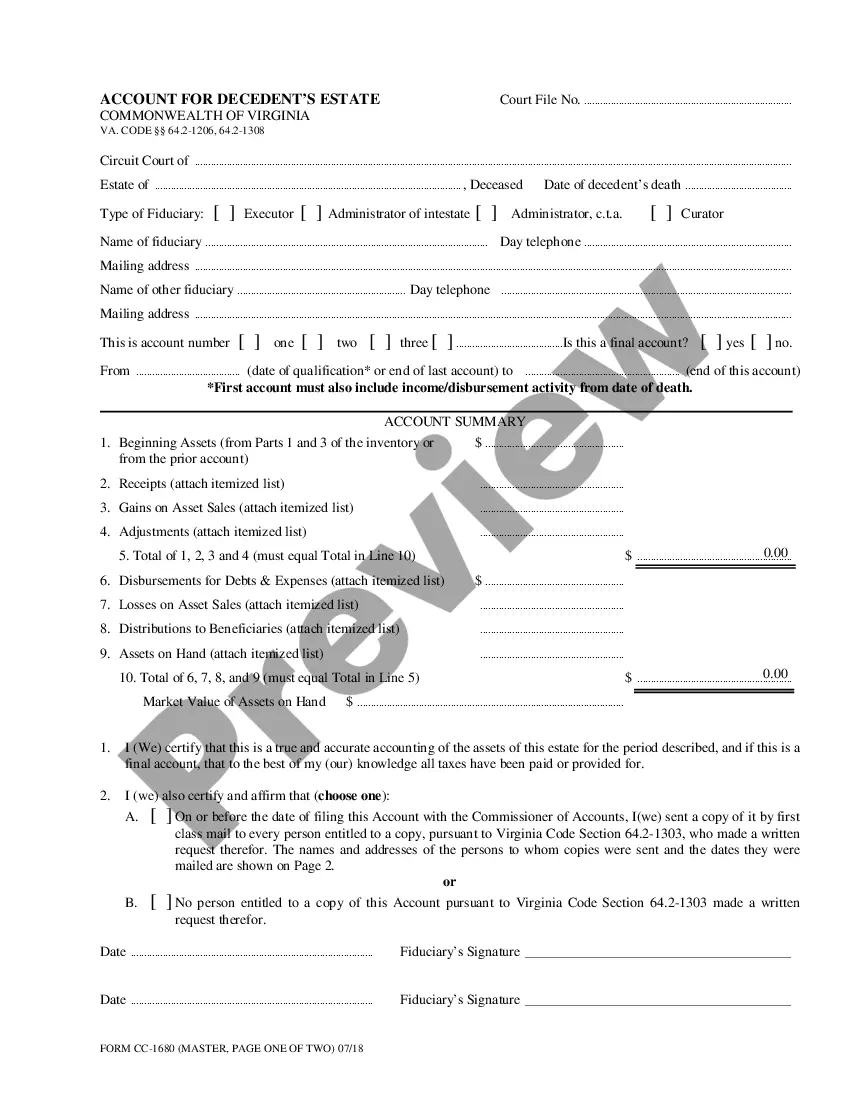

In order for the closing of an estate to occur, a final accounting showing that all estate assets have been distributed to beneficiaries in accordance with the written will or Virginia law if no will exists and a statement by the executor that all taxes have been paid must be filed and approved by the Commissioner of

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. f0a7 if no surviving spouse, all passes to the children and their descendants.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

Step 1 Write in your name as the successor in interest. Step 2 In Section 1, enter in decedent's name and the date of death. Step 3 Check the box that indicates the type of asset. Step 4 In Section 7, check the box which indicates your relationship to the decedent.

If there is no will, or the person named in the will isn't available or willing to serve, the probate court will appoint an administrator. This person does the same job as an executor. Under Virginia law, anyone who inherits from the deceased person can be appointed as administrator.