Virginia Letter from Landlord to Tenant Returning security deposit less deductions

Definition and meaning

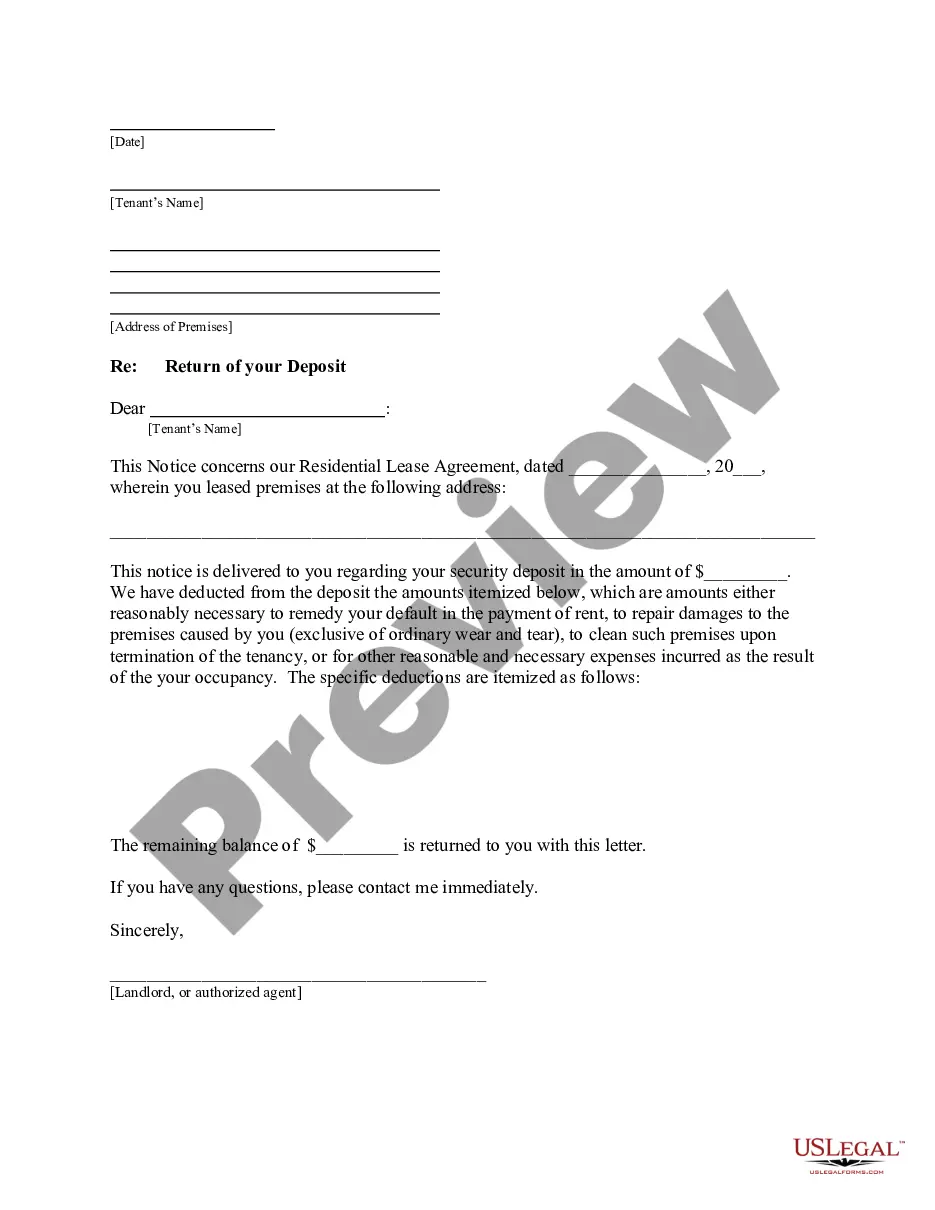

A Virginia Letter from Landlord to Tenant Returning security deposit less deductions is a formal communication from a landlord to a tenant regarding the return of their security deposit. This letter outlines the total amount of the deposit, specifies any deductions made due to damages or unpaid rent, and informs the tenant of the remaining balance that will be returned to them. The context of this letter is crucial for establishing legal clarity and ensuring that both parties understand their rights and obligations under the lease agreement.

How to complete a form

To properly complete a Virginia Letter from Landlord to Tenant Returning security deposit less deductions, follow these steps:

- Begin with the date at the top of the letter.

- Insert the tenant’s name and address where the lease was executed.

- Clearly state the subject, indicating it concerns the return of the security deposit.

- Reference the original lease agreement, including the date of execution and the property address.

- Specify the total amount of the security deposit collected.

- List each deduction made from the security deposit, providing details of the reasons for these deductions.

- Calculate the remaining balance to be returned and include this amount in the letter.

- Provide your name and signature as the landlord or authorized agent.

- Indicate the method of delivery for the notice.

Key components of the form

A Virginia Letter from Landlord to Tenant Returning security deposit less deductions should include the following vital components:

- Date: The date on which the letter is written.

- Tenant Information: Name and address of the tenant.

- Subject Line: Clearly stating the purpose of the letter.

- Reference to Lease: Details of the lease agreement being referenced.

- Deposit Amount: The total amount of the security deposit collected.

- Deductions: A detailed list of all deductions made, including amounts and reasons.

- Remaining Balance: Total amount being returned to the tenant.

- Landlord Sign-off: Landlord’s name and signature.

- Proof of Delivery: Indication of how the notice was delivered to the tenant.

Common mistakes to avoid when using this form

When completing a Virginia Letter from Landlord to Tenant Returning security deposit less deductions, it's essential to avoid the following common mistakes:

- Failing to clearly itemize deductions, which can lead to confusion.

- Omitting the tenant’s correct name or address, causing delivery issues.

- Not referencing the specific lease agreement, which is vital for context.

- Leaving out the date of the letter, which is essential for record-keeping.

- Not ensuring the letter is delivered in accordance with any clauses in the lease regarding notification.

Form popularity

FAQ

No, the landlord can use the deposit for other costs set out in the lease. For instance, some leases state that the tenant agrees to pay the cost of carpet cleaning once she moves out. If that part of the lease is proper, the landlord can deduct for that charge.That is okay if the landlord wants to do that.

Virginia Landlord Tenant Law Security Deposits The landlord can withhold the amount of money equal to the cost of repairs for damages to the premises caused by the tenant. Virginia Landlord Tenant Law forbids a landlord from withholding any portion of the security deposit for normal wear and tear to the property.

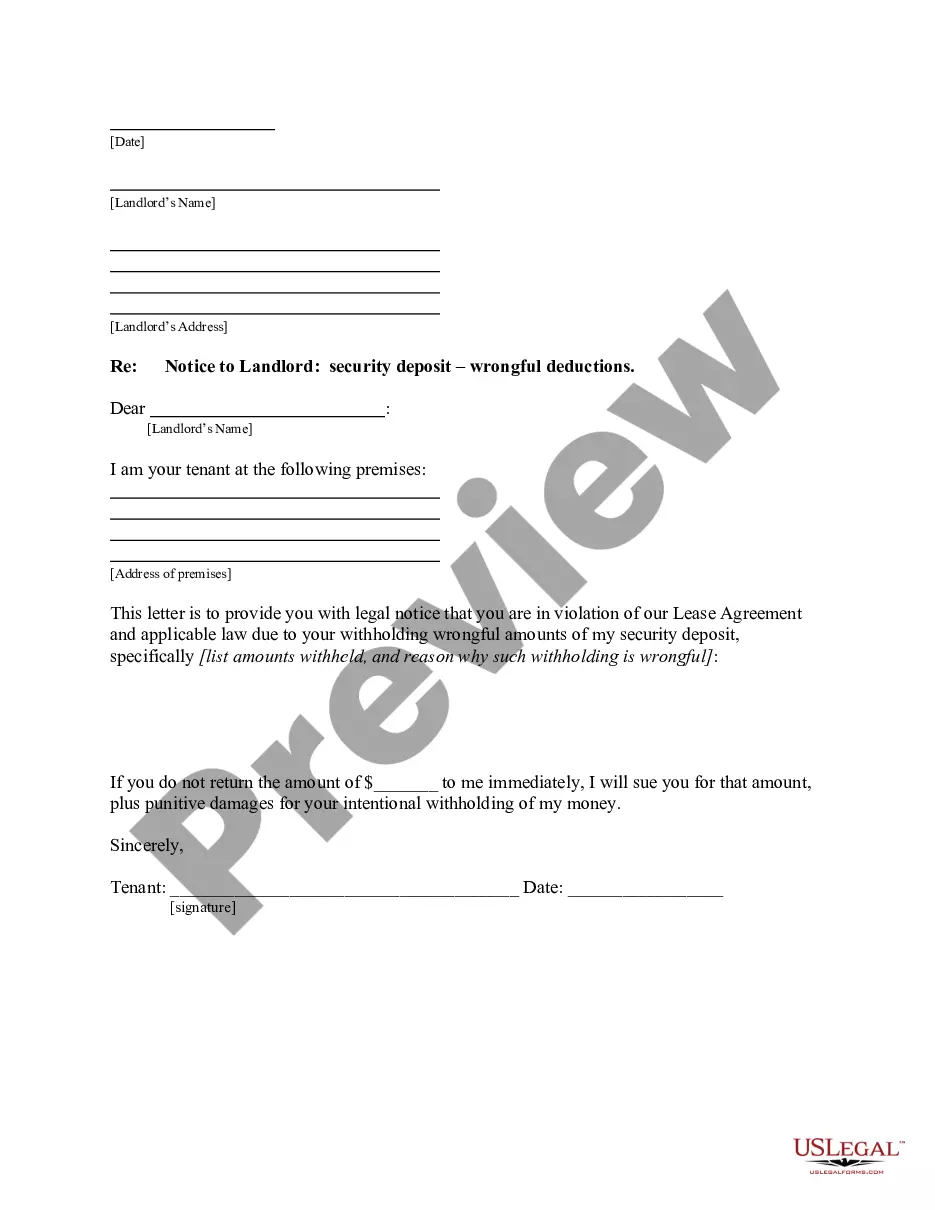

Concisely review the main facts and lay out the reasons your landlord owes you money. Include copies of relevant letters and agreements, such as your notice to move out. Ask for exactly what you want, such as the full amount of your deposit within ten days. Cite state security deposit law.

Virginia law was changed in 2014, removing the requirement that interest accrue on security deposits held by landlords unless otherwise agreed in writing.

First, let's define our terms. Normal wear and tear is any damage that occurs in on a property due to aging. Typically this kind of damage is merely the result of a tenant(s) living in the property and is considered a part of normal depreciation. Its cause is neither neglect or abuse of the property by the tenant(s).

Unpaid rent at the end of the tenancy. Unpaid bills at the end of the tenancy. Stolen or missing belongings that are property of the landlord. Direct damage to the property and it's contents (owned by the landlord) Indirect damage due to negligence and lack of maintenance.

Generally, a landlord may retain all or part of the security deposit to pay for damages to the unit that occurred during the tenants' occupancy, except for those resulting from normal wear and tear. Usually, the landlord can deduct other costs, such as late fees, unpaid rent, and unpaid utility bills.