This office lease clause is used to respond to various changes that might occur within the tenant's office building or shopping center.

Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

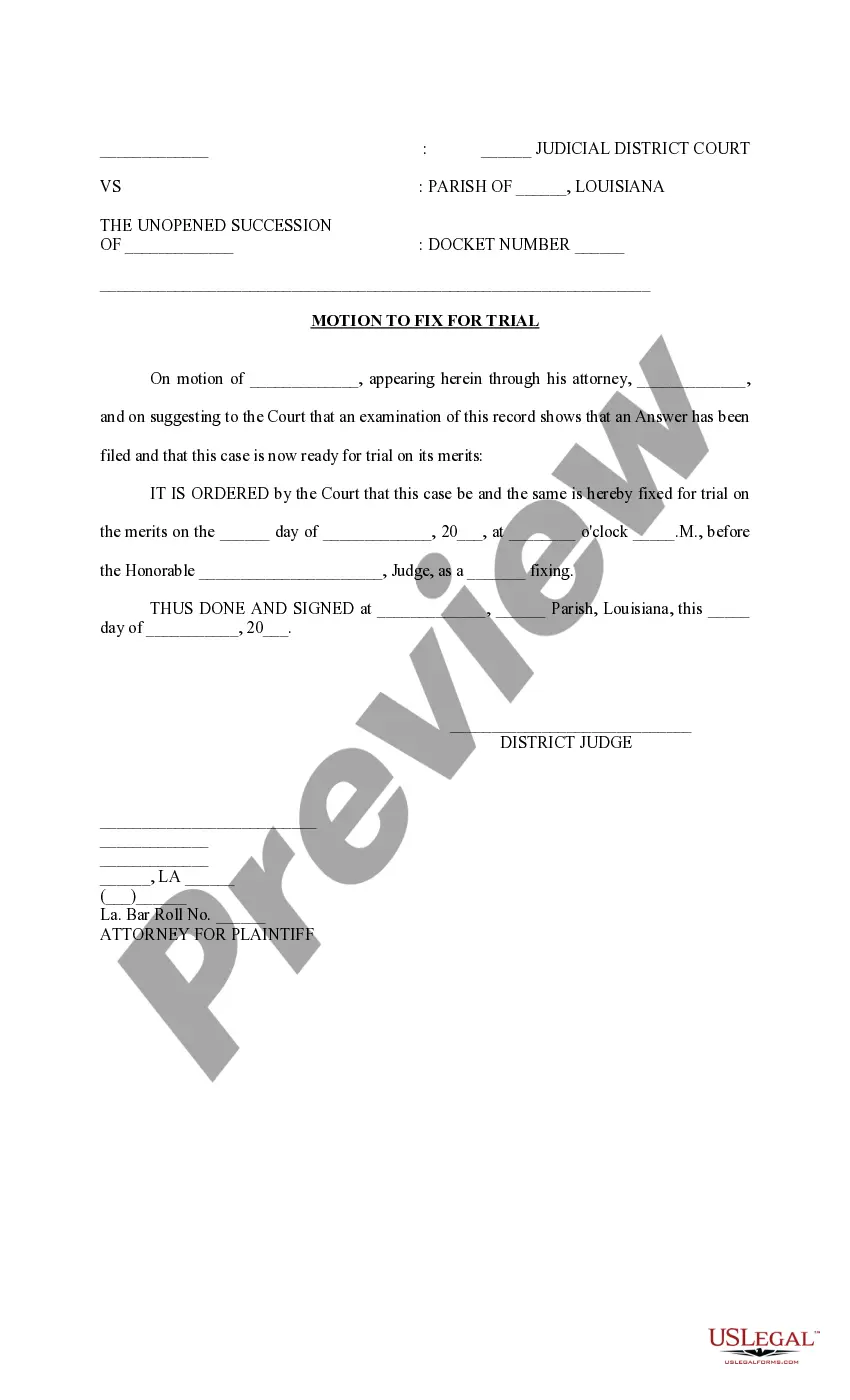

How to fill out Measurement Representations And Proportionate Share Adjustment Of Tenants Proportionate Tax Share?

If you want to complete, down load, or print out legal papers templates, use US Legal Forms, the most important collection of legal types, which can be found on the Internet. Make use of the site`s easy and practical research to find the files you will need. Different templates for organization and individual uses are categorized by groups and says, or search phrases. Use US Legal Forms to find the Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share with a handful of mouse clicks.

In case you are previously a US Legal Forms client, log in to your accounts and click on the Download switch to obtain the Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share. You can even access types you in the past downloaded within the My Forms tab of your own accounts.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for that correct metropolis/country.

- Step 2. Take advantage of the Review option to look through the form`s content material. Never forget about to read through the explanation.

- Step 3. In case you are unsatisfied with the type, use the Search industry on top of the monitor to discover other types in the legal type format.

- Step 4. Once you have identified the form you will need, go through the Purchase now switch. Select the costs program you choose and include your references to sign up for an accounts.

- Step 5. Approach the transaction. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure in the legal type and down load it on your device.

- Step 7. Full, change and print out or sign the Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share.

Each and every legal papers format you buy is your own forever. You possess acces to each and every type you downloaded inside your acccount. Go through the My Forms portion and choose a type to print out or down load once more.

Be competitive and down load, and print out the Utah Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share with US Legal Forms. There are millions of professional and express-particular types you can utilize to your organization or individual needs.

Form popularity

FAQ

Your pro rata share of household operating expenses is the average monthly household operating expenses (based on a reasonable estimate if exact figures are not available) divided by the number of people in the household, regardless of age.

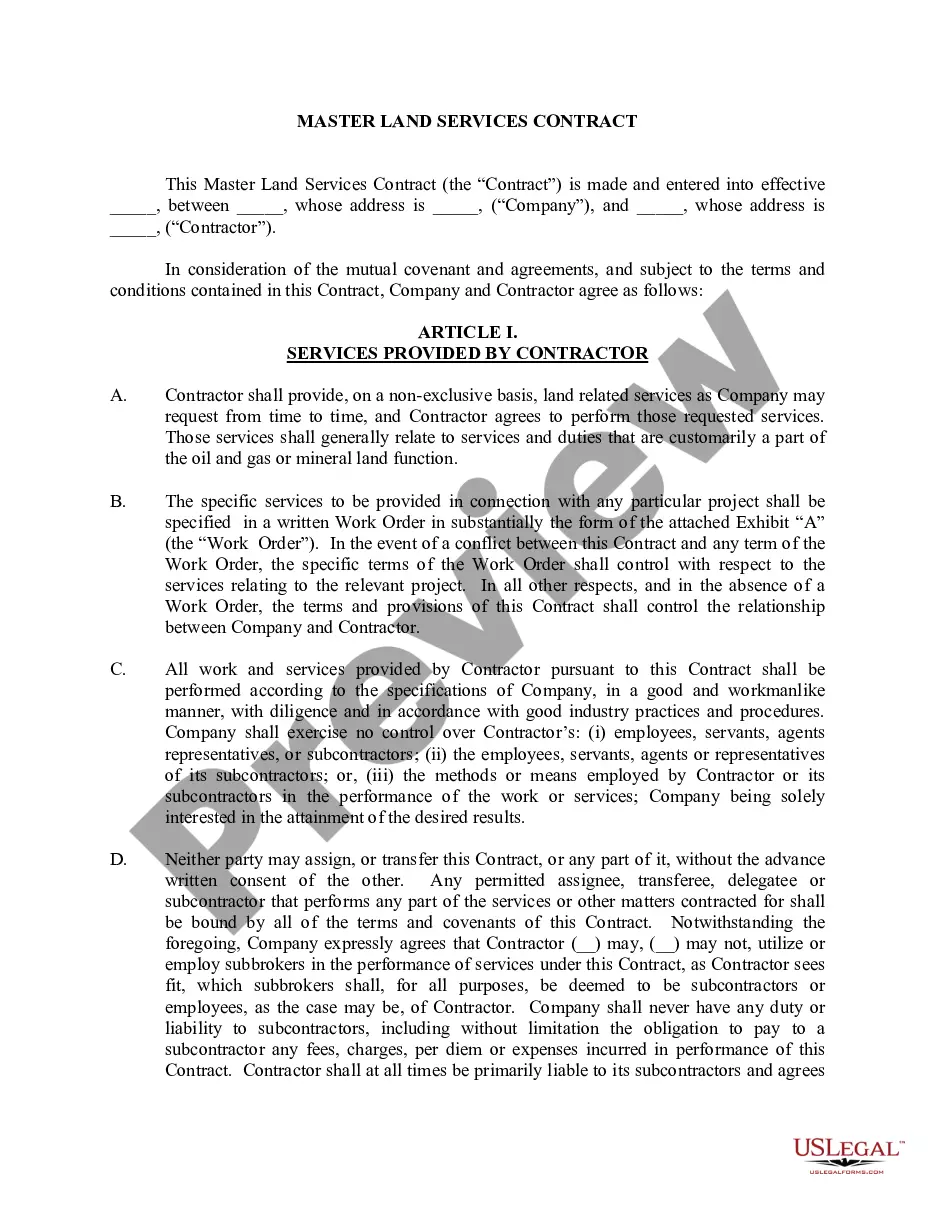

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

Also known as tenant's pro rata share. The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.

Lessee's Proportion means the proportion that the net lettable are of the Premises bears to the net lettable area of the Building, being the percentage in item 16 of the Reference Schedule (or any other corrected or recalculated percentage notified in writing by the Lessor to the Lessee from time to time).

Proportionate Share of Operating Expenses means a fraction equal to the total Gross Rentable Area of the Premises divided by the total Gross Rentable Area of the Building.

The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.