"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Utah Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

It is possible to devote time on the Internet attempting to find the authorized papers web template that suits the state and federal requirements you want. US Legal Forms gives a large number of authorized forms that happen to be analyzed by experts. It is simple to download or print the Utah Form of Mortgage Deed of Trust and Variations from my service.

If you currently have a US Legal Forms account, you are able to log in and then click the Acquire button. Next, you are able to comprehensive, modify, print, or signal the Utah Form of Mortgage Deed of Trust and Variations. Every single authorized papers web template you buy is your own forever. To obtain one more backup of the obtained kind, go to the My Forms tab and then click the related button.

If you use the US Legal Forms web site initially, adhere to the easy recommendations below:

- Very first, be sure that you have chosen the right papers web template for the area/metropolis of your choosing. Read the kind outline to make sure you have selected the proper kind. If readily available, use the Preview button to look throughout the papers web template too.

- If you wish to find one more edition of your kind, use the Look for industry to discover the web template that fits your needs and requirements.

- Upon having identified the web template you need, simply click Get now to proceed.

- Find the rates plan you need, key in your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal account to purchase the authorized kind.

- Find the structure of your papers and download it to the device.

- Make adjustments to the papers if needed. It is possible to comprehensive, modify and signal and print Utah Form of Mortgage Deed of Trust and Variations.

Acquire and print a large number of papers web templates making use of the US Legal Forms web site, which offers the greatest selection of authorized forms. Use expert and state-certain web templates to handle your business or personal requirements.

Form popularity

FAQ

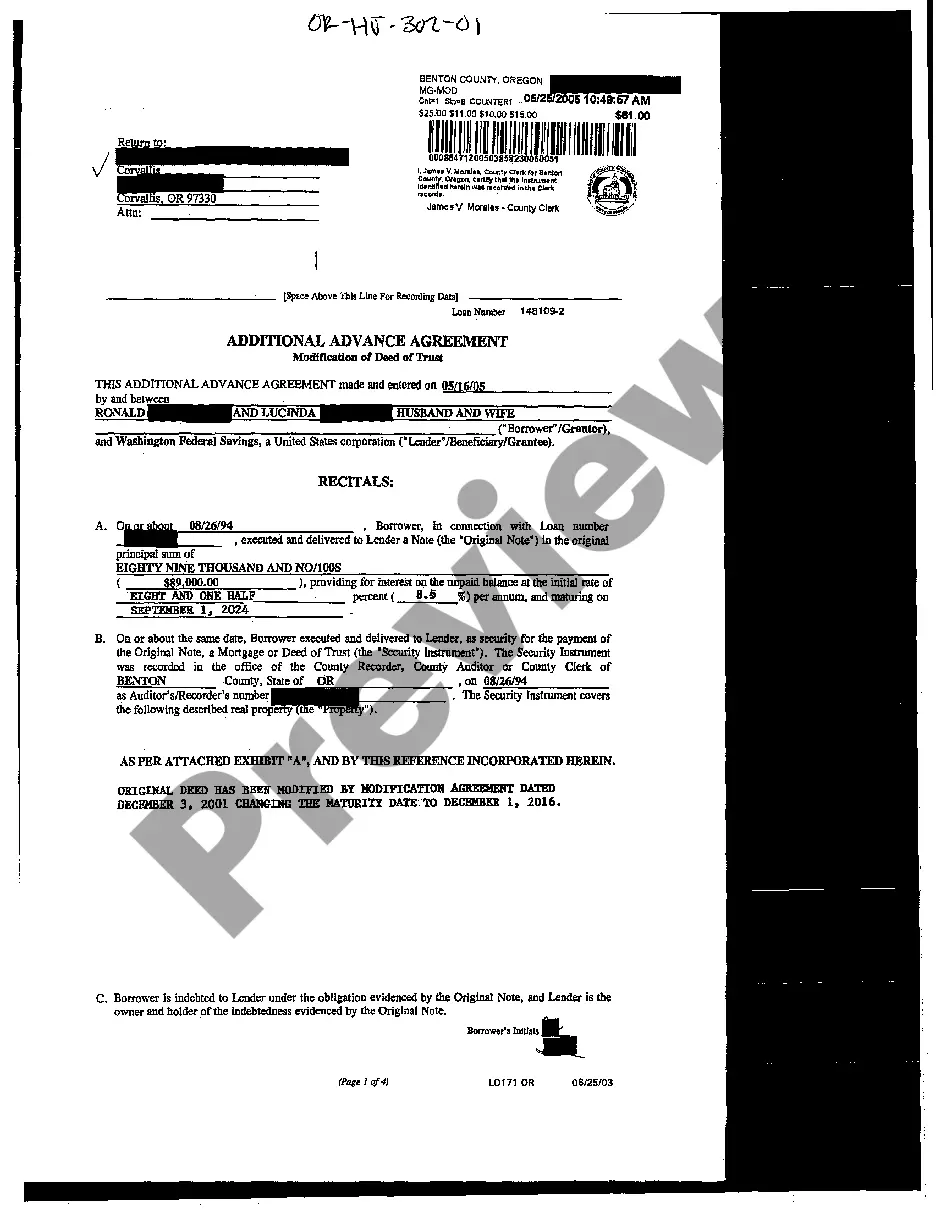

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Utah is known as a Trust Deed and Promissory Note state. There are references to a foreclosure being allowed under the law, typically in a Contract for Deed transaction but this is certainly not the standard. Is Utah a Title Theory or Lien Theory State? | Real Estate Exam prepagent.com ? article ? is-utah-a-title-theo... prepagent.com ? article ? is-utah-a-title-theo...

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ... Example Trust Deed - Basel Institute on Governance baselgovernance.org ? sites ? default ? files ? Exa... baselgovernance.org ? sites ? default ? files ? Exa...

Any assignment of a mortgage and any assignment of the beneficial interest under a deed of trust may be recorded, and from the time the same is filed for record operates as constructive notice of the contents thereof to all persons; and any instrument by which any mortgage or deed of trust of, lien upon or interest in ... Cal. Civ. Code § 2934 - Casetext casetext.com ? article-1-mortgages-in-general ? se... casetext.com ? article-1-mortgages-in-general ? se...

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

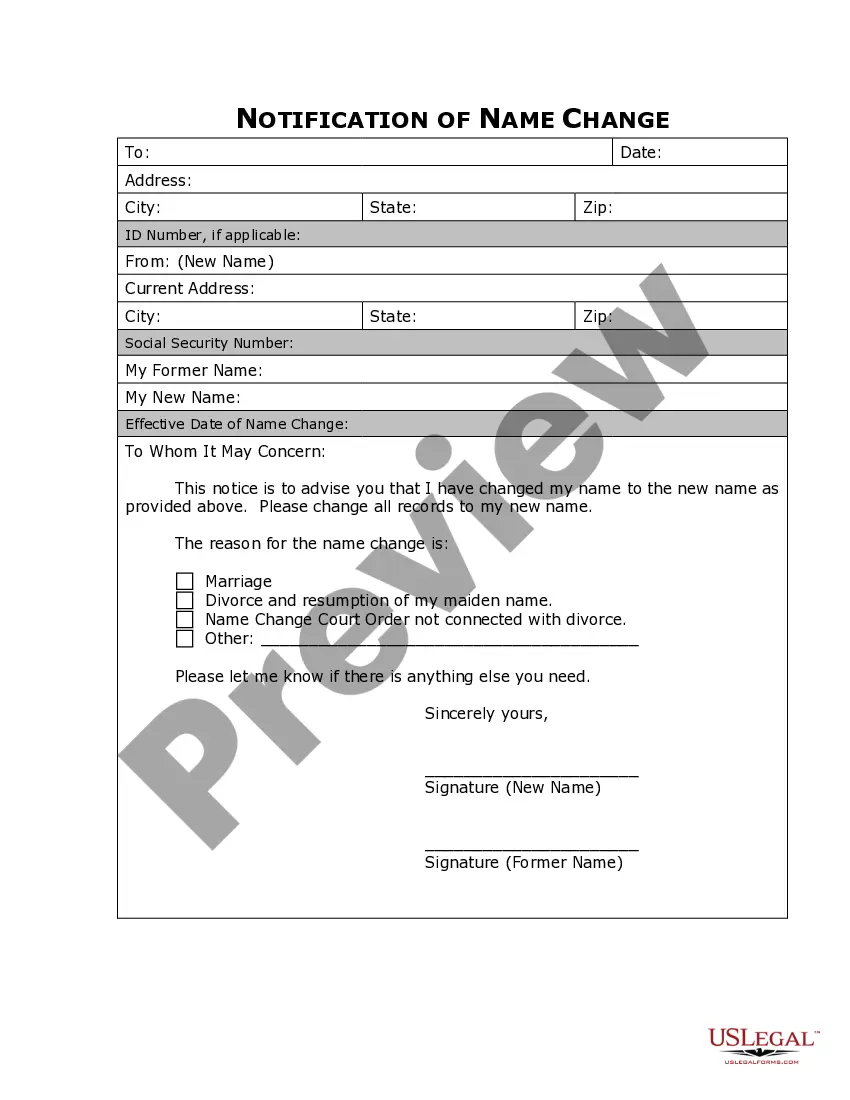

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed. INSTRUCTIONS FOR TRANSFERRING ASSETS TO TRUST affinityplus.org ? docs ? estate-planning ? tr... affinityplus.org ? docs ? estate-planning ? tr...