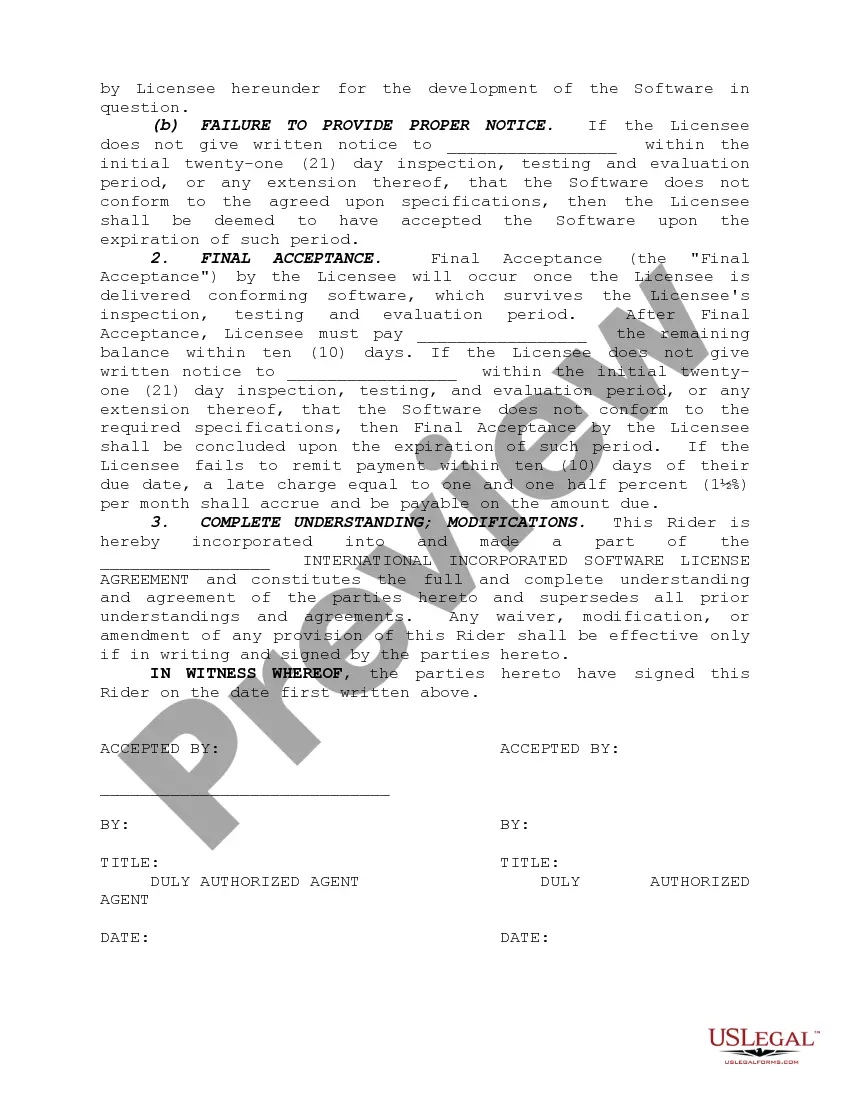

Utah Software Specifications Agreement

Description

How to fill out Software Specifications Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of forms such as the Utah Software Specifications Agreement in just moments.

If you have an account, Log In to download the Utah Software Specifications Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents tab in your account.

Make modifications. Fill out, edit, print, and sign the downloaded Utah Software Specifications Agreement.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Utah Software Specifications Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started:

- Ensure you have chosen the correct form for your area/region. Click the Preview button to review the form’s details. Check the form summary to confirm you have selected the right form.

- If the form does not suit your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

Yes, in Utah, software licenses are typically subject to sales tax. The state treats the licensing of software as a sale of tangible personal property, which means that taxes apply. Therefore, when you establish a Utah Software Specifications Agreement that includes software licensing, it is imperative to factor in the sales tax to remain compliant with state regulations.

Utah's contract law is grounded in the principles of common law and statutory guidelines. Contracts in Utah must have an offer, acceptance, and consideration to be enforceable. When creating a Utah Software Specifications Agreement, it's important to outline the terms clearly to avoid misunderstandings and ensure that the contract holds up in court.

In Utah, the right of rescission allows consumers to cancel certain types of contracts, but this right typically applies to specific situations. For contracts related to real estate and some consumer credit transactions, consumers usually have three business days to cancel. If you are drafting a Utah Software Specifications Agreement, it is crucial to understand whether this right applies to your specific agreement, as the nuances can vary.

Filling out a Utah bill of sale is straightforward. Begin by providing details about the item being sold, including its description and value. Ensure both parties' information is complete. For clarity in transactions, consider how your Utah Software Specifications Agreement fits into the overall sale process.

Absolutely, software as a service is taxable in Utah. This classification means that if you're offering SaaS products, you need to collect and remit sales tax. Your Utah Software Specifications Agreement should reflect these obligations to avoid any future complications.

Indeed, tax applies to software as a service in Utah. If your business model involves providing software remotely, you should be prepared for tax assessments. Clarifying these aspects in your Utah Software Specifications Agreement can help you stay compliant.

Yes, SaaS software is considered taxable in Utah. The state treats SaaS as a form of tangible personal property, subjecting it to sales tax. If you provide SaaS solutions under a Utah Software Specifications Agreement, it's vital to factor in these tax implications.

Yes, Utah businesses must file an annual report to maintain good standing. This requirement applies to corporations and limited liability companies, ensuring all information is up to date. If you have a business structured around a Utah Software Specifications Agreement, ensure you meet this requirement annually.

SaaS products are generally subject to sales tax in Utah. When a software is delivered online and qualifies as SaaS, users may face tax obligations. Understanding these rules can help you align your Utah Software Specifications Agreement with state tax regulations.

In Utah, sales tax applies to various services, particularly those that include tangible personal property. Services like landscaping, cleaning, and repair services may be taxable. It's crucial to identify if your services involve selling products, as this could affect the applicability of the Utah Software Specifications Agreement.