Utah Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

You can spend multiple hours online searching for the appropriate legal document template that fulfills the federal and state requirements you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can download or print the Utah Payroll Specialist Agreement - Self-Employed Independent Contractor from my service.

To find another version of your form, utilize the Search field to discover the template that fulfills your needs and preferences.

- If you possess a US Legal Forms account, you can sign in and then hit the Obtain button.

- After that, you can complete, modify, print, or sign the Utah Payroll Specialist Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is your property indefinitely.

- To retrieve another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for your area/city of preference.

- Review the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Choosing between payroll and 1099 status depends on your work preferences and financial goals. Being on payroll offers benefits like health insurance and retirement plans, while 1099 status provides flexibility and tax deductions for business expenses. Understanding these differences is essential when drafting a Utah Payroll Specialist Agreement - Self-Employed Independent Contractor.

Independent contractors do not need to be on payroll because they operate as separate entities. They invoice clients for their work and receive payment directly, rather than receiving a regular paycheck. This distinction is critical for those using a Utah Payroll Specialist Agreement - Self-Employed Independent Contractor, as it outlines the independence of the contractor.

Independent contractors in Utah must comply with several legal requirements, including maintaining their own taxes and following industry regulations. They should also ensure their contracts are valid and properly documented to protect their rights. The US Legal platform offers resources and templates, making it easier to meet the legal requirements for a Utah Payroll Specialist Agreement - Self-Employed Independent Contractor.

In Utah, whether an independent contractor needs a business license depends on the nature of the work. Certain trades and professions require licensing at the state or local level. It's important to check the specific requirements applicable to your services, and the US Legal platform can assist in determining if your Utah Payroll Specialist Agreement - Self-Employed Independent Contractor requires a business license.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and deadlines. Clearly define the relationship and responsibilities of both parties to avoid misunderstandings. Utilizing a resource like the US Legal platform can simplify this process, as it provides templates specifically designed for the Utah Payroll Specialist Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement requires attention to detail. Begin by defining the services to be provided, followed by payment arrangements and deadlines. Be sure to include termination clauses and confidentiality agreements if necessary. To streamline the process, consider using platforms like uslegalforms, which offer templates for a Utah Payroll Specialist Agreement - Self-Employed Independent Contractor.

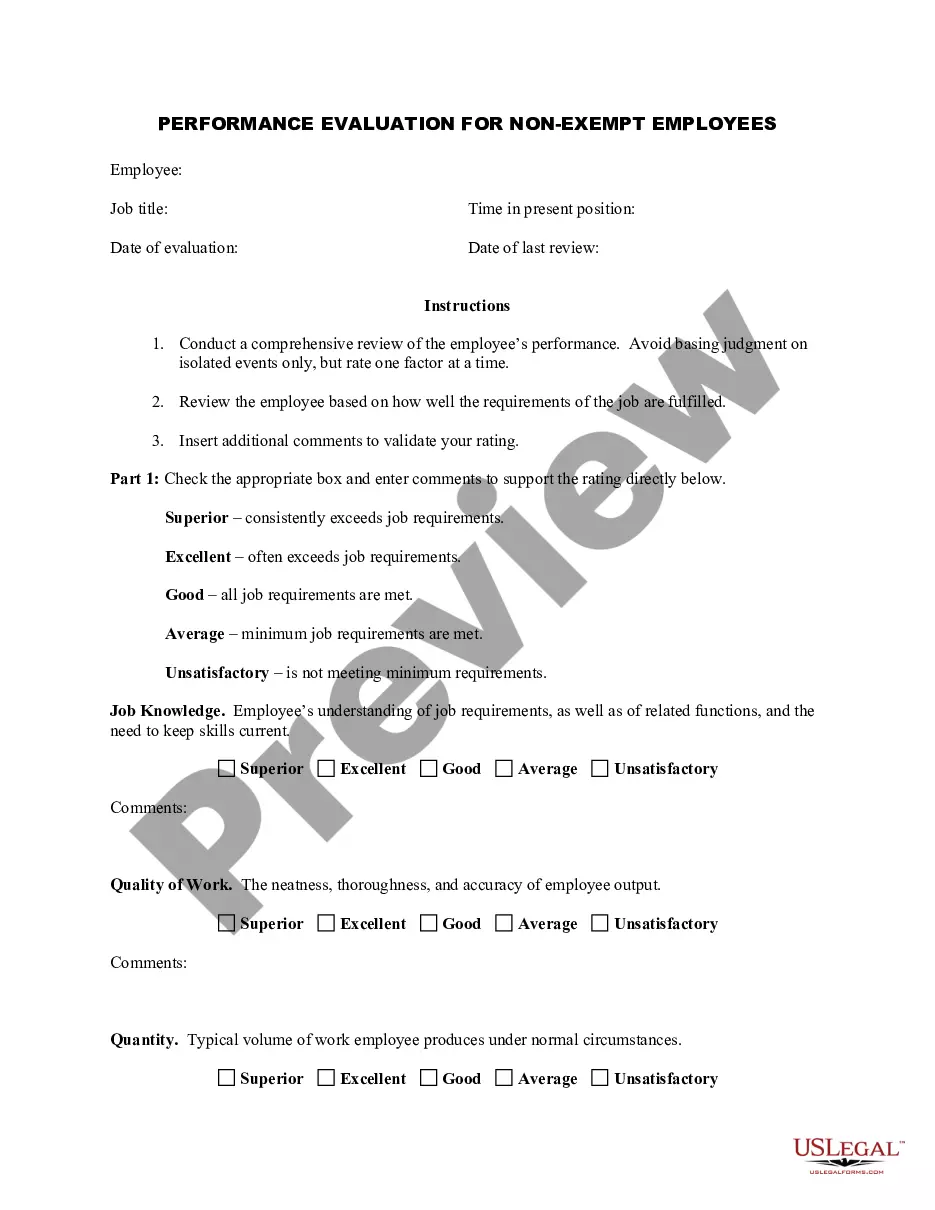

Managing payroll for independent contractors differs from traditional payroll processes. Typically, contractors submit invoices detailing their services, which you then review for payment. It’s essential to keep accurate records for tax purposes. Utilizing a Utah Payroll Specialist Agreement - Self-Employed Independent Contractor can simplify this process and ensure compliance.

Filling out an independent contractor agreement is straightforward. Start by clearly identifying the parties involved, including their names and addresses. Next, outline the scope of work, payment terms, and deadlines. Remember, a well-defined Utah Payroll Specialist Agreement - Self-Employed Independent Contractor ensures clarity and protects both parties.