Utah Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

If you wish to be thorough, download, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to locate the Utah Foundation Contractor Agreement - Self-Employed in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Utah Foundation Contractor Agreement - Self-Employed. Each legal format you acquire is yours forever. You will have access to every type you obtained in your account. Visit the My documents section and choose a form to print or download again. Stay competitive and download, and print the Utah Foundation Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you may utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Utah Foundation Contractor Agreement - Self-Employed.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your correct area/state.

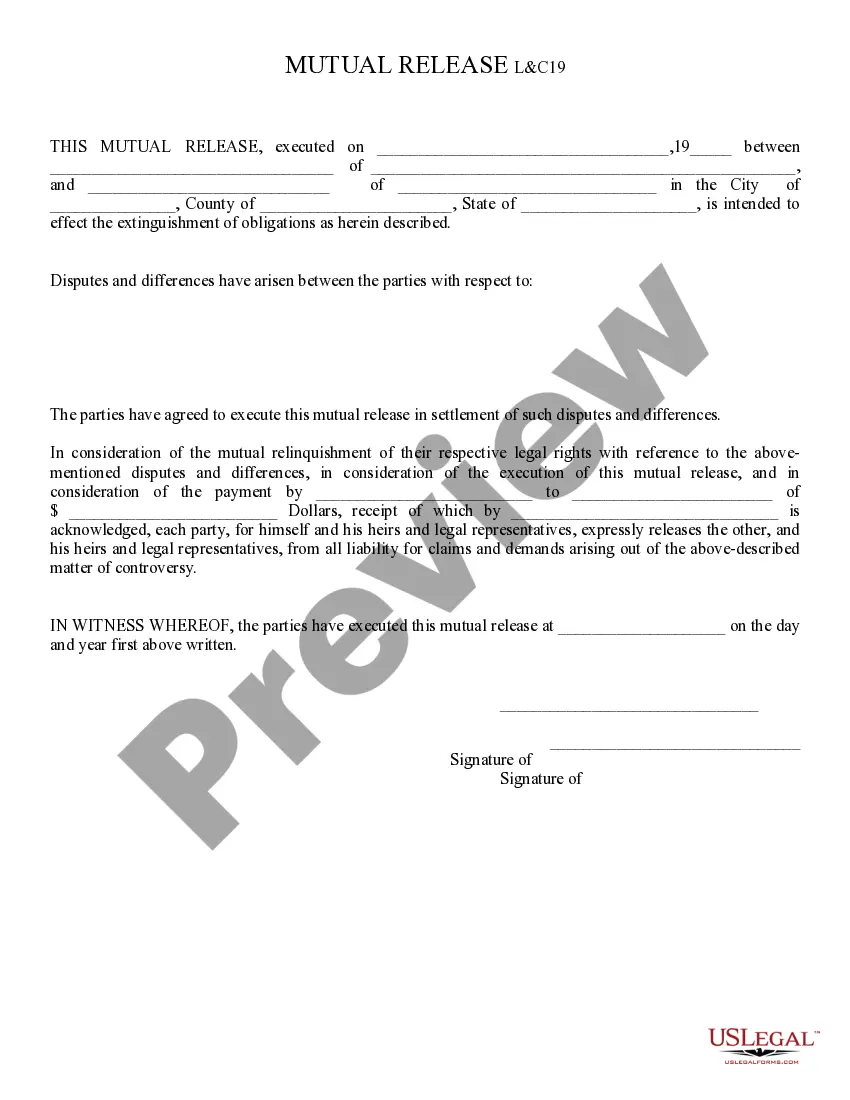

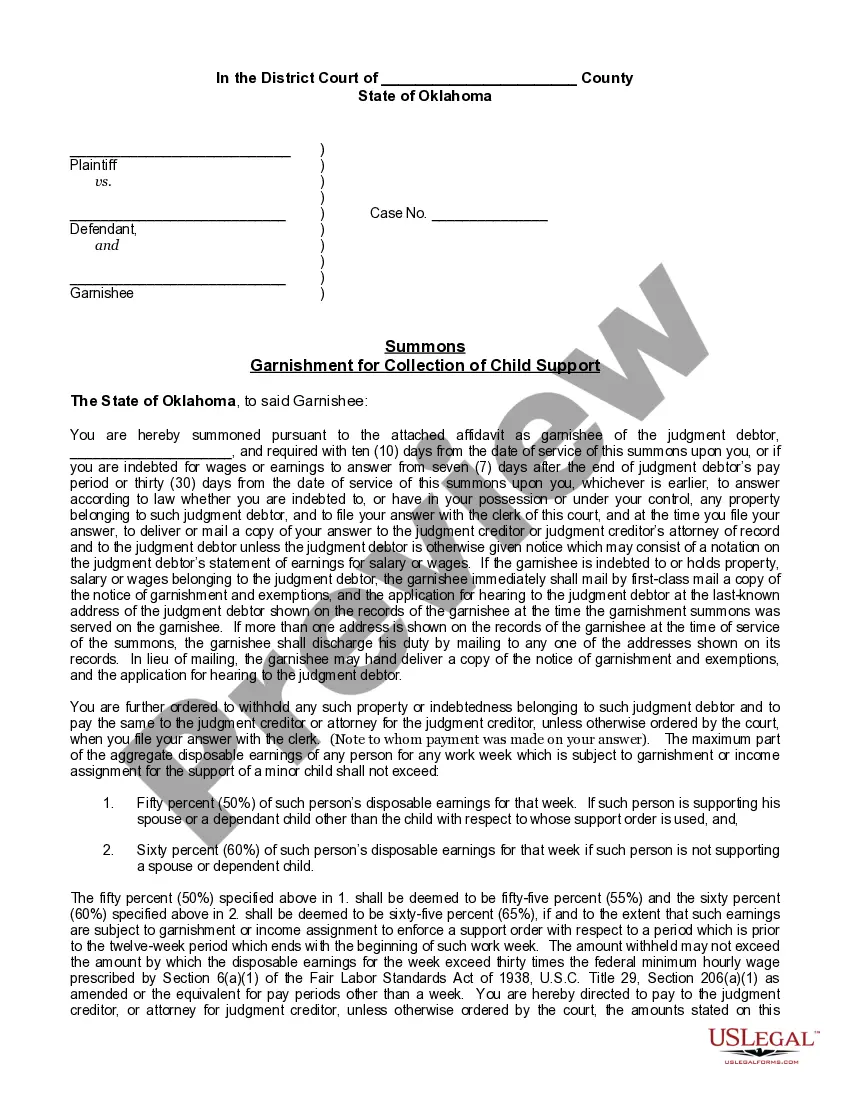

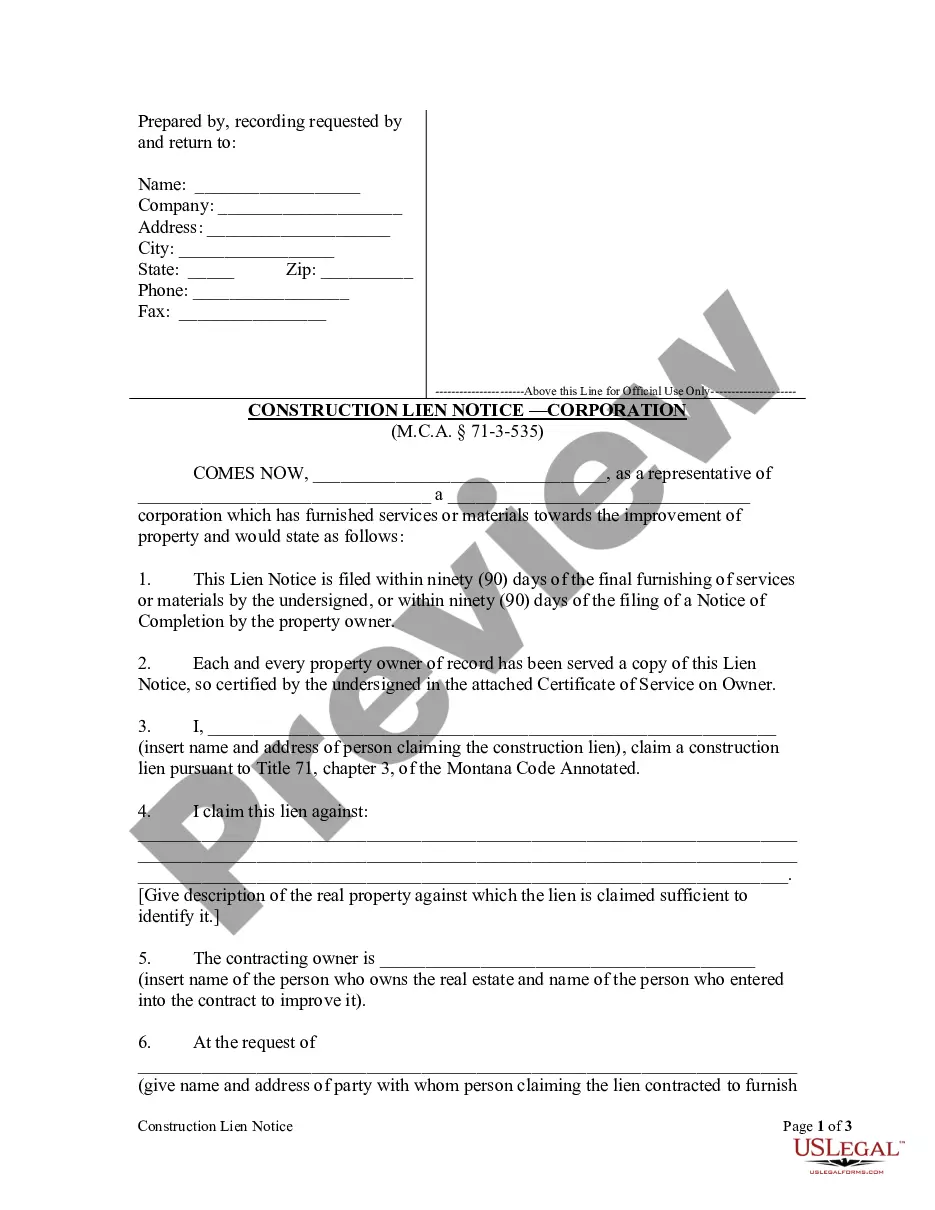

- Step 2. Use the Review option to check the form's details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining key elements such as scope of work, payment terms, and confidentiality clauses. It's important to be clear and precise in each section, ensuring both parties understand their responsibilities. If you need assistance, platforms like US Legal Forms provide templates, including the Utah Foundation Contractor Agreement - Self-Employed, to help you create a comprehensive and legally sound agreement.

Absolutely, a contractor is indeed regarded as self-employed. This classification signifies that you are responsible for your own business operations, including securing clients and managing taxes. When entering into agreements like the Utah Foundation Contractor Agreement - Self-Employed, it’s crucial to recognize this status, as it affects your rights and obligations.

Yes, a contractor is generally considered self-employed. This means that they operate their own business and maintain control over the work they perform. Having a clear understanding of your status is vital when drafting legal frameworks, such as the Utah Foundation Contractor Agreement - Self-Employed, to ensure mutual understanding between you and your clients.

Contract work does not count as traditional employment. Instead, it categorizes you as a self-employed individual or an independent contractor. This distinction is crucial, especially when it comes to understanding agreements like the Utah Foundation Contractor Agreement - Self-Employed, which outlines your rights and responsibilities as a contractor.

Yes, if you receive a 1099 form for the work you perform, you are typically considered self-employed. This form indicates that you have earned income as a contractor, not as an employee. Therefore, when navigating the Utah Foundation Contractor Agreement - Self-Employed, recognizing your status as a self-employed individual is important for legal and tax purposes.

Using the terms self-employed and independent contractor can often depend on context. Generally, both terms imply that you run your own business and are not an employee. However, the term independent contractor is more frequently used in legal agreements, such as the Utah Foundation Contractor Agreement - Self-Employed. Understanding these nuances can help you effectively communicate your status to clients.

To write an independent contractor agreement, start with a title and include the names and addresses of both parties involved. Clearly define the work to be performed, payment terms, and duration of the agreement. Lastly, consider incorporating clauses for confidentiality and termination. The Utah Foundation Contractor Agreement - Self-Employed offered by uslegalforms can guide you in drafting a strong and effective document.

To fill out an independent contractor form, begin by inputting the contractor's information, including contact details and the services provided. Make sure to include payment details and specify project timelines. Utilizing resources like the Utah Foundation Contractor Agreement - Self-Employed will help ensure your form is completed correctly and in a compliant manner.

Yes, an independent contractor often needs a business license in Utah, depending on their work type. This requirement ensures you comply with local regulations and can operate legally. Always check the local laws relevant to your specific field and consider consulting uslegalforms for assistance in understanding these requirements.

Filling out an independent contractor agreement involves providing essential details such as the contractor's name, the services they will perform, and payment terms. Additionally, specify the duration of the contract and any specific conditions or requirements. To ensure clarity and completeness, consider using a framework like the Utah Foundation Contractor Agreement - Self-Employed.