Utah Sample Letter for Short Sale Request to Lender

Description

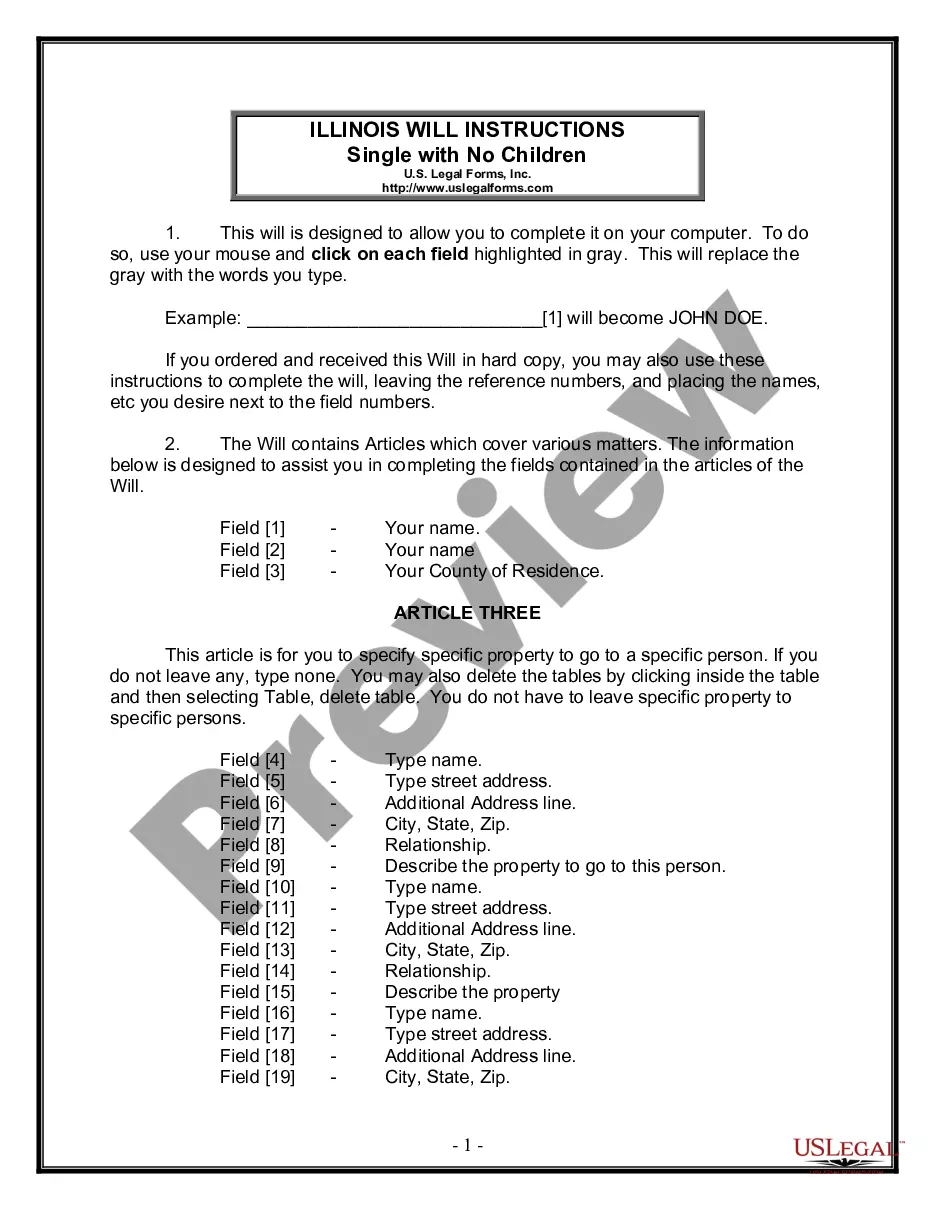

How to fill out Sample Letter For Short Sale Request To Lender?

Selecting the correct legal document template can be a challenge. Of course, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Utah Sample Letter for Short Sale Request to Lender, which can be utilized for business and personal purposes.

All of the forms are reviewed by experts and meet both state and federal requirements.

If the form does not meet your requirements, use the Search field to find the right form. Once you confirm that the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your system. Complete, modify, print, and sign the downloaded Utah Sample Letter for Short Sale Request to Lender. US Legal Forms is the largest repository of legal forms where you can find various document templates. Make use of this service to obtain well-crafted documents that comply with state requirements.

- If you are currently registered, Log In to your account and click on the Acquire button to access the Utah Sample Letter for Short Sale Request to Lender.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy instructions to follow.

- First, ensure you have selected the appropriate form for your city/region.

- You can preview the form using the Preview button and review the form details to ensure it is the right one for you.

Form popularity

FAQ

To get approved for a short sale, you need to demonstrate financial hardship and submit a formal request to the lender. Providing complete documentation and a compelling letter can improve your chances of approval. Engaging with professionals can also be beneficial during this process. Accessing templates like the Utah Sample Letter for Short Sale Request to Lender from our platform can streamline your application effectively.

A short sale can be beneficial for buyers seeking a good deal on a property. Buyers may find homes at lower prices than market value, but the process can be lengthy and complex. It's important to conduct due diligence to ensure the property is in good condition. Ultimately, understanding the intricacies of a short sale can help buyers make informed decisions, with resources like the Utah Sample Letter for Short Sale Request to Lender to guide them.

Lender approval is necessary for a short sale because the lender must agree to accept less than what is owed. Without this approval, the sale cannot proceed, leaving the homeowner at risk of foreclosure. The lender's consent is crucial to ensure that both parties understand the terms of the sale. Utilizing a Utah Sample Letter for Short Sale Request to Lender can help present your case effectively.

A hardship letter explains to a lender the circumstances that have made you unable to keep up with your debt payments. It provides specific details such as the date the hardship began, the cause and how long you expect it to continue.

The first paragraph should focus on introducing yourself and your particular situation. This will be the section that explains exactly what your hardship is and establish your desire to work with the lender to continue paying off your debts.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

A short sale approval letter is a letter that a lender issues to the seller if a short sale offer is approved for less than the amount the borrower owes on a mortgage. It is sent by the lender at the end of a short sale to demand the "short" loan payoff in return for releasing the lien on the property.

You'll need to include a letter that notifies the bank of who your agent is and authorizes them to make decisions on your behalf. Your package should also document your financial reasons for seeking a short sale.

In the body of the letter, state the hardship that led you to fall behind on your mortgage payments. Explain to the lender what happened and why it was beyond your control. Keep your explanation brief. The goal of the hardship letter is to explain to the lender the nature of your hardship.

Depending on the state, a deficiency arising from a short sale is liable for collection by the lender. In some states you'll need a waiver in writing from your lender for any mortgage deficiency after a short sale to avoid debt collection.