Utah LLC Agreement - Open Source

Description

How to fill out LLC Agreement - Open Source?

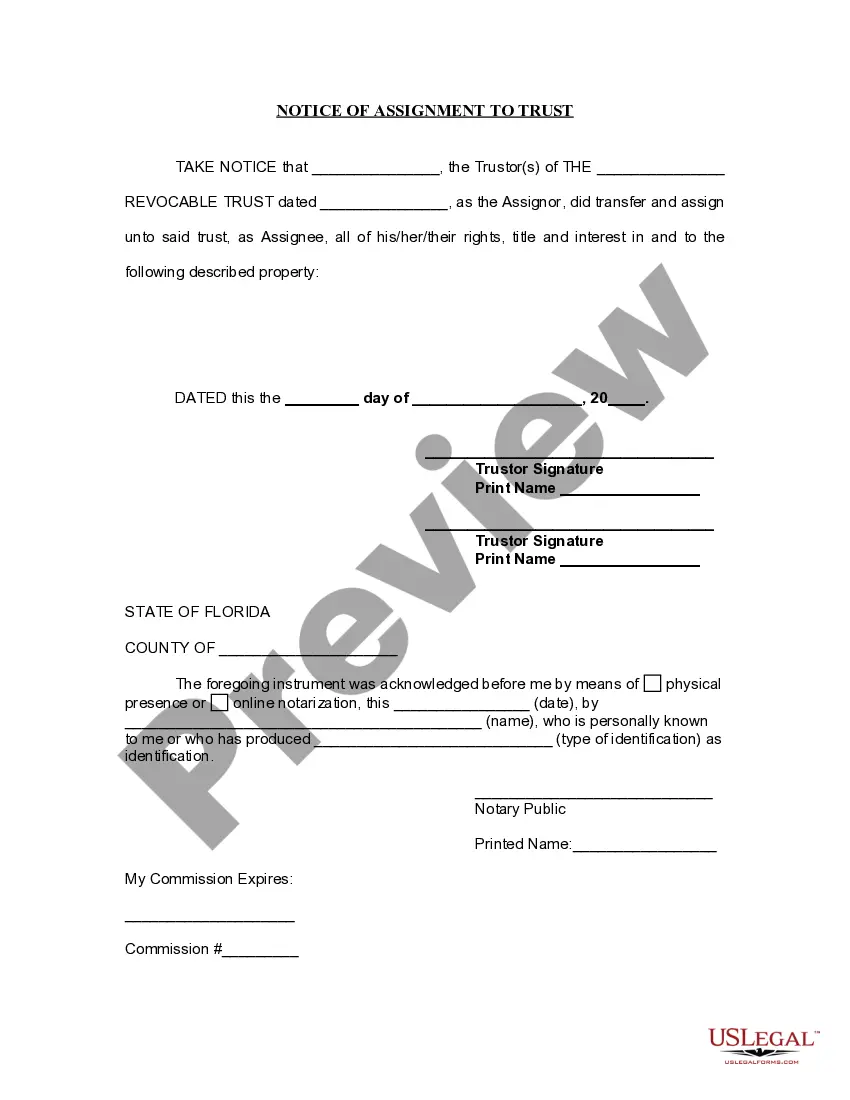

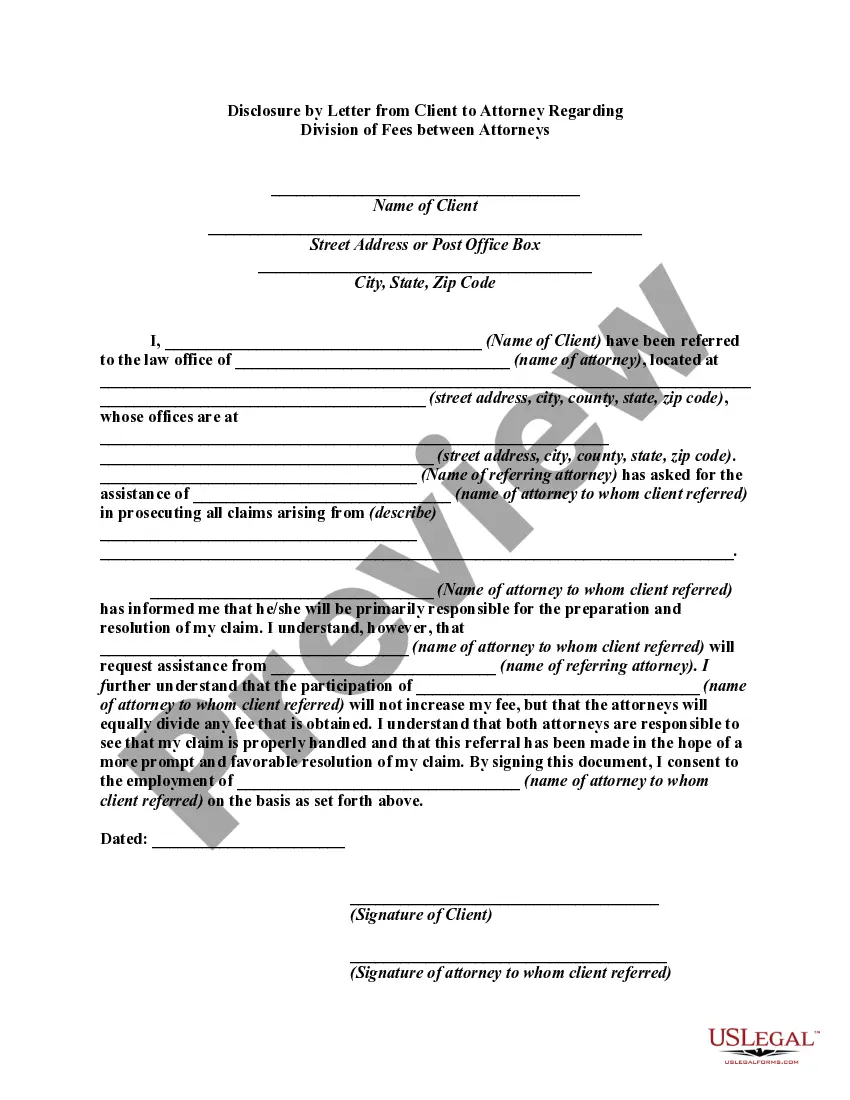

Discovering the right legal file design could be a battle. Naturally, there are plenty of web templates available online, but how can you discover the legal form you want? Use the US Legal Forms web site. The services delivers a huge number of web templates, such as the Utah LLC Agreement - Open Source, which you can use for organization and personal requirements. Each of the kinds are checked by pros and fulfill state and federal demands.

In case you are currently signed up, log in in your account and click the Download key to get the Utah LLC Agreement - Open Source. Make use of account to search from the legal kinds you possess bought formerly. Proceed to the My Forms tab of your respective account and get yet another version in the file you want.

In case you are a new end user of US Legal Forms, allow me to share straightforward instructions for you to follow:

- Very first, make sure you have selected the appropriate form for the area/state. You can look through the shape using the Preview key and read the shape explanation to make sure this is the best for you.

- In the event the form will not fulfill your requirements, make use of the Seach industry to find the correct form.

- Once you are certain the shape is suitable, click the Get now key to get the form.

- Choose the costs strategy you would like and type in the essential info. Create your account and purchase an order using your PayPal account or charge card.

- Choose the file format and download the legal file design in your product.

- Total, edit and produce and signal the obtained Utah LLC Agreement - Open Source.

US Legal Forms is the greatest library of legal kinds for which you will find a variety of file web templates. Use the service to download professionally-made documents that follow status demands.

Form popularity

FAQ

Yes, you can be your own Registered Agent in Utah as long as you meet the state requirements. (Unfortunately, most Registered Agent Services and LLC filing companies hide this information.) We explain the pros and cons below so you can make your own decision.

In This Article: Pros and Cons of Forming an LLC in Utah. Step 1: Name Your LLC. Step 2: Nominate Your Registered Agent. Step 3: File Your Certificate of Organization. Learn More About Online LLC Formation Services. Step 4: Get Your Business Licensed. Step 5: Create Your Operating Agreement. Step 6: Get Your EIN.

The filing fee for both in-state and out-of-state entities forming LLCs is $70. Remittance should be made payable to the state of Utah. It costs $75 to expedite the process. You may submit documents online, directly to the Division of Corporations and Commercial Code, or mail them to P.O. Box 146705.

How much is an LLC in Utah? The cost to file a limited liability company (LLC) in Utah is $56. For an additional $50, you can expedite the filing process.

Register Your Company There is a $22 fee to complete the form, which can be done as a paper application or via the online portal. It costs $54 to file articles of organization and articles of incorporation and $70 for the other forms.

Is an operating agreement required in Utah? Utah doesn't specifically require LLCs to enter into an operating agreement. However, in the absence of one, your LLC will be governed by the Utah Revised Uniform Limited Liability Company Act.

As an LLC member in Utah, you'll pay both federal and state personal income tax, along with the federal self-employment tax of 15.3%. Utah collects personal income tax at a flat rate of 4.85%. Other taxes that may apply to your Utah LLC include the state's 6.1% sales tax, industry-specific taxes, and employer taxes.

To start an LLC in Utah, you'll need to choose a Utah registered agent, file business formation paperwork with the Utah Department of Commerce, Division of Corporations and Commercial Code, and pay a $54 filing fee.