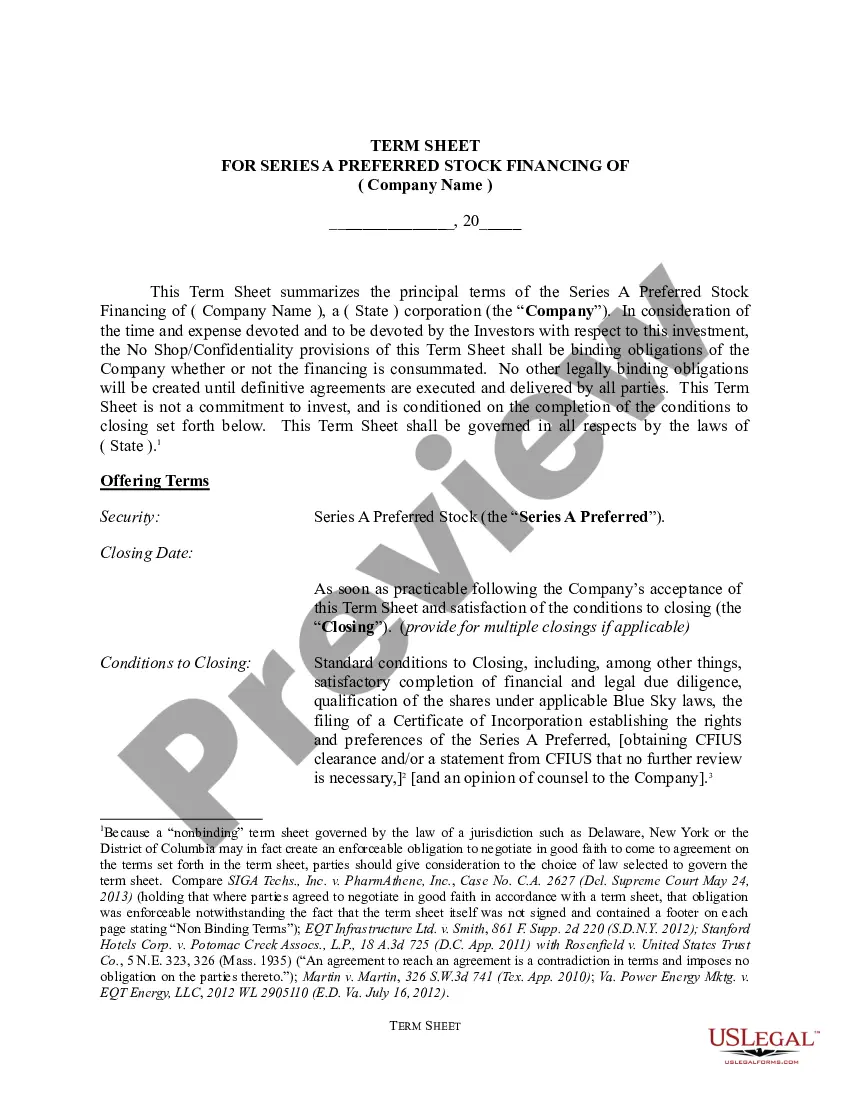

Utah Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Are you currently in a place that you need to have paperwork for both enterprise or personal uses just about every working day? There are tons of authorized record layouts accessible on the Internet, but discovering versions you can rely on is not effortless. US Legal Forms provides thousands of kind layouts, just like the Utah Term Sheet - Series A Preferred Stock Financing of a Company, which are written to fulfill federal and state demands.

Should you be already informed about US Legal Forms site and also have an account, simply log in. Afterward, it is possible to download the Utah Term Sheet - Series A Preferred Stock Financing of a Company format.

If you do not offer an bank account and wish to start using US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for your correct town/region.

- Take advantage of the Review button to analyze the shape.

- Browse the information to ensure that you have chosen the right kind.

- If the kind is not what you`re looking for, take advantage of the Look for discipline to discover the kind that meets your requirements and demands.

- When you find the correct kind, simply click Acquire now.

- Pick the prices prepare you want, fill out the required info to create your bank account, and pay for your order making use of your PayPal or credit card.

- Pick a practical data file file format and download your duplicate.

Find all of the record layouts you may have purchased in the My Forms menu. You can get a extra duplicate of Utah Term Sheet - Series A Preferred Stock Financing of a Company anytime, if possible. Just go through the needed kind to download or print out the record format.

Use US Legal Forms, probably the most considerable assortment of authorized forms, in order to save some time and avoid mistakes. The services provides skillfully made authorized record layouts that can be used for a variety of uses. Produce an account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

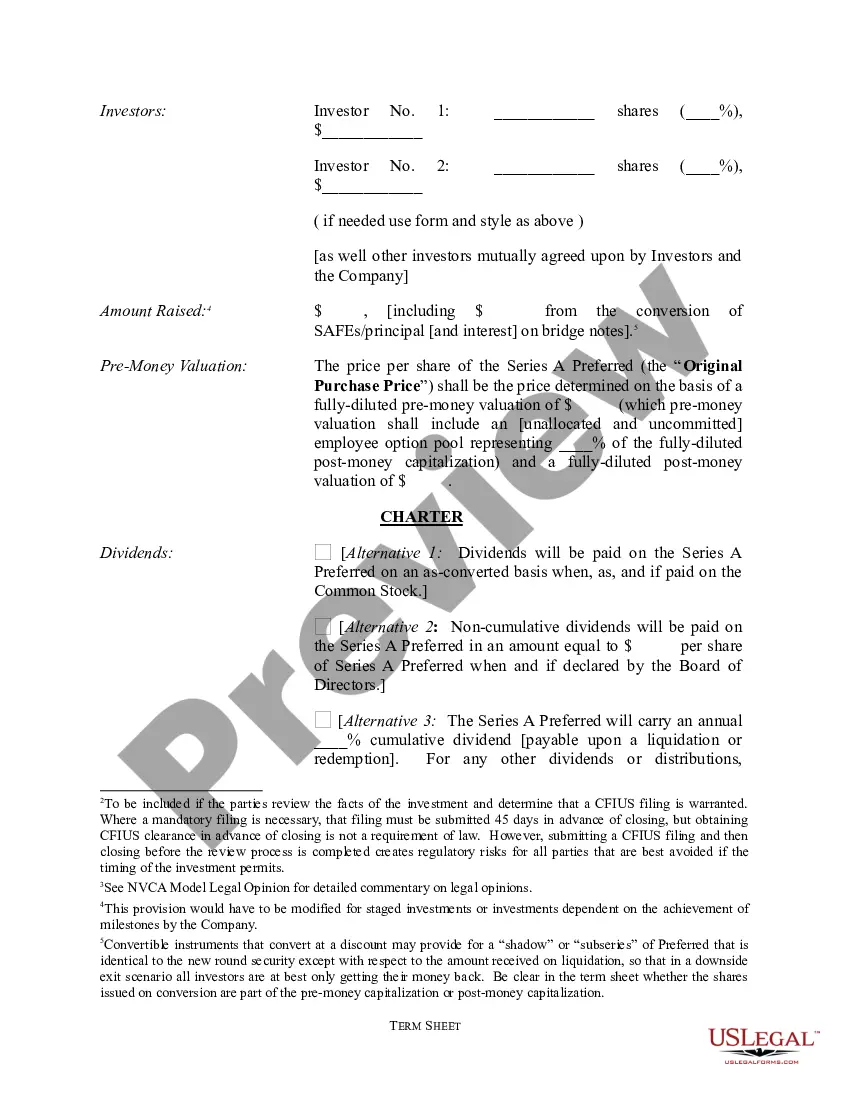

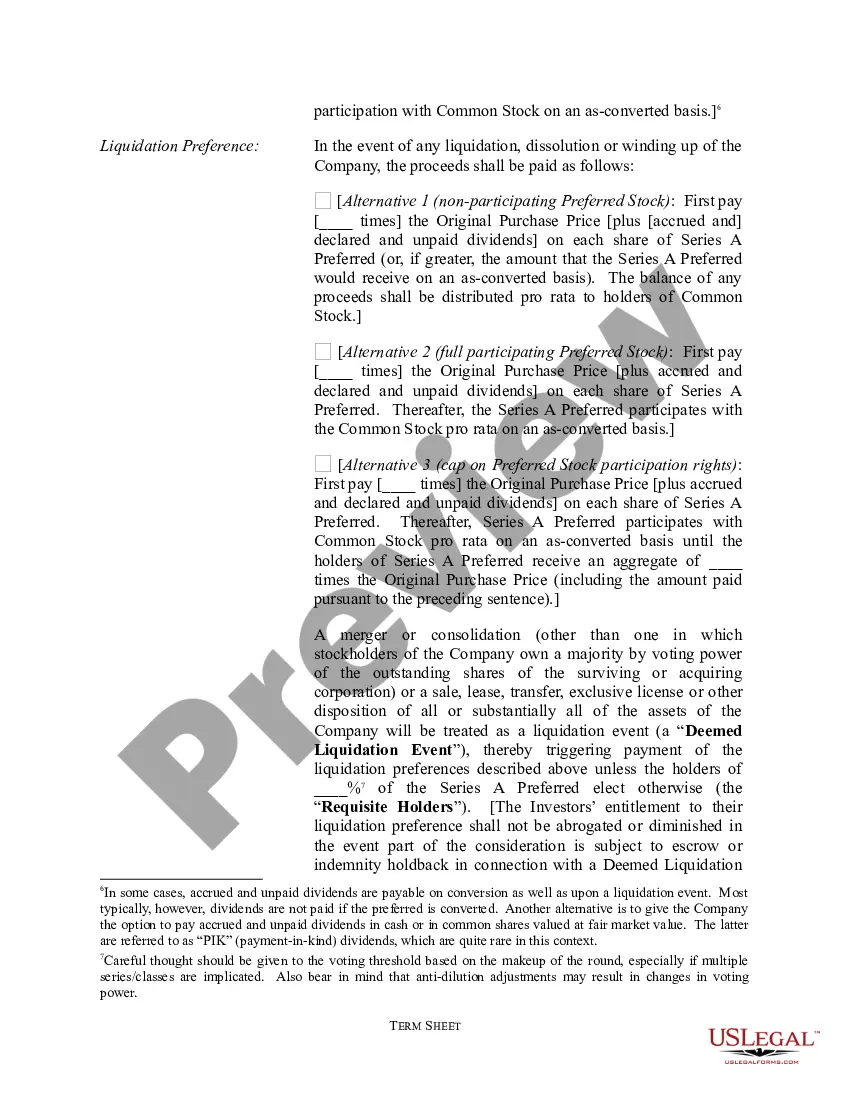

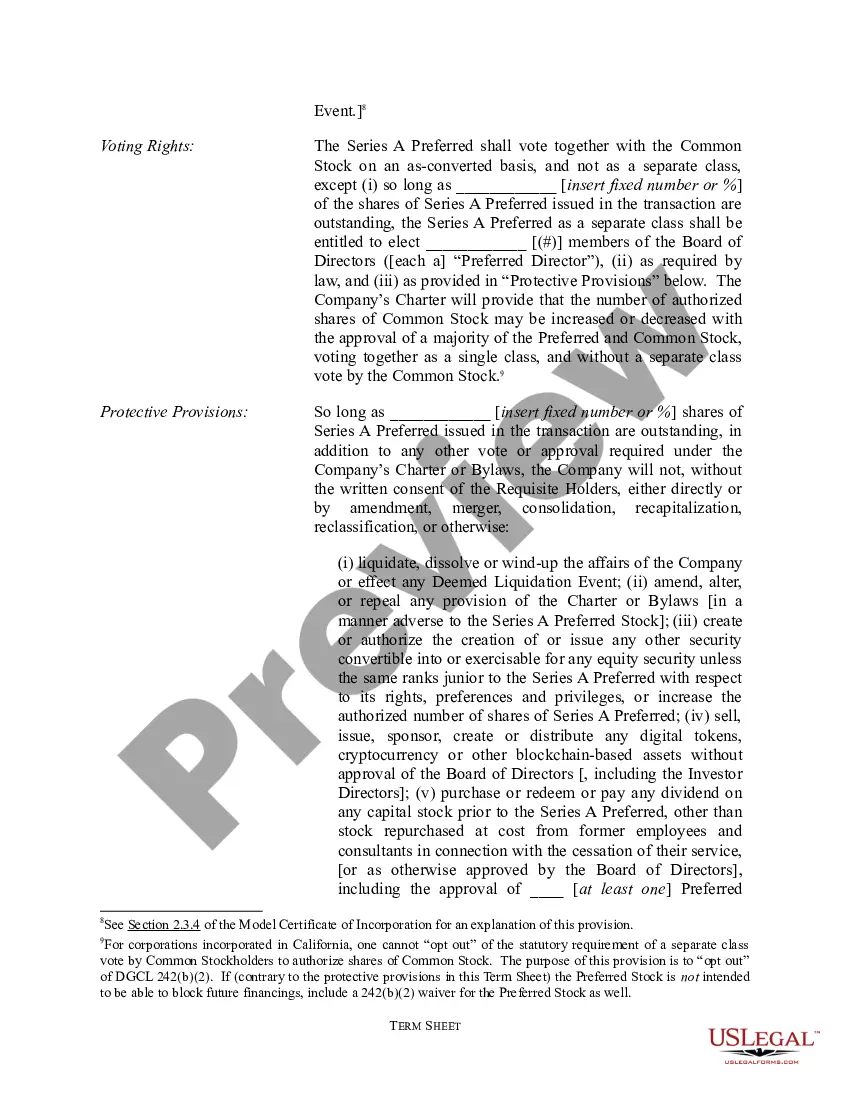

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

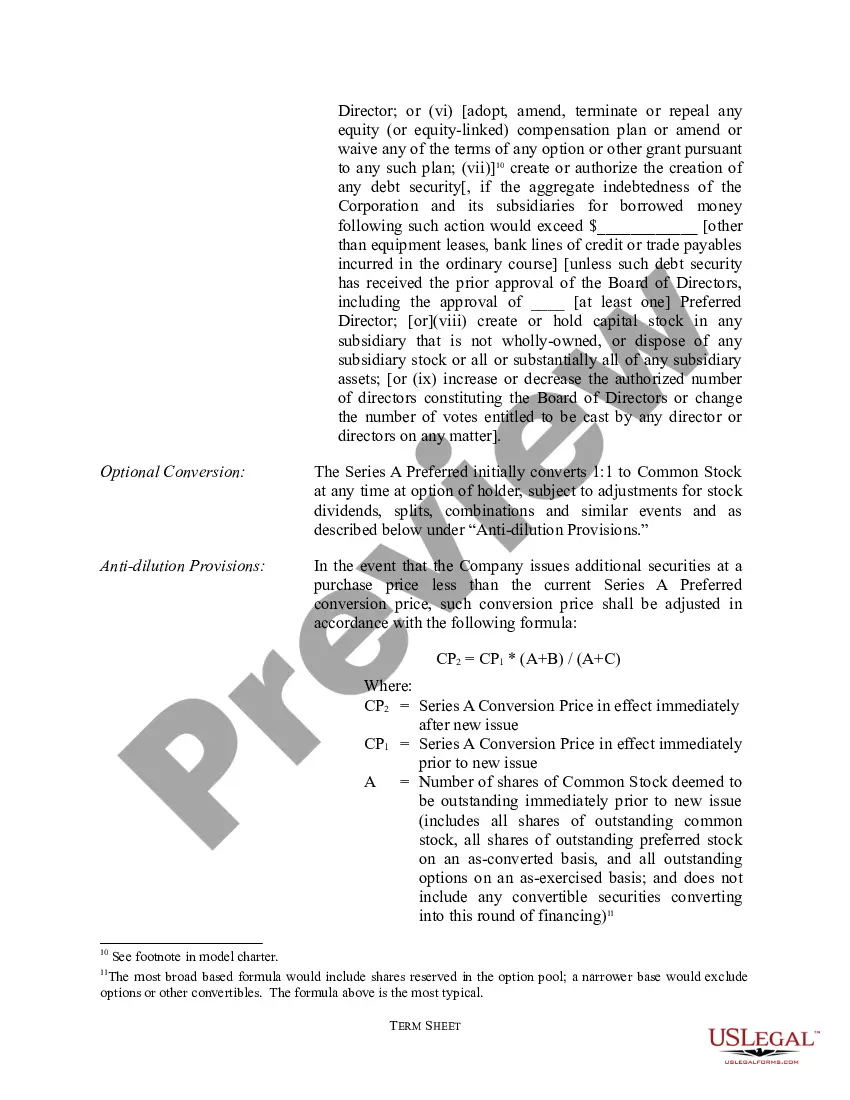

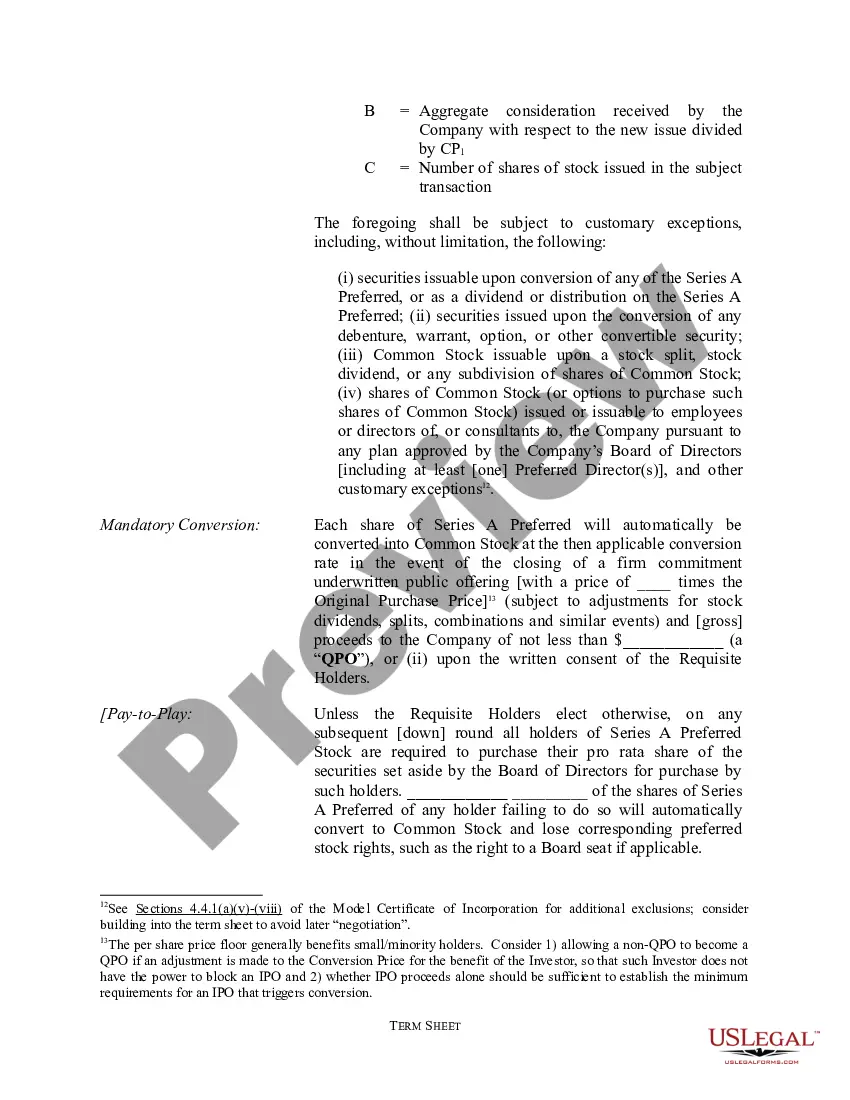

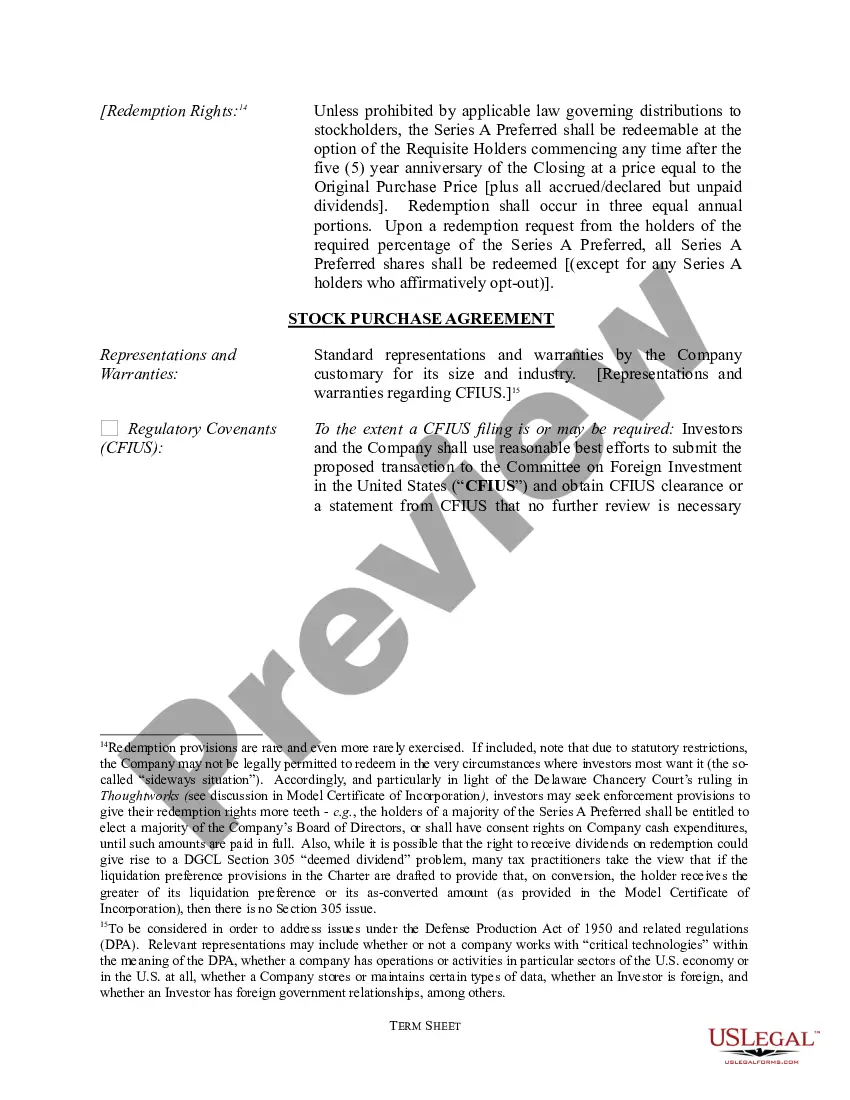

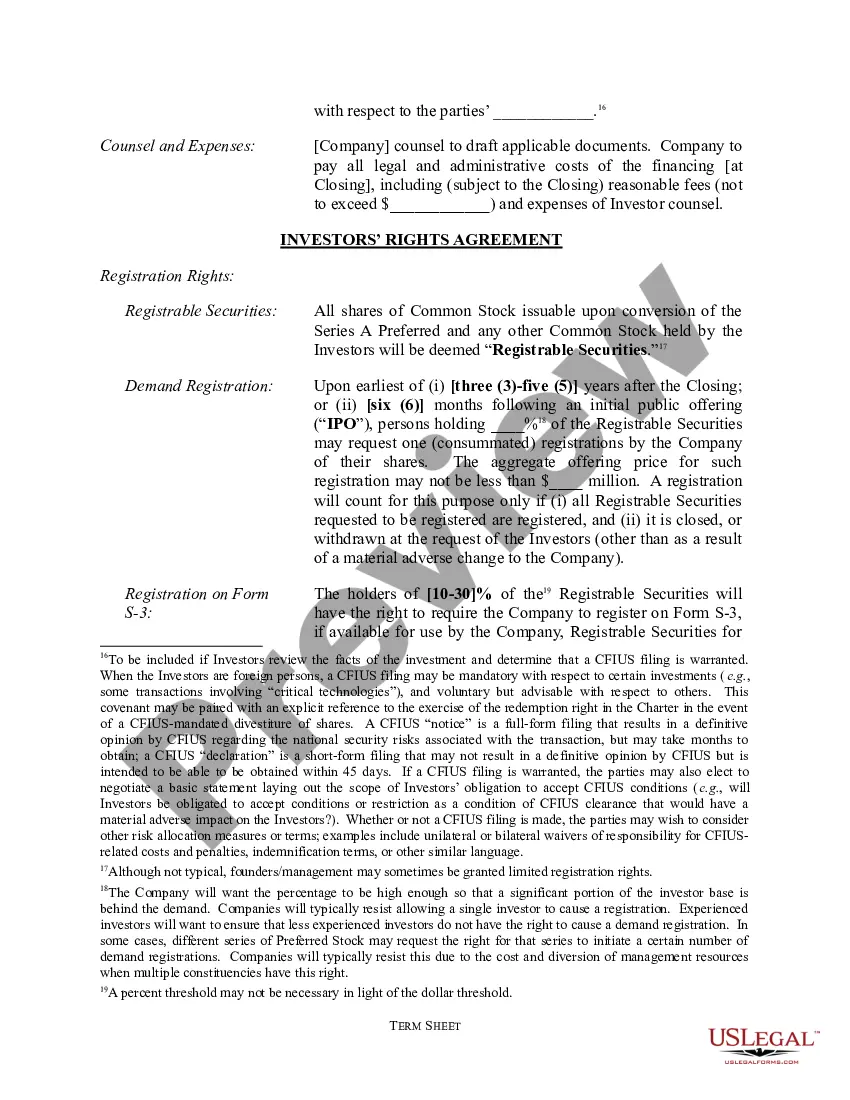

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

It shouldn't take more than a week, or even just a few days, to negotiate a term sheet. That is ? once a VC decides they truly want to do a deal. There really aren't many variables these days for seed to Series A deals, really just price and how much you are raising/selling.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information. Term sheets are most often associated with startups.

A term sheet is a relatively short document that an investor prepares for presentation to the company in which the investor states the investment that he is willing to make in the company. This document is usually 5-8 pages in length.