Utah Letter to Debt Collector - Only call me on the following days and times

Description

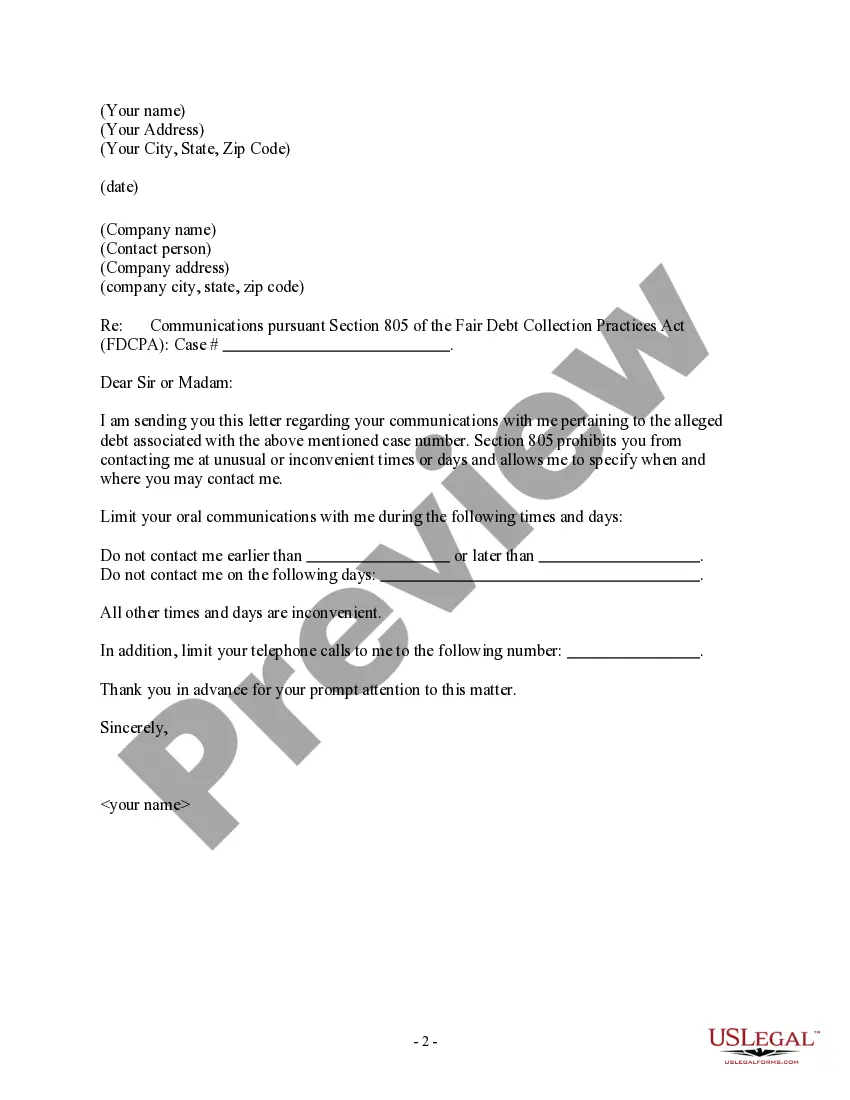

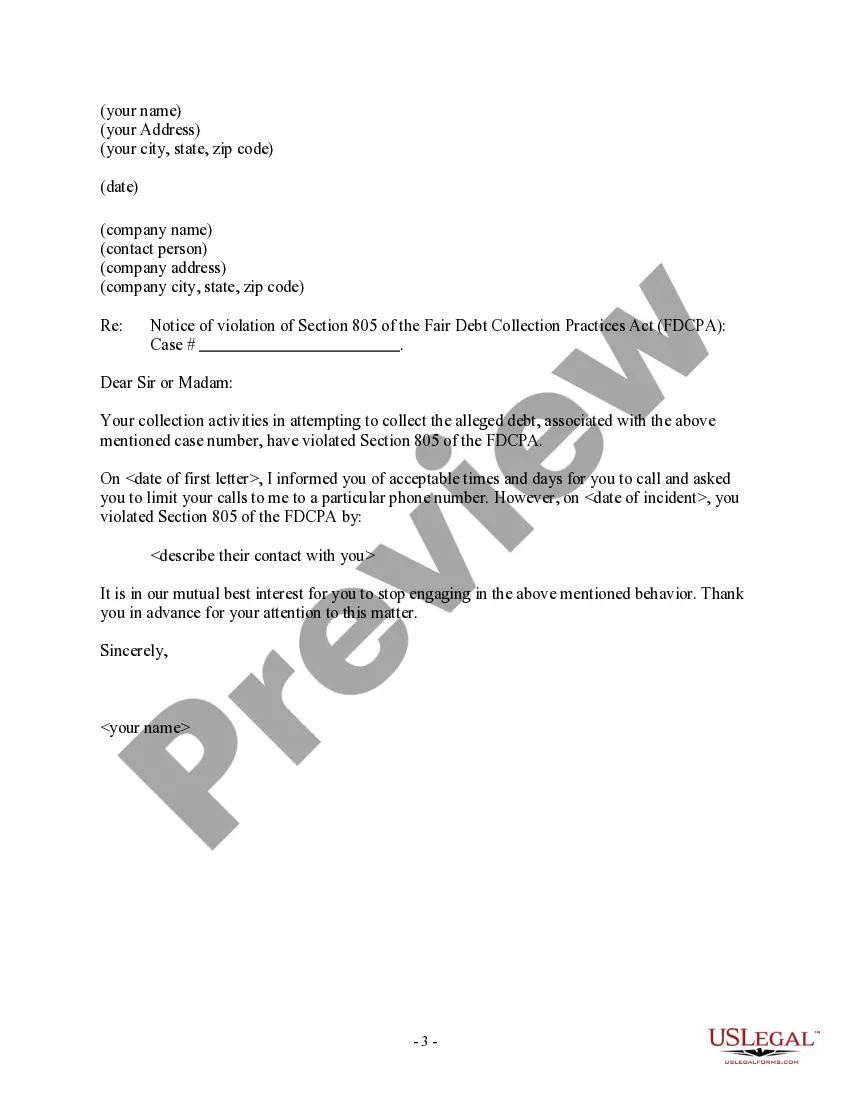

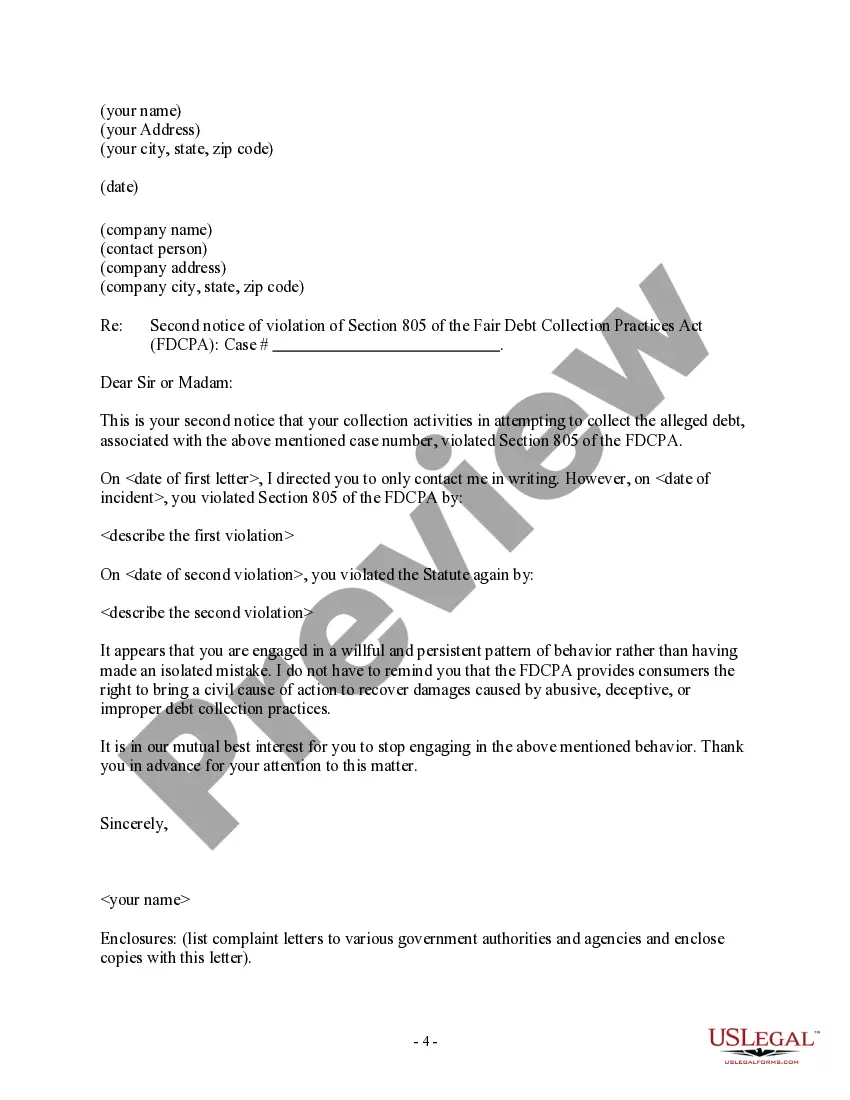

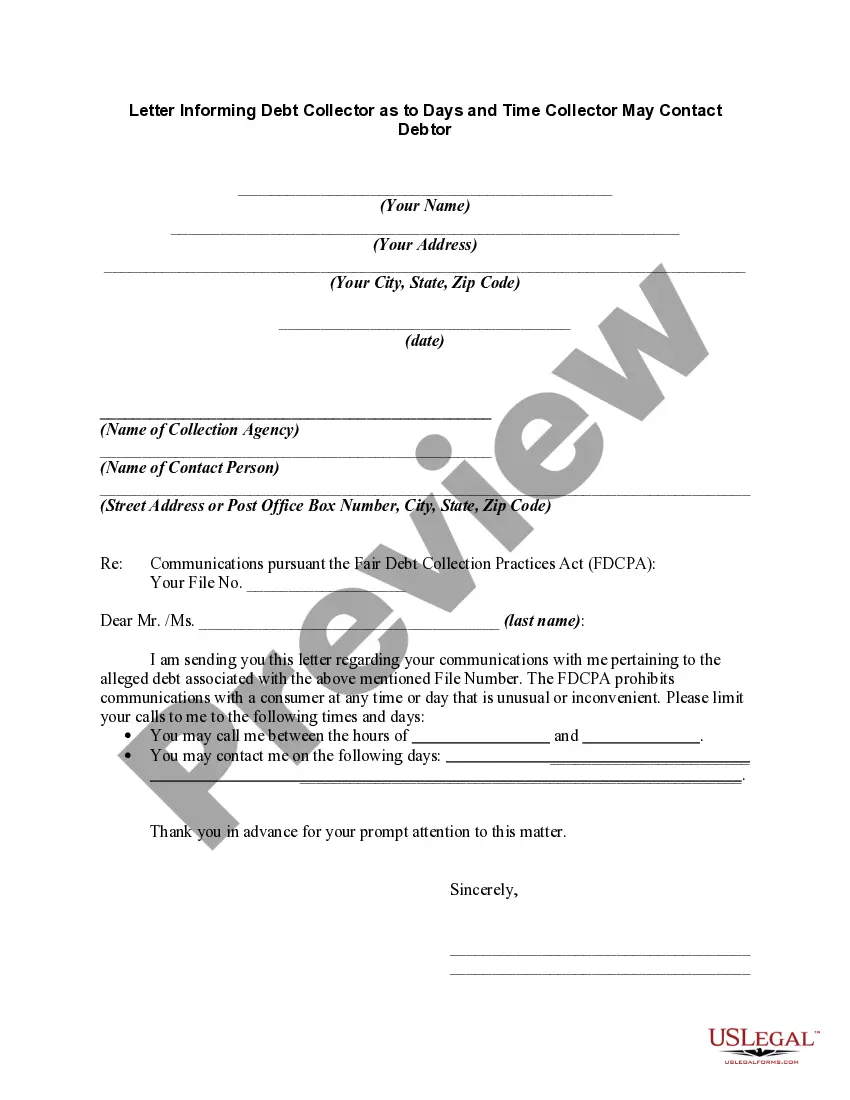

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Are you currently in a circumstance where you require documents for both professional or personal purposes almost every day.

There are numerous valid form templates available on the internet, but finding ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the Utah Letter to Debt Collector - Only contact me on the following days and times, which are designed to comply with state and federal regulations.

Once you locate the correct form, click Purchase now.

Select the payment plan you prefer, complete the required details to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Letter to Debt Collector - Only contact me on the following days and times template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs and specifications.

Form popularity

FAQ

The 11-word phrase to stop debt collectors is: 'I want you to cease all communication with me.' This phrase is effective because it serves as a formal request under the Fair Debt Collection Practices Act. You may follow this up with a Utah Letter to Debt Collector - Only call me on the following days and times to establish clearer boundaries.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.