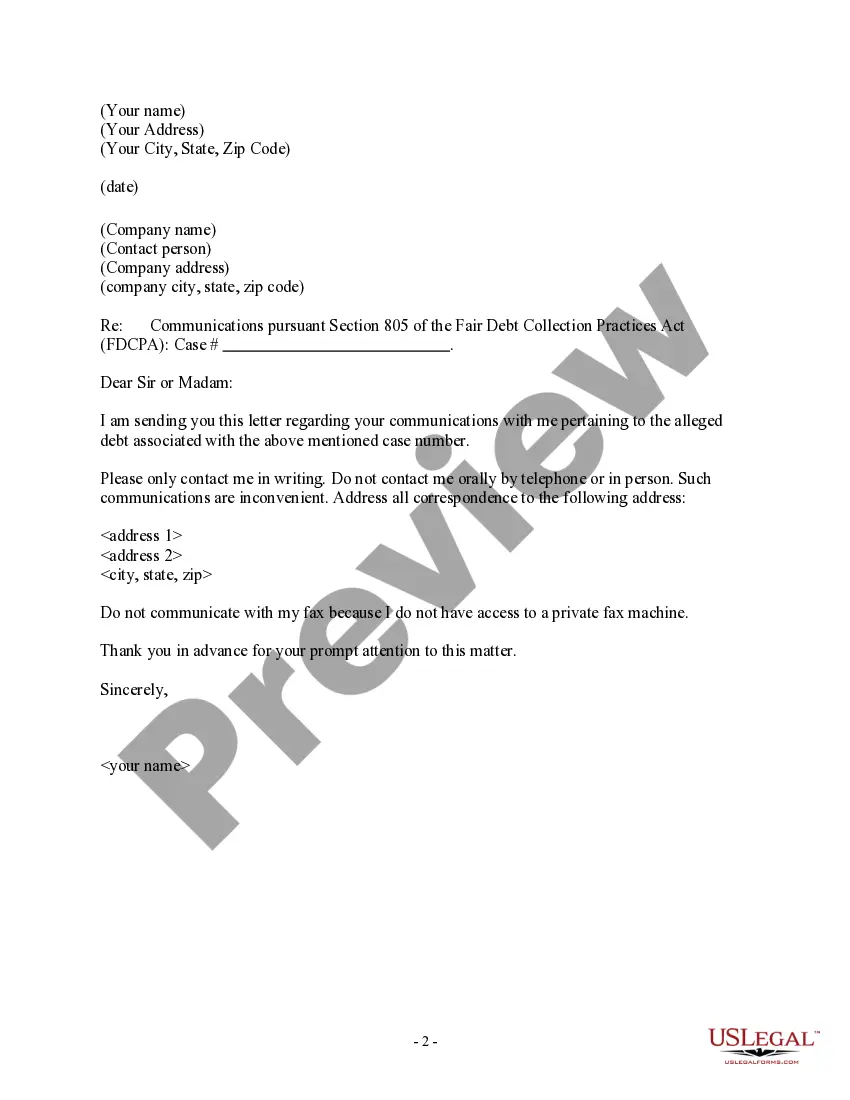

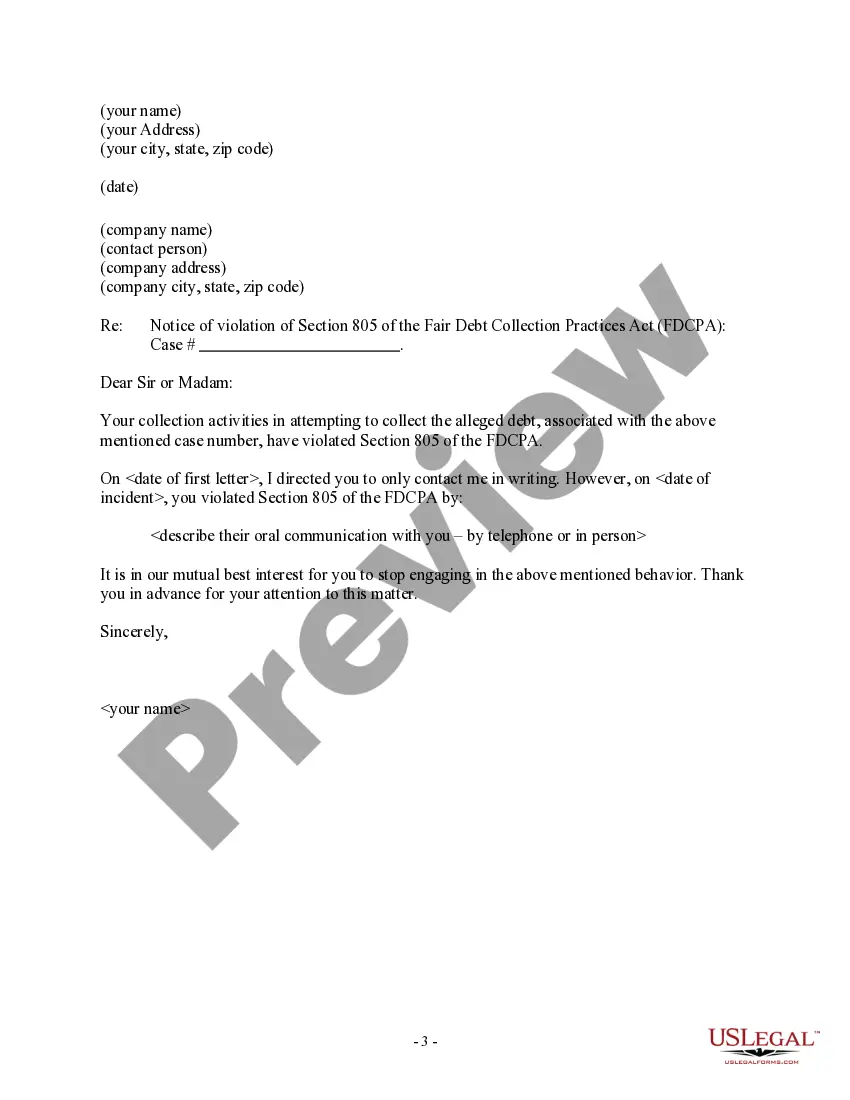

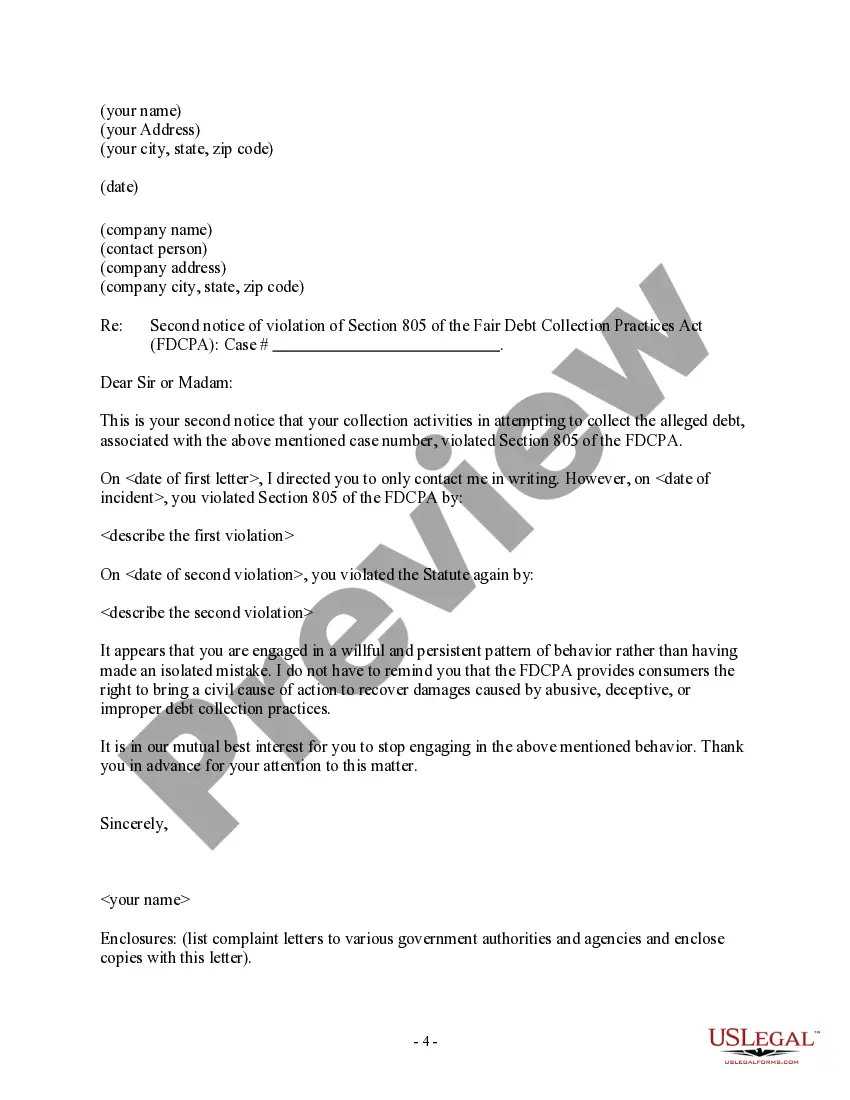

Utah Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Are you currently in a position where you require documentation for potential business or specific tasks every single day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging. US Legal Forms provides thousands of form templates, like the Utah Letter to Debt Collector - Only Contact Me In Writing, specifically designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Utah Letter to Debt Collector - Only Contact Me In Writing template.

Choose a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of Utah Letter to Debt Collector - Only Contact Me In Writing anytime if needed. Simply click on the necessary form to download or print the document template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to the appropriate city/county.

- Utilize the Review button to assess the form.

- Verify the details to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search section to locate a form that fulfills your requirements.

- Once you discover the correct form, simply click Purchase now.

- Select the pricing plan you prefer, provide the necessary information to establish your account, and pay for the order using PayPal or a credit card.

Form popularity

FAQ

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

When writing the letter, request that the collection agency or creditor provide you with: Documentation that you owed the debt at some point, such as a contract you signed. How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

For some folks, that means dealing with calls from debt collectors. Starting late next year, collectors will also be allowed to contact consumers by email, text message, and even through social media, according to the Consumer Financial Protection Bureau.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.