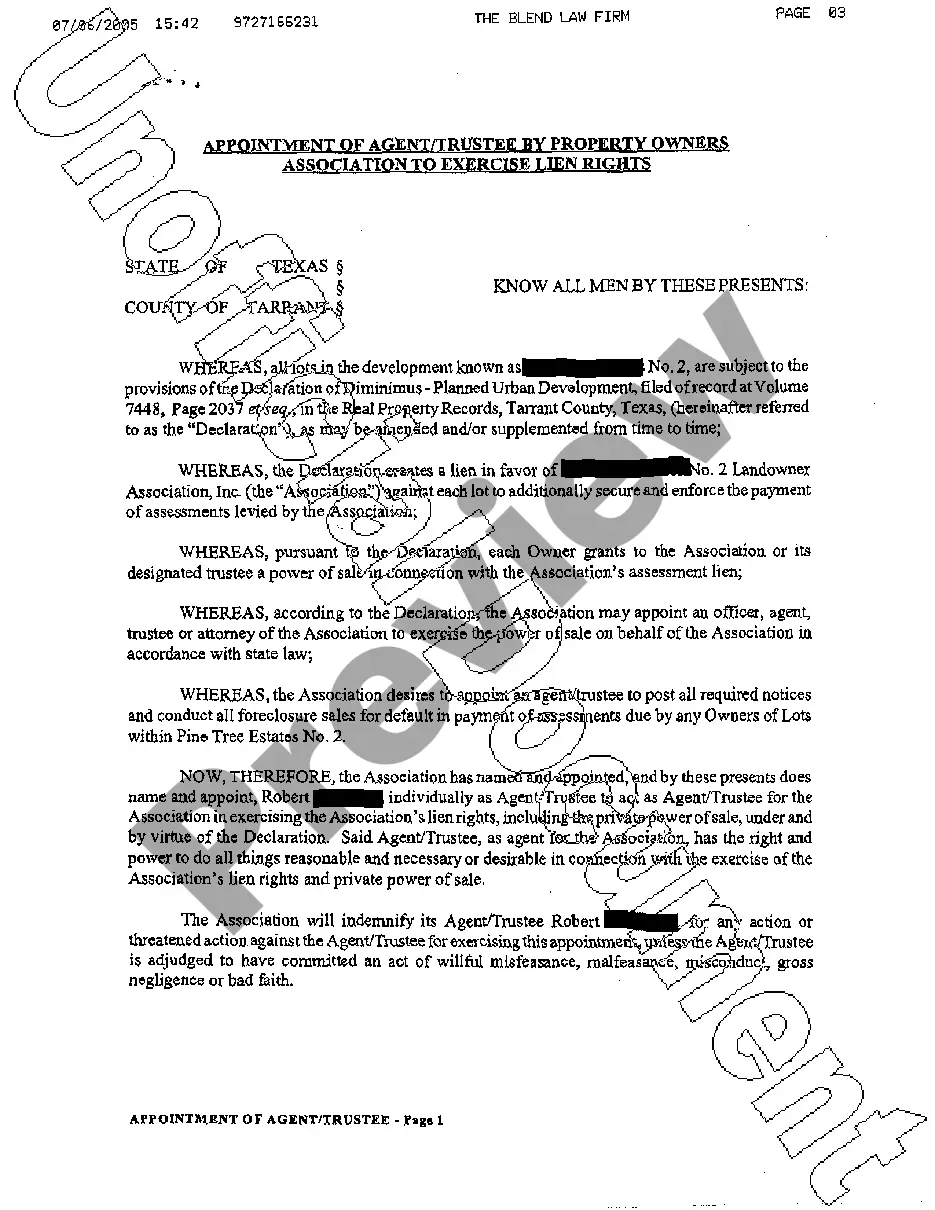

Utah Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

How to fill out Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

US Legal Forms - one of several largest libraries of legitimate forms in America - gives a variety of legitimate record layouts it is possible to download or printing. Making use of the site, you may get thousands of forms for business and specific purposes, sorted by types, suggests, or search phrases.You will find the latest models of forms such as the Utah Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits within minutes.

If you already have a monthly subscription, log in and download Utah Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits in the US Legal Forms local library. The Obtain key will show up on every single type you look at. You have access to all in the past acquired forms within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, allow me to share simple guidelines to obtain began:

- Be sure to have chosen the proper type for your area/county. Click the Review key to check the form`s articles. Browse the type explanation to actually have selected the appropriate type.

- If the type does not fit your needs, utilize the Research area near the top of the display screen to discover the the one that does.

- If you are content with the form, verify your selection by simply clicking the Purchase now key. Then, pick the pricing program you favor and give your accreditations to register to have an accounts.

- Process the deal. Use your charge card or PayPal accounts to complete the deal.

- Select the format and download the form on the device.

- Make changes. Complete, change and printing and indicator the acquired Utah Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits.

Every single format you included with your account does not have an expiry day and is also yours eternally. So, if you want to download or printing yet another version, just proceed to the My Forms area and then click in the type you need.

Gain access to the Utah Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits with US Legal Forms, by far the most considerable local library of legitimate record layouts. Use thousands of skilled and state-particular layouts that fulfill your small business or specific demands and needs.