Utah Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

You can devote time on the Internet looking for the authorized document format that fits the state and federal demands you need. US Legal Forms supplies thousands of authorized varieties which can be reviewed by professionals. You can easily down load or print out the Utah Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock from the assistance.

If you have a US Legal Forms bank account, you may log in and then click the Download button. After that, you may full, change, print out, or sign the Utah Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Each authorized document format you acquire is your own property permanently. To obtain an additional duplicate associated with a purchased kind, visit the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site the first time, adhere to the straightforward directions under:

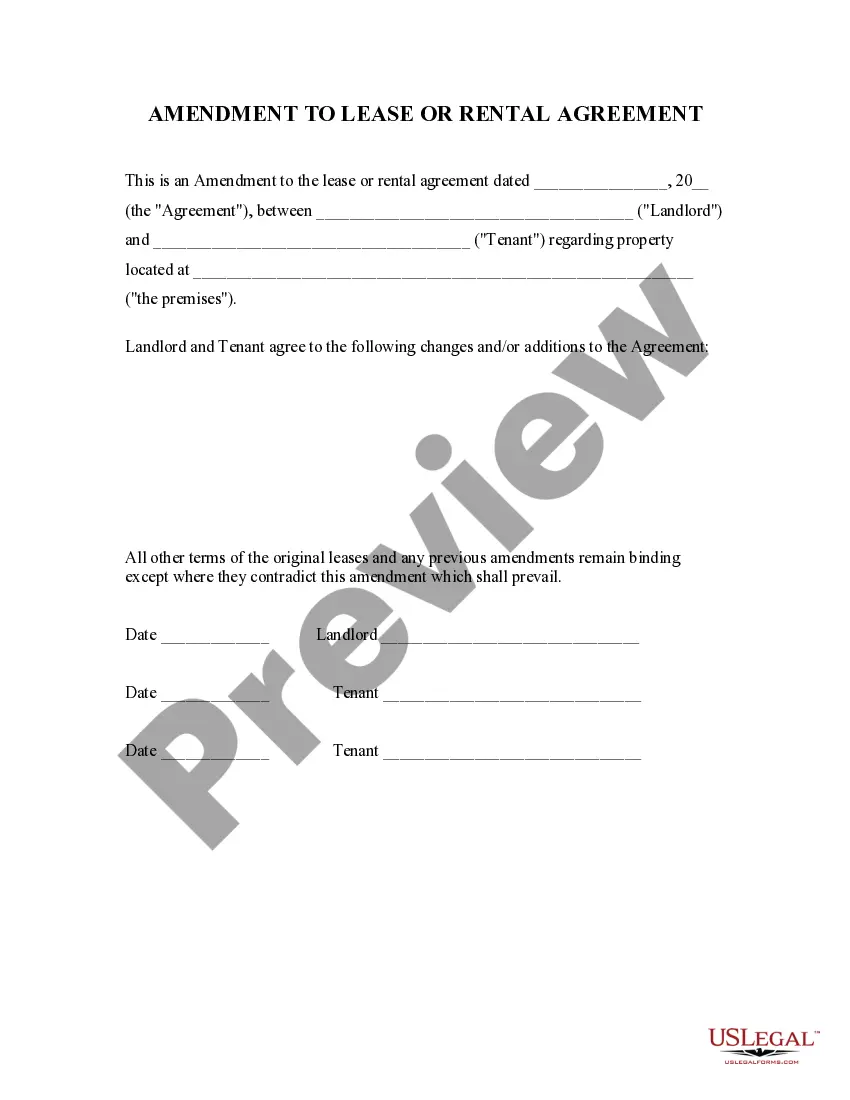

- Initially, make sure that you have selected the right document format for your area/area that you pick. Read the kind outline to make sure you have picked out the appropriate kind. If offered, make use of the Preview button to check throughout the document format as well.

- If you would like get an additional edition of the kind, make use of the Look for discipline to discover the format that suits you and demands.

- Upon having found the format you want, just click Acquire now to move forward.

- Find the pricing plan you want, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal bank account to cover the authorized kind.

- Find the formatting of the document and down load it in your system.

- Make alterations in your document if possible. You can full, change and sign and print out Utah Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

Download and print out thousands of document web templates utilizing the US Legal Forms web site, which provides the greatest assortment of authorized varieties. Use specialist and status-specific web templates to deal with your company or personal needs.

Form popularity

FAQ

Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

Corporation defined. - A corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.

A company's board of directors announces a cash dividend on a declaration date, which entails paying a certain amount of money per common share. After that notification, the record date is established, which is the date on which a firm determines its shareholders on record who are eligible to receive the payment.

The board of directors authorizes a cash dividend or distribution of cash to its investors. A stock dividend, declared by a corporation's directors, is a distribution of additional shares of the corporation's own stock. Authorizing a cash dividend payment to investors requires three crucial dates.

The given statement is True. Explanation: When a company declares a dividend, the retained earnings are reduced by the amount of dividends. It results in a decline in the amount of shareholders' equity.

A dividend is the distribution of a company's earnings to its shareholders and is determined by the company's board of directors. Dividends are often distributed quarterly and may be paid out as cash or in the form of reinvestment in additional stock.