Utah Proposal to decrease authorized common and preferred stock

Description

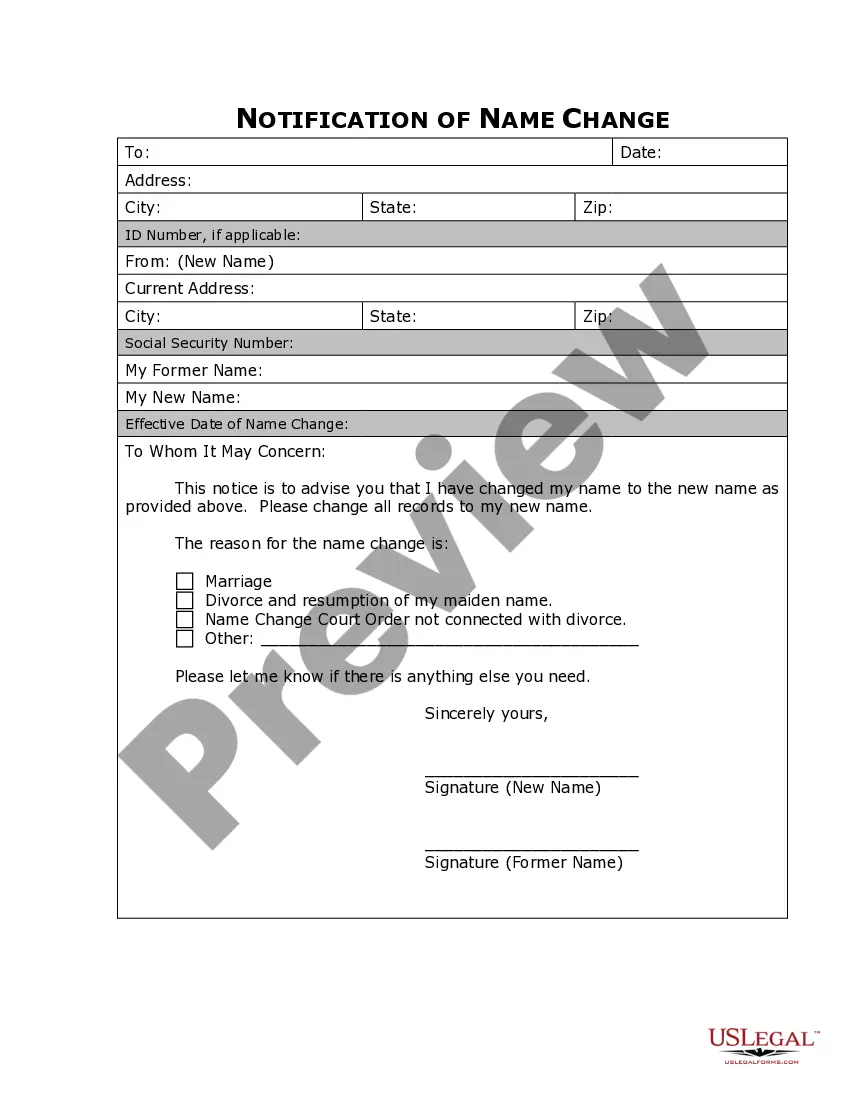

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

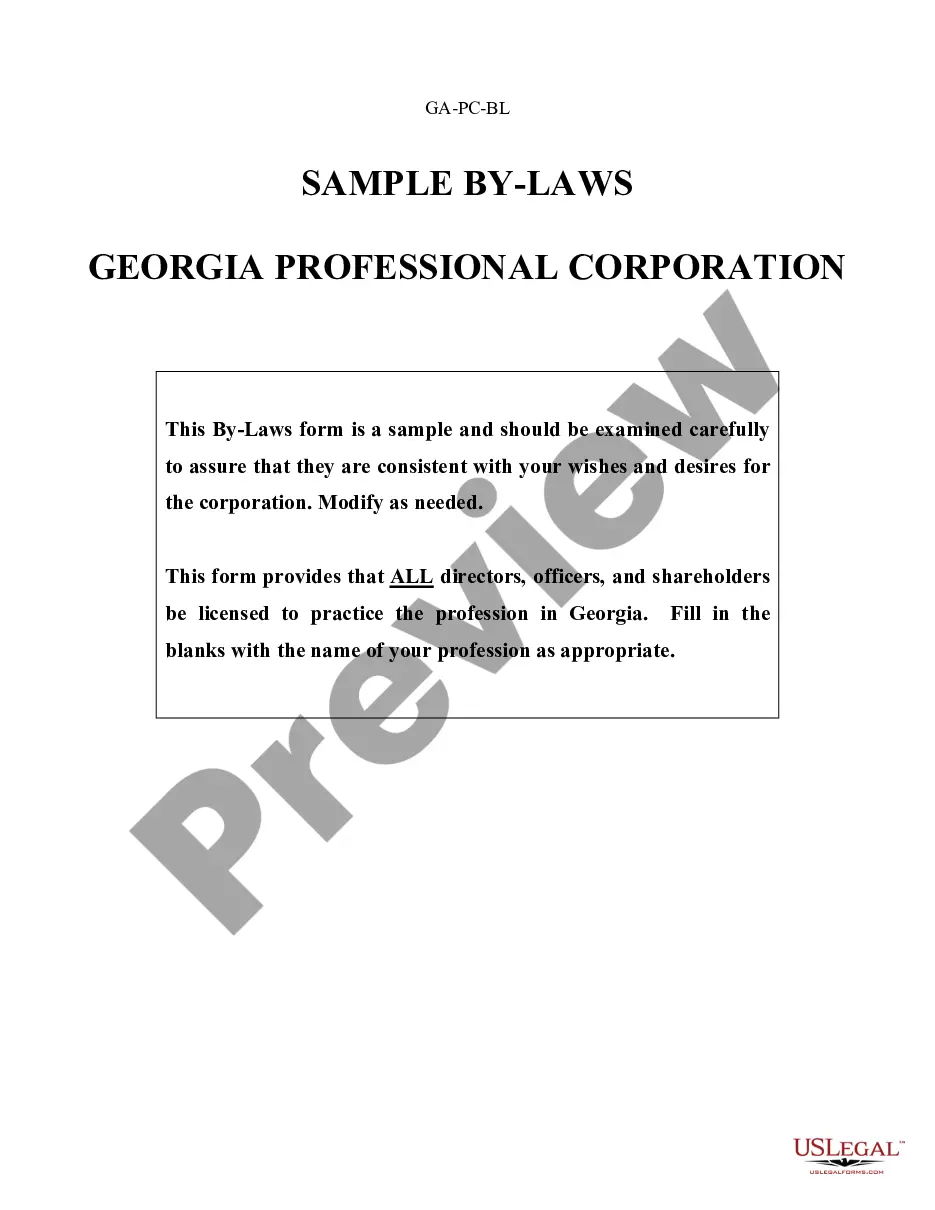

If you have to complete, download, or printing legitimate file layouts, use US Legal Forms, the most important collection of legitimate types, that can be found on-line. Use the site`s simple and easy handy look for to get the papers you want. Different layouts for enterprise and personal purposes are categorized by types and states, or key phrases. Use US Legal Forms to get the Utah Proposal to decrease authorized common and preferred stock within a couple of clicks.

When you are already a US Legal Forms consumer, log in in your account and then click the Download key to have the Utah Proposal to decrease authorized common and preferred stock. You may also gain access to types you previously saved within the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape to the proper city/nation.

- Step 2. Use the Preview choice to look over the form`s content material. Don`t neglect to read the explanation.

- Step 3. When you are not happy together with the develop, make use of the Look for discipline towards the top of the monitor to find other models of your legitimate develop design.

- Step 4. Upon having discovered the shape you want, go through the Purchase now key. Select the pricing strategy you favor and add your references to sign up for an account.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Find the structure of your legitimate develop and download it on the product.

- Step 7. Total, revise and printing or sign the Utah Proposal to decrease authorized common and preferred stock.

Each and every legitimate file design you buy is your own eternally. You might have acces to each and every develop you saved in your acccount. Select the My Forms section and pick a develop to printing or download yet again.

Be competitive and download, and printing the Utah Proposal to decrease authorized common and preferred stock with US Legal Forms. There are millions of expert and express-certain types you may use for the enterprise or personal requirements.

Form popularity

FAQ

With preferred stock, the dividend is fixed. It's paid out first, before dividends on common stock can be calculated. Dividends on common stock are paid second and depend on how they're set up by the corporation's board. They may be paid out quarterly or whenever the board of directors declares a dividend payout.

A corporation shall keep as permanent records minutes of all meetings of its shareholders and board of directors, a record of all actions taken by the shareholders or board of directors without a meeting, and a record of all actions taken on behalf of the corporation by a committee of the board of directors in place of ...

There are usually two types of stocks that a C corporation could issue: common stocks and preferred stocks.

Definition. "Oppressive conduct" means a continuing course of conduct, a significant action, or a series of actions that substantially interferes with the interests of a shareholder as a shareholder.

Usually, bondholders are paid out first, and common shareholders are paid out last. Because preferred shares are a combination of both bonds and common shares, preferred shareholders are paid out after the bond shareholders but before the common stockholders.

Liability of shareholders. A shareholder of a corporation, when acting solely in the capacity of a shareholder, has no fiduciary duty or other similar duty to any other shareholder of the corporation, including not having a duty of care, loyalty, or utmost good faith.

16-10a-1501 Authority to transact business required. This applies to foreign corporations that conduct a business governed by other statutes of this state only to the extent this part is not inconsistent with those other statutes.

16-10a-601 Authorized shares. All shares of a class shall have preferences, limitations, and relative rights identical with those of other shares of the same class except to the extent otherwise permitted by this section and Section 16-10a-602.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

What is the difference between preferred and common stock? Preferred stock has no voting privileges but common stock does. Preferred stock has their stock holders get paid first. Common stock pays their dividend after preferred stock holders.