Utah Articles of Incorporation with Indemnification

Description

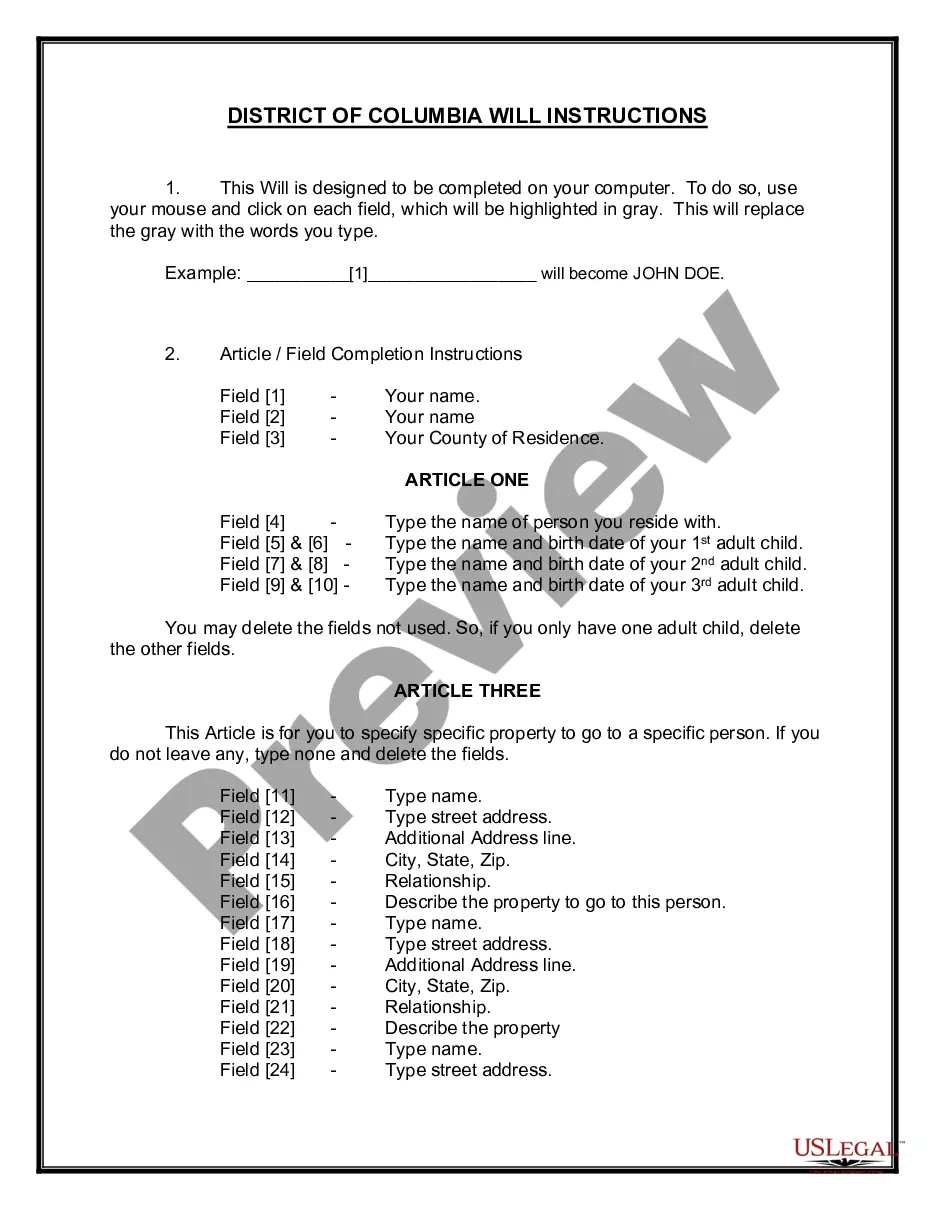

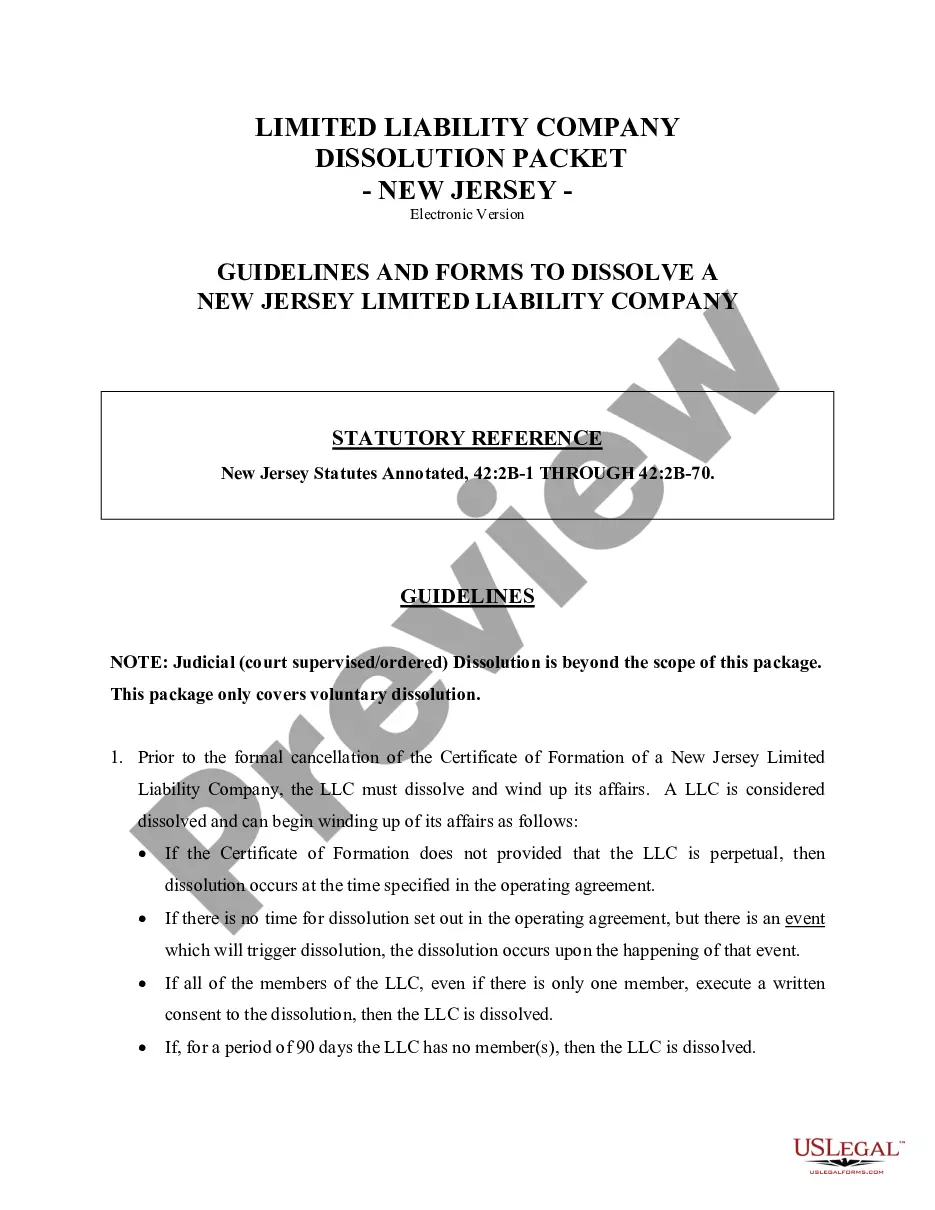

How to fill out Articles Of Incorporation With Indemnification?

Are you in the placement where you need to have documents for both business or personal uses virtually every time? There are a variety of lawful record templates available online, but finding versions you can depend on is not easy. US Legal Forms delivers a large number of form templates, like the Utah Articles of Incorporation with Indemnification, which are created in order to meet federal and state specifications.

Should you be previously familiar with US Legal Forms web site and get an account, basically log in. Afterward, you can obtain the Utah Articles of Incorporation with Indemnification template.

Should you not come with an account and need to begin using US Legal Forms, adopt these measures:

- Discover the form you need and ensure it is for the appropriate city/state.

- Utilize the Review button to analyze the form.

- Browse the explanation to ensure that you have selected the appropriate form.

- In the event the form is not what you`re looking for, utilize the Research field to obtain the form that fits your needs and specifications.

- Whenever you obtain the appropriate form, click on Get now.

- Opt for the costs plan you want, complete the required details to create your money, and pay money for your order utilizing your PayPal or bank card.

- Pick a practical paper format and obtain your backup.

Get every one of the record templates you have bought in the My Forms menus. You can get a further backup of Utah Articles of Incorporation with Indemnification whenever, if needed. Just click on the essential form to obtain or printing the record template.

Use US Legal Forms, one of the most considerable collection of lawful forms, in order to save some time and steer clear of blunders. The support delivers professionally manufactured lawful record templates that you can use for a variety of uses. Make an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Indemnification is a way to provide limited liability protection to the people whose role is to manage, operate or oversee a company.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

Indemnification in the context of nonprofit bylaws generally refers to how the nonprofit will protect its directors and other agents in the event they are sued for acting in their capacity as agents of the nonprofit.

Indemnification clauses are exceedingly common in many contracts, but what you should pay close attention to is the scope of your indemnification agreement. Generally, you should only agree to pay for losses arising from your own actions and not the other party's actions.

In the indemnification agreement, the corporation agrees to reimburse the director or officer for losses incurred in legal proceedings related to their service as a corporate director or officer to the maximum extent permitted by law.

In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

Breach of Contract For the state of Utah, the statutes of limitations start running on the date the breach is made?even if the affected party was not aware at the moment. The statute of limitations for contract breaches are: Written contract: Six years. Oral/non-written contract: Four years.

Indemnification & Volunteer Protection ? Most nonprofit bylaws include indemnification provisions ? language that expresses the intent of the nonprofit to cover the expenses a board member might incur in defending an action and paying settlements or judgments related to his service on the board.

Utah's anti-indemnification statute defines an ?indemnification provision? as an agreement between any combination of construction managers, general contractors, subcontractors, sub-subcontractors or suppliers (collectively, ?construction workers?) ?requiring the promisor to insure, hold harmless, indemnify, or defend ...

What Is an Indemnification Clause? An indemnification clause is a legally binding agreement between two parties specifying that one party (the indemnifying party) will compensate the other party (the indemnified party) for any losses or damages that may arise from a particular event or circumstance.