Full text and statutory guidelines for the Life and Health Insurance Guaranty Association Model Act.

Utah Life and Health Insurance Guaranty Association Model Act

Description

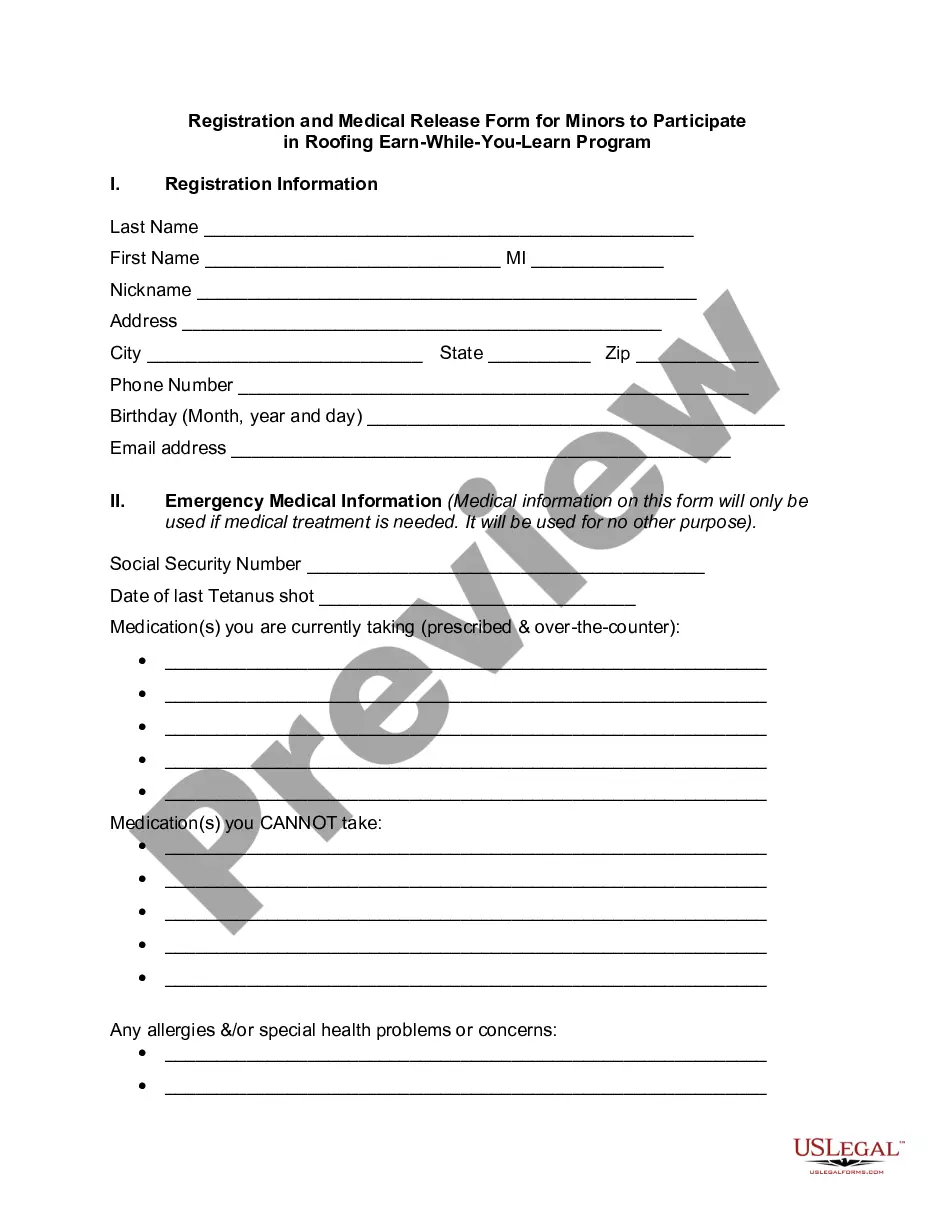

How to fill out Life And Health Insurance Guaranty Association Model Act?

Choosing the right legal papers web template could be a have a problem. Needless to say, there are tons of layouts available on the Internet, but how would you obtain the legal kind you will need? Utilize the US Legal Forms web site. The assistance offers a huge number of layouts, for example the Utah Life and Health Insurance Guaranty Association Model Act, that you can use for company and personal requirements. All the forms are examined by specialists and satisfy state and federal requirements.

When you are currently authorized, log in for your bank account and then click the Acquire key to obtain the Utah Life and Health Insurance Guaranty Association Model Act. Make use of your bank account to check throughout the legal forms you have ordered earlier. Go to the My Forms tab of your bank account and get another copy of your papers you will need.

When you are a whole new end user of US Legal Forms, listed here are easy instructions that you should follow:

- Very first, ensure you have selected the correct kind for your area/region. It is possible to check out the shape making use of the Review key and browse the shape description to make sure it will be the best for you.

- In case the kind is not going to satisfy your preferences, use the Seach area to obtain the proper kind.

- When you are certain the shape would work, click the Get now key to obtain the kind.

- Opt for the pricing plan you desire and type in the necessary info. Build your bank account and buy the transaction using your PayPal bank account or Visa or Mastercard.

- Choose the file format and down load the legal papers web template for your system.

- Comprehensive, change and printing and sign the acquired Utah Life and Health Insurance Guaranty Association Model Act.

US Legal Forms is definitely the biggest collection of legal forms where you can discover different papers layouts. Utilize the company to down load expertly-created files that follow express requirements.

Form popularity

FAQ

When do guaranty associations become activated to continue coverage and pay claims? Guaranty associations typically are activated to continue coverage and pay claims when a court issues a liquidation order with a finding of insolvency against a member company. Frequently Asked Questions - NOLHGA.com NOLHGA.com ? main.cfm ? location ? quest... NOLHGA.com ? main.cfm ? location ? quest...

When an insurance company fails, a guaranty association is an entity which steps into the shoes of the failed insurer for the purpose of providing certain continued benefits and/or resolution of covered claims. However, not all types of insurance policies or claims are covered by guaranty associations.

Protections and Limits on Protection The Guaranty Fund provides up to $500,000 of coverage to a life insurance policy owner, individual annuity (such as a single premium deferred annuity) contract holder or individual accident and health insurance policyholder, or any beneficiary, assignee, or payee of the foregoing.

Life insurance net cash surrender and net cash withdrawal values: 80% of the policy value up to a maximum of $100,000; Present value of annuity benefits including net cash surrender and net cash withdrawal values: 80% of the present value up to a maximum of $250,000.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes. Frequently ... - California Life & Health Insurance Guarantee Association califega.org ? FAQ ? Print califega.org ? FAQ ? Print

Most states provide the following amounts of coverage (or more), which are specified in the National Association of Insurance Commissioners' (NAIC) Life and Health Insurance Guaranty Association Model Law: $300,000 in life insurance death benefits. $100,000 in net cash surrender or withdrawal values for life insurance. Guaranty Associations - The American Council of Life Insurers acli.com ? about-the-industry ? guaranty-ass... acli.com ? about-the-industry ? guaranty-ass...

$300,000 per individual Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual. Insurance Guaranty Association: Meaning, Requirements, FAQs investopedia.com ? terms ? insurance-guara... investopedia.com ? terms ? insurance-guara...