Utah Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

Are you currently in a situation where you need documentation for either business or personal purposes almost every workday.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, such as the Utah Agreement to Obtain Share of Retiring Law Partner, which are crafted to comply with state and federal regulations.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the Utah Agreement to Obtain Share of Retiring Law Partner at any time, simply select the needed form to download or print the template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and begin easing your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Utah Agreement to Obtain Share of Retiring Law Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it suits your particular city/region.

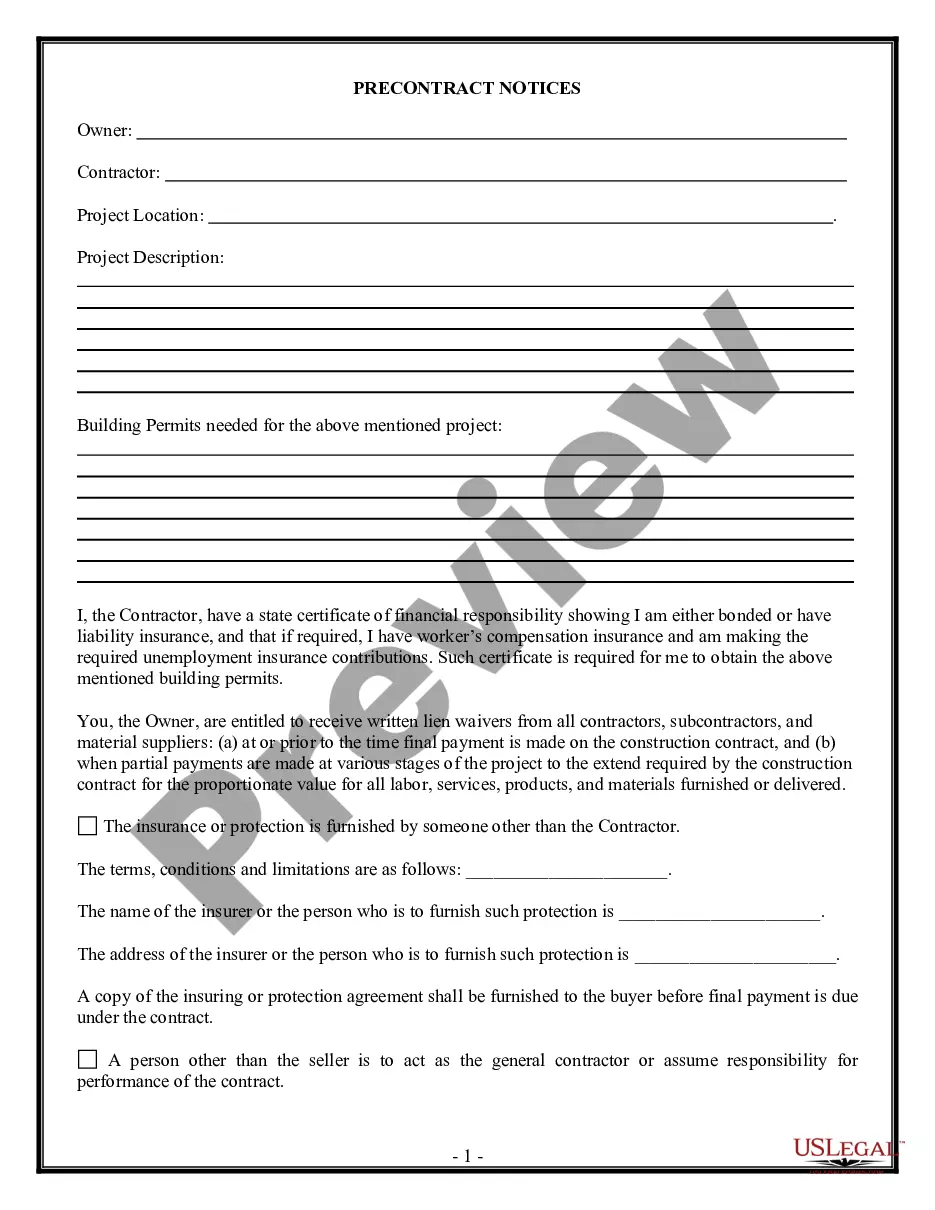

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Retiring from a partnership usually involves giving notice as specified in the partnership agreement. You should settle any outstanding financial matters, such as profit distributions and debts, to ensure a smooth transition. Utilizing a Utah Agreement Acquiring Share of Retiring Law Partner can help clarify these obligations and streamline the retirement process.

Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified. Any reason can be used as the basis for establishing a profit-sharing ratio, but the two main factors are responsibility and capital contributions.

Businesses earn profits based on the size of the company. Partners divide their profits equally. By contributing 50% of the startup money each will gain the right to 50% of the profits, Weltman wrote.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

This means that in a partnership there is more than one owner, and the profit is shared between the owners. In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio.

The partnership pays the leaving partner for the value of his or her capital account + a cash bonus. The leaving partner pays a bonus to the remaining partners by not taking the full amount of the his or her capital balance. Any remaining balance would be allocated between the remaining partners.

Suppose A and B invest Rs. x and Rs. y respectively for a year in a business, then at the end of the year: (A's share of profit) : (B's share of profit) = x : y.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

Dissolution of Partnership by agreementMost partnership agreements will include clauses and procedures for the partnership to be dissolved. The partners must comply with the agreement. Often there is a clause in the partnership agreement requiring less than a 100% vote to dissolve the partnership.