Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

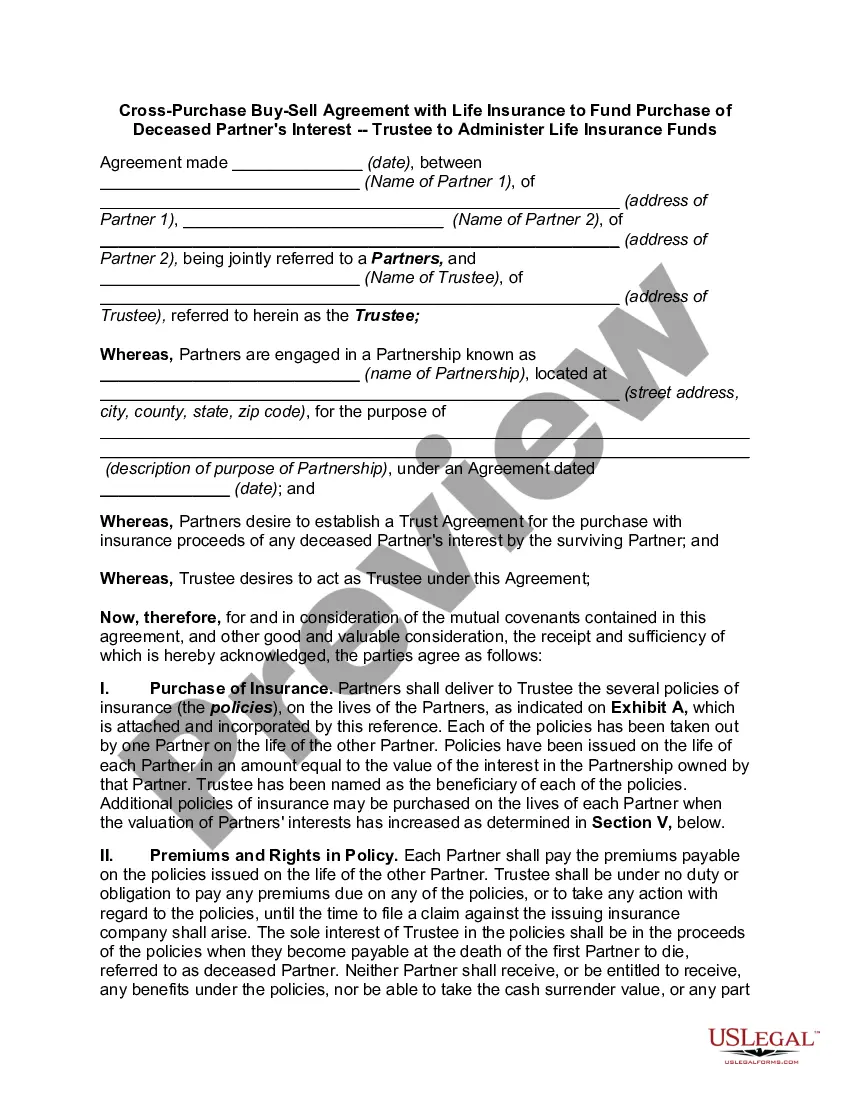

How to fill out Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Locating the appropriate legal document format can be a challenge. Certainly, there are numerous templates accessible on the web, but how do you find the legal form you require? Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, suitable for both business and personal purposes. All templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. Use your account to look up the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are some straightforward steps to follow: First, ensure you have selected the appropriate form for your specific city/county. You may preview the document using the Review button and examine the form description to confirm this is indeed the correct one for you. If the form does not meet your needs, utilize the Search section to find the suitable form. Once you are confident that the document is correct, click the Buy now button to acquire the form. Choose the pricing plan you desire and provide the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document to your device. Fill out, edit, print, and sign the acquired Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death.

US Legal Forms is the largest repository of legal documents where you can find various file templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- Ensure you select the correct form for your area.

- Use the Review button to check the document.

- Search for the appropriate form if needed.

- Click Buy now to make your purchase.

- Provide payment details to complete your order.

- Download the document in your preferred format.

Form popularity

FAQ

If one partner dies, the impact on a partnership can be significant, but it doesn't have to disrupt the business. The Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death serves to provide clarity in such matters. This agreement allows surviving partners to purchase the deceased partner's interest, thus maintaining operational continuity and protecting the interests of all stakeholders.

A partnership does not automatically end with the death of a partner, particularly when there is a good buy-sell agreement in place. The Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death helps outline what happens next, allowing remaining partners to buy out the deceased partner's share. This ensures the partnership can continue operating smoothly and efficiently.

Yes, a partner can retire from a partnership, and having a strong buy-sell agreement can facilitate this process. The Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death provides clear terms regarding the retirement of a partner. This agreement allows for an orderly buyout of the retiring partner’s shares, ensuring a smooth transition for the remaining partners.

A partnership does not necessarily have to be reformed if a partner dies, especially if there is a buy-sell agreement in place. The Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death outlines the procedures that can help avoid the need for reformation. This allows the remaining partners to retain control and continue operations without major structural changes.

sell agreement in a partnership is a legally binding contract that dictates what happens to a partner’s share in the event of death, retirement, or withdrawal. The Utah Partnership BuySell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death ensures that partners can seamlessly transition ownership. This agreement protects both the business and its partners, fostering a transparent operational environment.

When a partner dies, the future of the partnership may come into question. However, a well-crafted Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death provides a structured process for dealing with such situations. It typically stipulates that surviving partners can buy the deceased partner's share, minimizing disruptions and preserving the business.

sell agreement with life insurance is a legal arrangement that provides a clear path for transferring ownership of a deceased partner's share in a business. With the Utah Partnership BuySell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, life insurance funds can be used to buy out the deceased partner's interest, allowing the remaining partners to maintain control. This setup ensures that the partnership remains intact without financial strain.

In the event that one member of a partnership dies, the partnership can face significant challenges. The Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death helps ensure a smooth transition by outlining how the partnership will handle the deceased partner's share. This agreement typically allows remaining partners to buy the deceased partner's interest, ensuring continuity and stability for the partnership.

The most secure way to fund a buy-sell agreement is through life insurance, particularly in a Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. With this method, life insurance policies ensure that funds are readily available for the purchase of a partner's interest upon their death or retirement. This solution protects the partnership from financial instability and provides peace of mind for all partners. For streamlined solutions, consider platforms like uslegalforms, which offer templates and guidance around these critical agreements.

To effectively fund a buy-sell agreement, you may consider establishing a Utah Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. One common method is to fund the agreement with term or whole life insurance policies that cover each partner's ownership value. When a triggering event occurs, the insurance pays out, allowing the surviving partners to buy out the deceased or withdrawing partner’s share. This strategy not only secures the business’s future but also minimizes financial strain during an emotional time.