Utah Cash Register Payout

Description

How to fill out Cash Register Payout?

Are you currently in a circumstance where you require documentation for both business or personal purposes almost every day.

There is a multitude of legitimate document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Utah Cash Register Payout, which are designed to comply with state and federal requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. View all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Utah Cash Register Payout at any time, as needed. Click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Utah Cash Register Payout template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for your correct city/state.

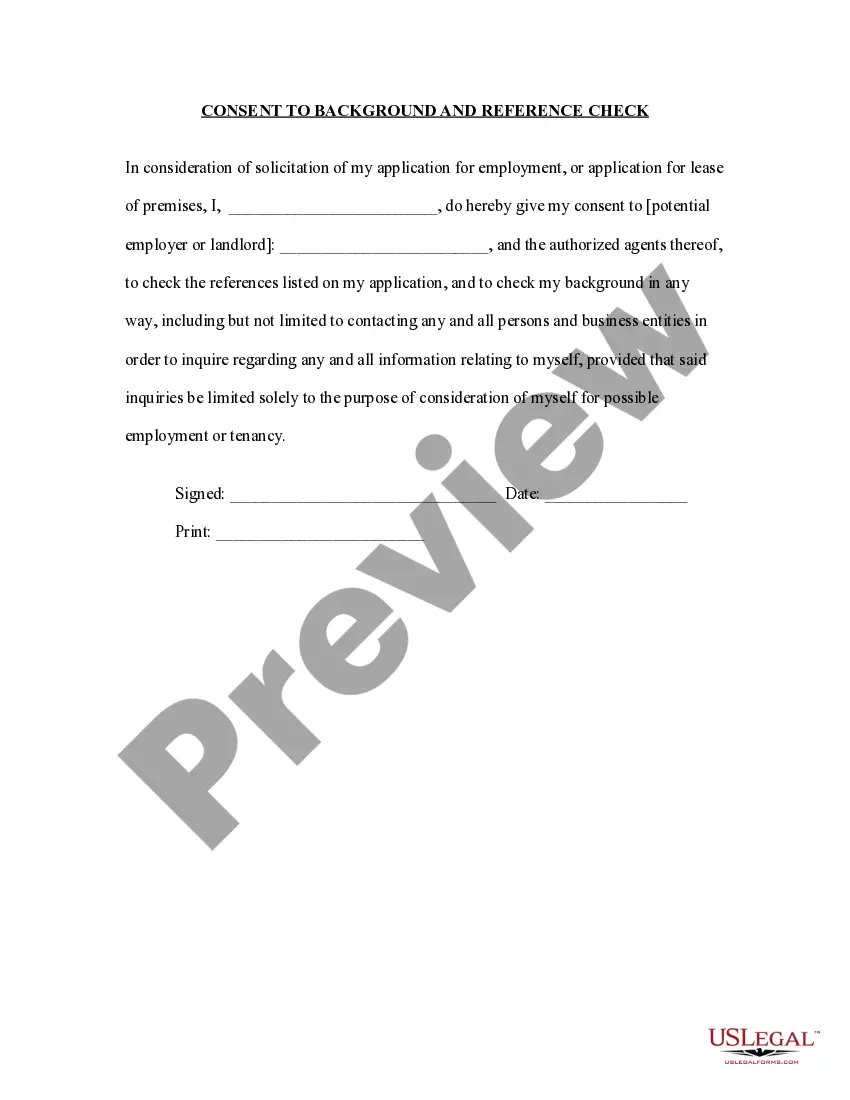

- Utilize the Review button to examine the form.

- Read the information to confirm you have selected the correct document.

- If the form is not what you’re looking for, use the Lookup field to find a form that meets your requirements.

Form popularity

FAQ

To apply for a Utah withholding account, complete the necessary application available through the Utah State Tax Commission's website. You’ll need to provide relevant business information and identify your expected withholding obligations. Setting up your Utah withholding account correctly can ensure smooth payroll processes and timely Utah Cash Register Payouts to your employees.

Utah does accept out of state resale certificates as long as they meet Utah's requirements. When you use these certificates, make sure they are properly filled out and include necessary details. Using valid resale certificates can streamline your Utah Cash Register Payouts and maintain accurate accounting practices.

To close your Utah sales tax account, you must complete the appropriate closing form found on the Utah State Tax Commission website. Provide details about your business activities and indicate that you wish to close your sales tax account. Completing this process ensures that you will not face future tax obligations related to Utah Cash Register Payout activities.

Yes, Utah does accept out of state exemption certificates if they comply with Utah's requirements. When utilizing these certificates for Utah Cash Register Payout transactions, ensure that the documents provided are valid and signed. Always check the latest regulations to confirm compliance and avoid any issues during your sales processes.

Paid In and Out accounts are a way to remove or deposit money out of a drawer or safe and track why. For example if you run out of supplies and need to buy more at the store, you can take the money out of the register and perform a Paid Out to document that you took the money for supplies.

Count off big bills first and work your way down to smaller bills and change. Record each denomination as you count it off. For example if the largest bills in your till were three $50 bills, you'd write down 3 X $50, and a total of $150. Repeat that process for each smaller size of bill, then for the change.

A cash register closure should always be done at the end of a shift or when handing over a cash register to another employee. During a cash register closure, the currently edited register will need to register the actual amount and match it against the sales amount.

Guidance on Cash Handling ProceduresAll cash and where applicable, Petty Cash floats, should be held securely, either in a till or a locked cash box at all times. When using a cash box this should be kept out of sight at all times either in a locked cabinet or drawer.

In the pay-in and pay-outs list, you can book pay-ins and pay-outs without direct connection to an invoice or a reservation. Pay-Ins are when cash is collected on the business floor in an ad hoc manner, pay-Outs are when cash from the business floor is distributed to somebody.

PayoutsGo to the Orders tab then Cash Register.Click New Payment.Specify Employee / Vendor - Select Employee if you are removing cash tips from the drawer.Amount - Enter the total amount of money you are removing from the cash register.Date - Select the date when the money was removed.More items...