Utah Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Agreement That Statement Of Account Is True, Correct And Settled?

Have you ever found yourself in a situation where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Utah Agreement that Affirms the Statement of Account is Accurate, True, and Resolved, designed to comply with federal and state requirements.

Once you find the appropriate form, click on Acquire now.

Choose the pricing plan you need, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have a free account, simply Log In.

- After logging in, you will be able to download the Utah Agreement that Affirms the Statement of Account is Accurate, True, and Resolved template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

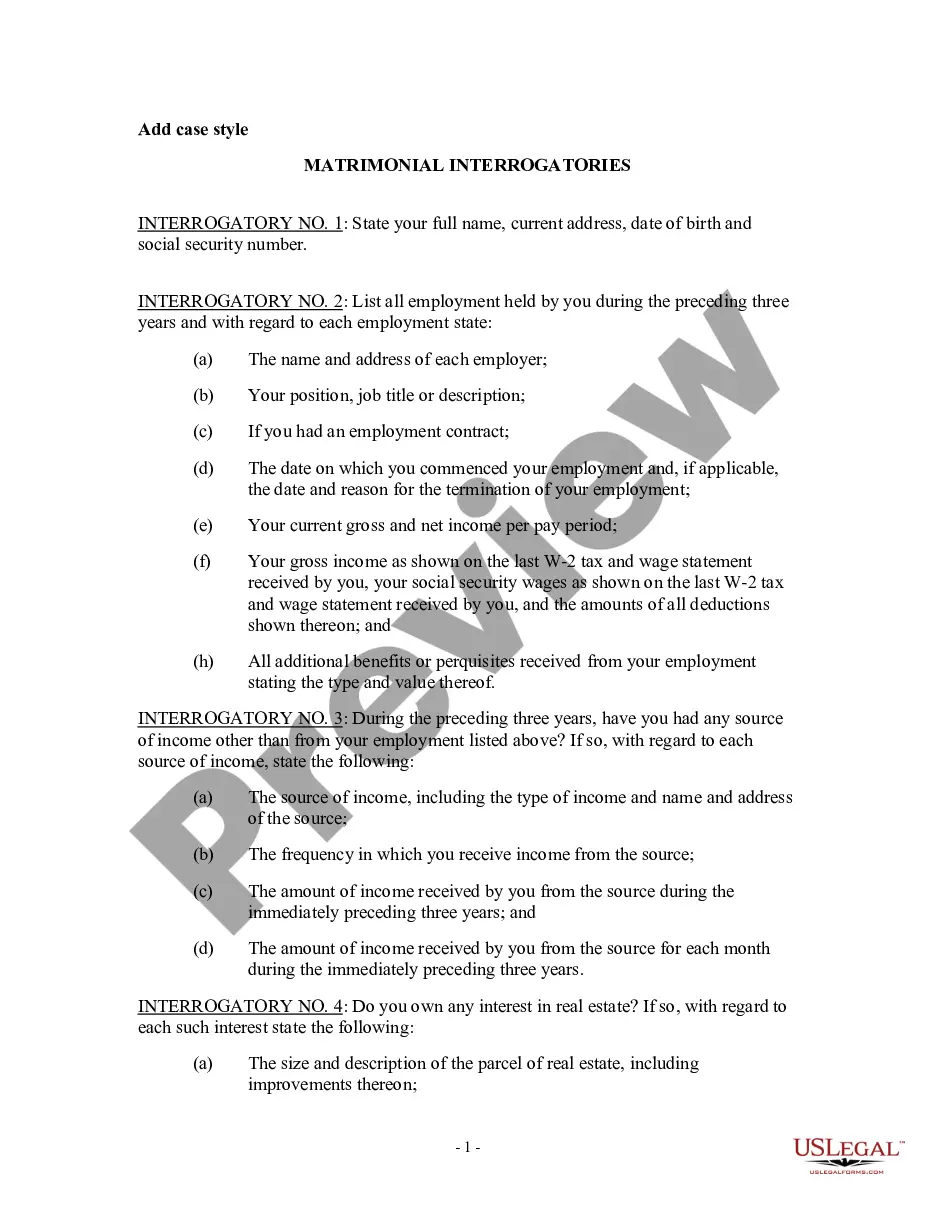

- Obtain the form you need and verify it is for the correct region/county.

- Utilize the Preview option to examine the form.

- Check the overview to confirm you have selected the correct form.

- If the form is not what you require, use the Research section to find the form that meets your needs and specifications.

Form popularity

FAQ

Yes, if you earn income in Utah, you typically need to file a Utah tax return. Filing ensures that you comply with state tax laws and can help you understand your tax obligations. You may need to include a signed Utah Agreement that Statement of Account is True, Correct and Settled to accurately report your income and expenses.