Utah Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Are you presently in a placement that you require papers for either company or specific purposes just about every working day? There are tons of authorized papers templates available on the net, but locating kinds you can rely on is not straightforward. US Legal Forms offers 1000s of develop templates, just like the Utah Sample Letter regarding Information for Foreclosures and Bankruptcies, which are published to meet federal and state demands.

When you are currently familiar with US Legal Forms website and possess an account, just log in. After that, you can obtain the Utah Sample Letter regarding Information for Foreclosures and Bankruptcies design.

If you do not have an bank account and need to begin to use US Legal Forms, abide by these steps:

- Find the develop you need and make sure it is to the correct area/county.

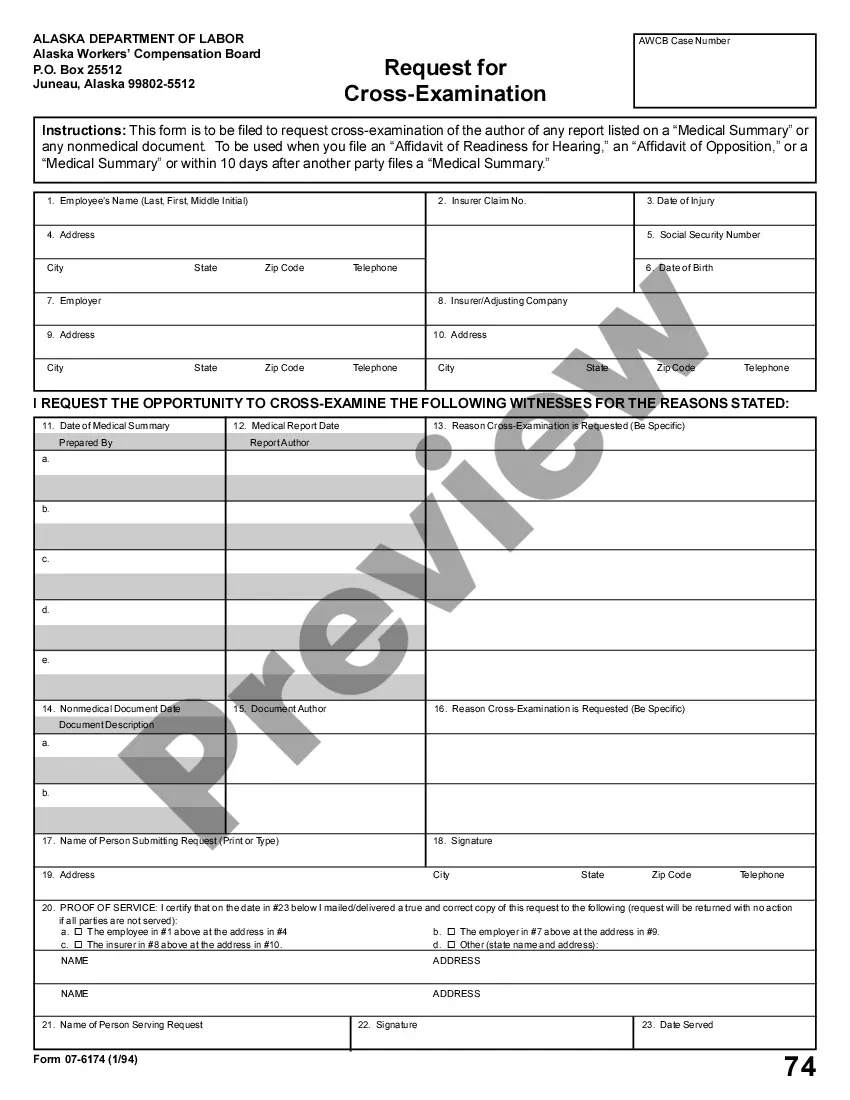

- Utilize the Review option to analyze the form.

- Look at the information to actually have chosen the appropriate develop.

- In the event the develop is not what you`re searching for, utilize the Search field to discover the develop that fits your needs and demands.

- Whenever you discover the correct develop, click on Buy now.

- Select the costs strategy you desire, submit the required info to produce your bank account, and buy an order utilizing your PayPal or credit card.

- Choose a handy data file structure and obtain your backup.

Find each of the papers templates you possess bought in the My Forms food selection. You can obtain a additional backup of Utah Sample Letter regarding Information for Foreclosures and Bankruptcies whenever, if needed. Just select the necessary develop to obtain or printing the papers design.

Use US Legal Forms, probably the most considerable collection of authorized forms, to save time as well as stay away from faults. The services offers expertly made authorized papers templates that you can use for a variety of purposes. Generate an account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

A non judicial foreclosure in Utah can be completed in about 4 months if it is not contested by the borrower. The time frame for a judicial foreclosure depends on the court's schedule and the rulings of the court.

DEED IN LIEU OF FORECLOSURE - To avoid foreclosure when you know you will be unable to make your payments, you may consider handing over your deed to the lender. This is also called voluntary repossession. It means you are giving your house back to the lender.

Some states also provide foreclosed borrowers a redemption period after the foreclosure sale, during which they can buy back the home. Under Utah law, however, foreclosed homeowners don't get a right of redemption after a nonjudicial foreclosure.

You can request that the trustee postpone or stop the sale and cancel the Notice of Default by paying the entire loan balance as well as legal fees and other fees associated with the foreclosure.

Therefore, a lender seeking to foreclose on a property secured by a trust deed must ?(1) commence an action to foreclose the trust deed, or (2) file for record a notice of default under [Utah Code] Section 57-1-24? before the six-year statute of limitations period expires. See Utah Code Ann. § 57-1-34.

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions.

A trustee records a Notice of Default at the county recorder's office. The Notice of Default includes the reason the trustee believes your loan is in default. A trustee must give written notice of the default to the borrower and anyone who has filed a Request for Notice. This is usually done by registered mail.