Utah Sample Letter to Foreclosure Attorney - Payment Dispute

Description

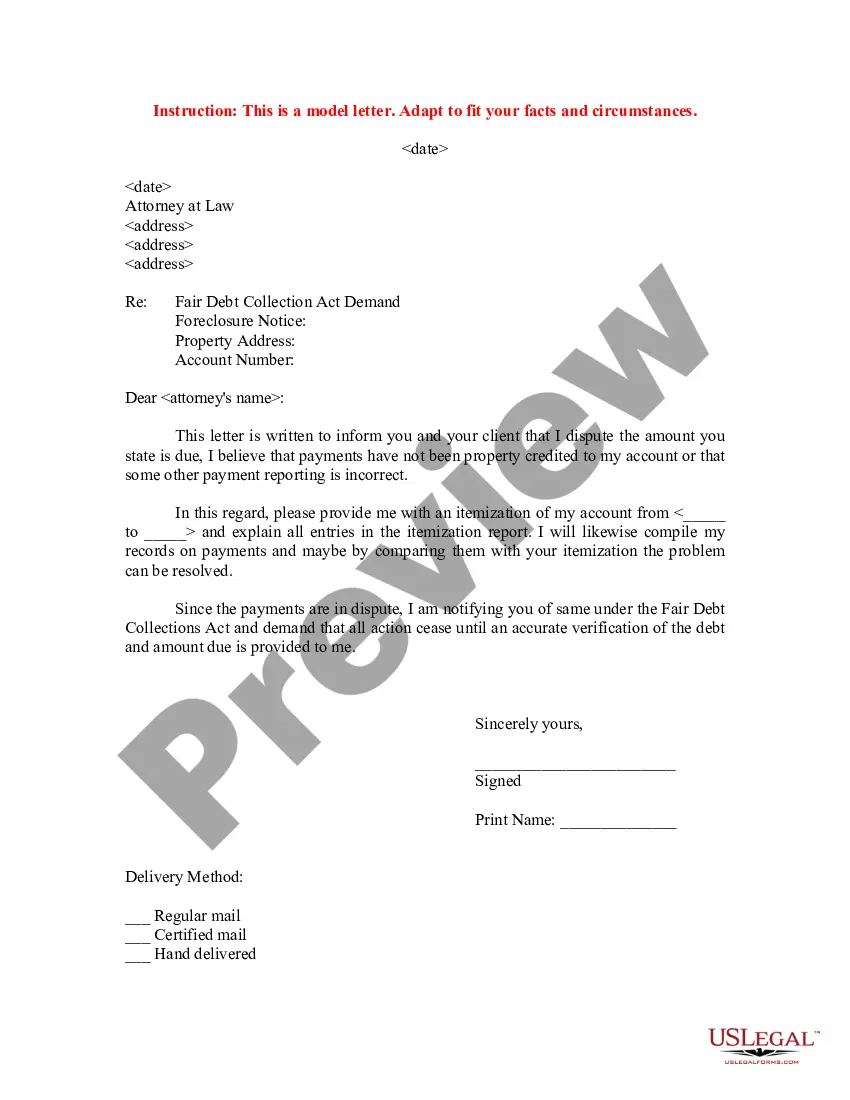

How to fill out Sample Letter To Foreclosure Attorney - Payment Dispute?

Are you currently within a position the place you require documents for possibly organization or individual purposes just about every day time? There are plenty of authorized file web templates available on the net, but finding kinds you can rely isn`t simple. US Legal Forms offers thousands of form web templates, such as the Utah Sample Letter to Foreclosure Attorney - Payment Dispute, that are written to fulfill state and federal requirements.

When you are presently acquainted with US Legal Forms site and get an account, merely log in. Next, it is possible to obtain the Utah Sample Letter to Foreclosure Attorney - Payment Dispute format.

Should you not come with an accounts and wish to begin to use US Legal Forms, follow these steps:

- Get the form you require and ensure it is for that appropriate metropolis/state.

- Take advantage of the Preview button to review the form.

- Browse the description to actually have selected the right form.

- When the form isn`t what you`re looking for, make use of the Research industry to obtain the form that fits your needs and requirements.

- Once you discover the appropriate form, click on Purchase now.

- Opt for the rates strategy you need, complete the required information and facts to make your money, and buy an order utilizing your PayPal or Visa or Mastercard.

- Decide on a handy data file structure and obtain your backup.

Discover each of the file web templates you have bought in the My Forms food selection. You can obtain a further backup of Utah Sample Letter to Foreclosure Attorney - Payment Dispute at any time, if possible. Just select the necessary form to obtain or produce the file format.

Use US Legal Forms, one of the most substantial variety of authorized forms, in order to save time as well as stay away from faults. The support offers skillfully created authorized file web templates that can be used for a range of purposes. Make an account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

As stated, the entire foreclosure process in Utah takes about 7 months to complete. You first need to be 90 days late in your payments before a notice of default is recorded. That recording is serving another 3 month notice. And finally, a 3 week notice is given that a home will be sold at auction.

Similar to medical debt and certain bankruptcies, it takes seven years for foreclosures to disappear from your credit report. The unfortunate news is that as long as the foreclosure is listed on your credit report, your credit score will be negatively impacted by it.

Therefore, a lender seeking to foreclose on a property secured by a trust deed must ?(1) commence an action to foreclose the trust deed, or (2) file for record a notice of default under [Utah Code] Section 57-1-24? before the six-year statute of limitations period expires. See Utah Code Ann. § 57-1-34.

Some states also provide foreclosed borrowers a redemption period after the foreclosure sale, during which they can buy back the home. Under Utah law, however, foreclosed homeowners don't get a right of redemption after a nonjudicial foreclosure. (Utah Code Ann. § 57-1-28(3)).

You can request that the trustee postpone or stop the sale and cancel the Notice of Default by paying the entire loan balance as well as legal fees and other fees associated with the foreclosure.