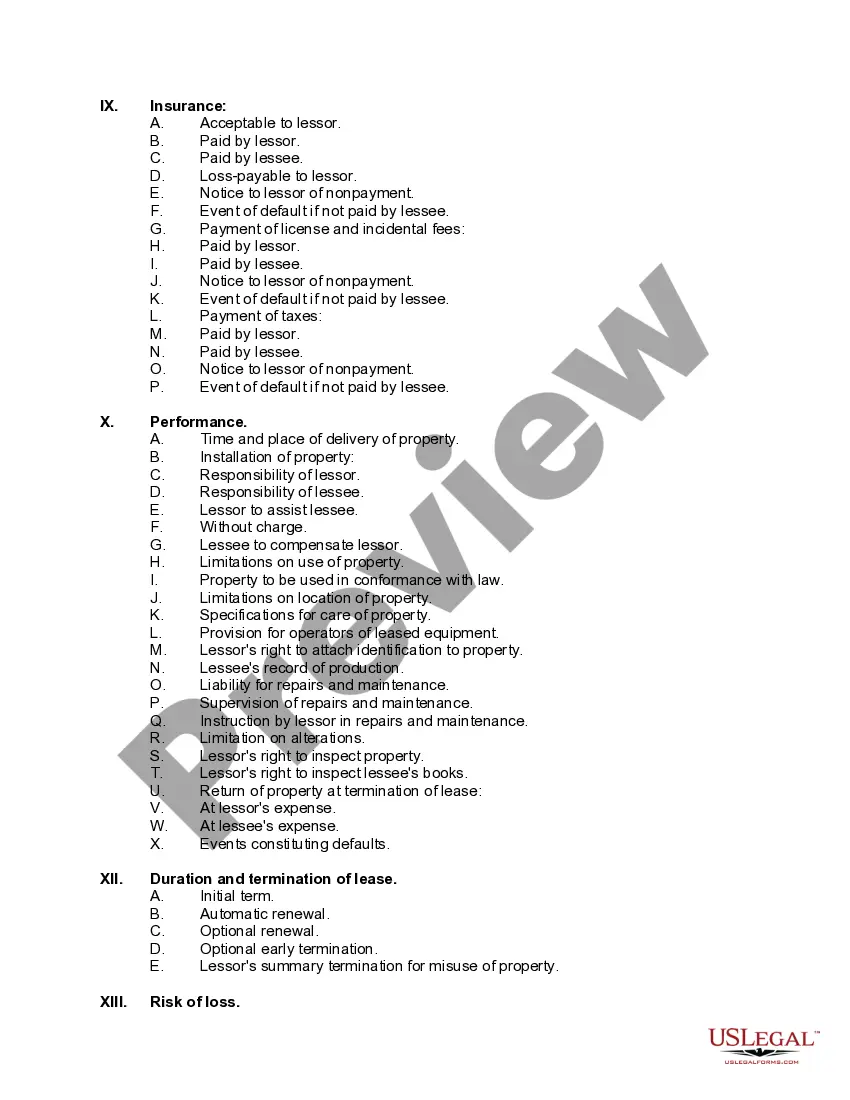

Utah Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

It is feasible to spend numerous hours online looking for the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of official forms that are reviewed by experts.

You can conveniently download or print the Utah Equipment Lease Checklist from the service.

If available, utilize the Review button to browse through the document template as well. If you want to locate another version of your form, use the Search field to find the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Utah Equipment Lease Checklist.

- Each official document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form description to guarantee you have chosen the right form.

Form popularity

FAQ

Filling out a commercial lease agreement involves listing essential details such as the tenant and landlord information, property description, and lease terms. You should also specify payment details and maintenance responsibilities. A well-crafted Utah Equipment Lease Checklist can simplify this process by highlighting necessary sections to complete. For further assistance, USLegalForms offers user-friendly templates tailored for various leasing needs.

Yes, you can write your own lease agreement. However, it's crucial to include specific terms related to your leasing situation, such as rental rate, duration, and responsibilities. Using a thorough Utah Equipment Lease Checklist can help ensure you cover all vital aspects needed for an effective lease. Additionally, consider legal assistance or resources like USLegalForms for reliable templates and guidance.

Under ASC 842, leases are classified into two primary categories: finance leases and operating leases. Each classification has different impacts on financial statements and reporting. A well-prepared Utah Equipment Lease Checklist can assist you in determining the appropriate classification for your equipment lease and ensuring compliance.

Accounting for leased equipment requires recognizing the lease liability and the corresponding right-of-use asset. This approach allows you to reflect the lease on your balance sheet accurately. A Utah Equipment Lease Checklist can provide clarity on the steps and documentation needed for correct accounting practices.

Absolutely, ASC 842 does apply to all types of equipment leases, standardizing how they are reported in financial statements. This standard requires all leases to be classified either as finance or operating leases. Using a Utah Equipment Lease Checklist will help you navigate these classifications and their implications.

To record leased equipment, recognize the asset and lease liability at the present value of lease payments. This practice aligns with the ASC 842 standard, which improves transparency in financial reporting. A Utah Equipment Lease Checklist can guide you through the essential steps to accurately document leased equipment.

Yes, equipment leases do fall under ASC 842. This standard requires companies to recognize lease liabilities and corresponding right-of-use assets on financial statements. Understanding this guidance is crucial and utilizing a Utah Equipment Lease Checklist can help ensure you remain compliant.

Leased equipment can be considered an asset, but it depends on the lease type. For example, a finance lease lets you recognize the leased item as an asset on your balance sheet. Using a Utah Equipment Lease Checklist can help clarify how different types of leases affect your financial statements.

To get a lease drawn up, start by gathering all necessary details about the equipment and parties involved. You can use a Utah Equipment Lease Checklist to ensure you have all relevant information and terms covered. It’s often best to consult with a legal professional or use reputable platforms like US Legal Forms to draft a comprehensive lease that meets your needs.

To successfully lease equipment, most lenders look for a credit score of at least 620. However, requirements can vary between lenders, so having a higher score may yield better terms. It’s essential to consider your overall financial health as well, since factors like your income and debt-to-income ratio also play a role. For an effective approach, our Utah Equipment Lease Checklist can guide you through the necessary steps to improve your chances of approval.