Utah Expense Report

Description

How to fill out Expense Report?

Selecting the ideal legal document format can be quite a challenge.

Of course, numerous templates are available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Utah Expense Report, that you can utilize for business and personal purposes.

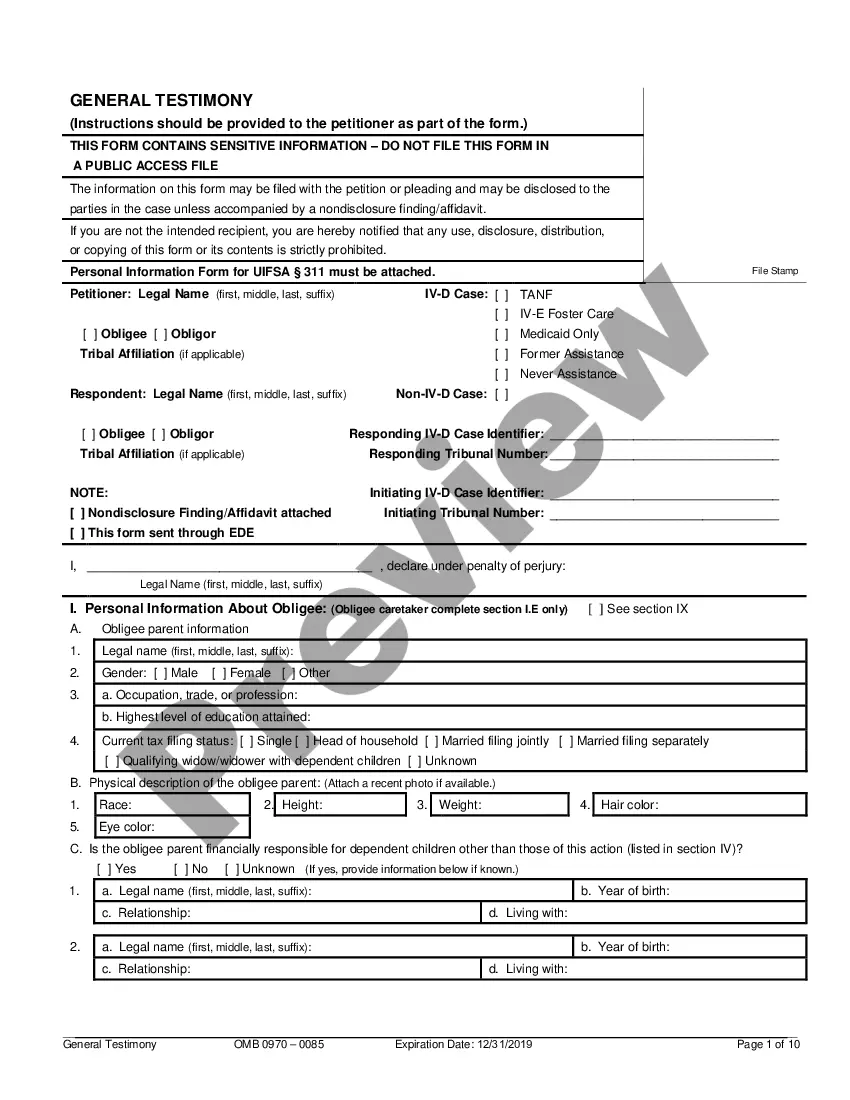

You can examine the form using the Review button and read the form summary to ensure it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Utah Expense Report.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents tab in your account to retrieve an additional copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have selected the correct form for your region/area.

Form popularity

FAQ

A travel expense report specifically highlights expenses related to business travel. This includes costs such as airfare, hotel stays, meals, and other travel-related expenditures. When you create a travel expense report, be sure to include all relevant details, as it plays a vital role in your Utah Expense Report and simplifies the reimbursement process.

An expense report is a document used to itemize expenses incurred during business activities. This report helps organizations track spending, ensure compliance with company policies, and facilitate reimbursement processes. By accurately completing your Utah Expense Report, you provide clear evidence of your expenditures, making the approval process smoother.

A travel expense refers to costs incurred when traveling for business-related purposes. Common examples include transportation, lodging, meals, and incidentals that arise during your trip. It’s important to detail these costs in your Utah Expense Report, as they can be reimbursable by your employer or organization.

To file an expense report in Utah, start by gathering your receipts and documentation for all expenses incurred. After organizing your materials, complete the expense report form, ensuring you include accurate details such as dates, amounts, and the purpose of each expense. You can simplify this process by using the Utah Expense Report template available on US Legal Forms, making it easy to submit your information accurately and efficiently.

An expense report travel expense report is a specific type designed to capture travel-related costs. This includes expenses like transportation, lodging, meals, and any other costs incurred during business travel. Utilizing a Utah Expense Report ensures that all travel expenses are documented correctly and submitted for reimbursement in a standardized format.

To complete an expense report, gather your receipts and organize them by category. Use a Utah Expense Report template to list each expense, including dates, amounts, and business purposes. Submitting the report accurately ensures prompt reimbursement and adherence to internal guidelines. Consider using tools from USLegalForms for an organized approach.

When asking for expense reimbursement, first prepare a detailed Utah Expense Report that outlines each expense clearly. Approach your supervisor, providing them with the report along with any necessary receipts. Be polite and concise, explaining the business context of your expenses. Follow up if needed, as procedures may vary by company.

The IRS requires detailed documentation for any expenses claimed on a Utah Expense Report. You must include receipts, the business purpose for each expense, and any necessary approvals from supervisors. It's crucial to maintain accurate records to comply with IRS regulations, as inaccurate reporting can lead to tax issues.

Creating an expense report starts with collecting all relevant receipts and documentation. You can utilize a Utah Expense Report template from USLegalForms to simplify the process. List each expense, categorizing them appropriately and providing a clear description. Always ensure that your report aligns with your company's submission guidelines.

To create a spending report, first compile all your expenses over a specified period. Use a template for a Utah Expense Report to ensure consistency. Include necessary details such as amounts, categories, and dates. This comprehensive overview helps you track and manage your finances effectively.