Utah Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

Are you presently in the location for which you need documents for occasional business or specific purposes almost every day.

There are numerous lawful document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a extensive collection of form templates, such as the Utah Auto Expense Travel Report, that are designed to fulfill state and federal criteria.

Once you find the appropriate form, click on Acquire now.

Choose the pricing plan you want, enter the required information to create your account, and pay for the order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Utah Auto Expense Travel Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/region.

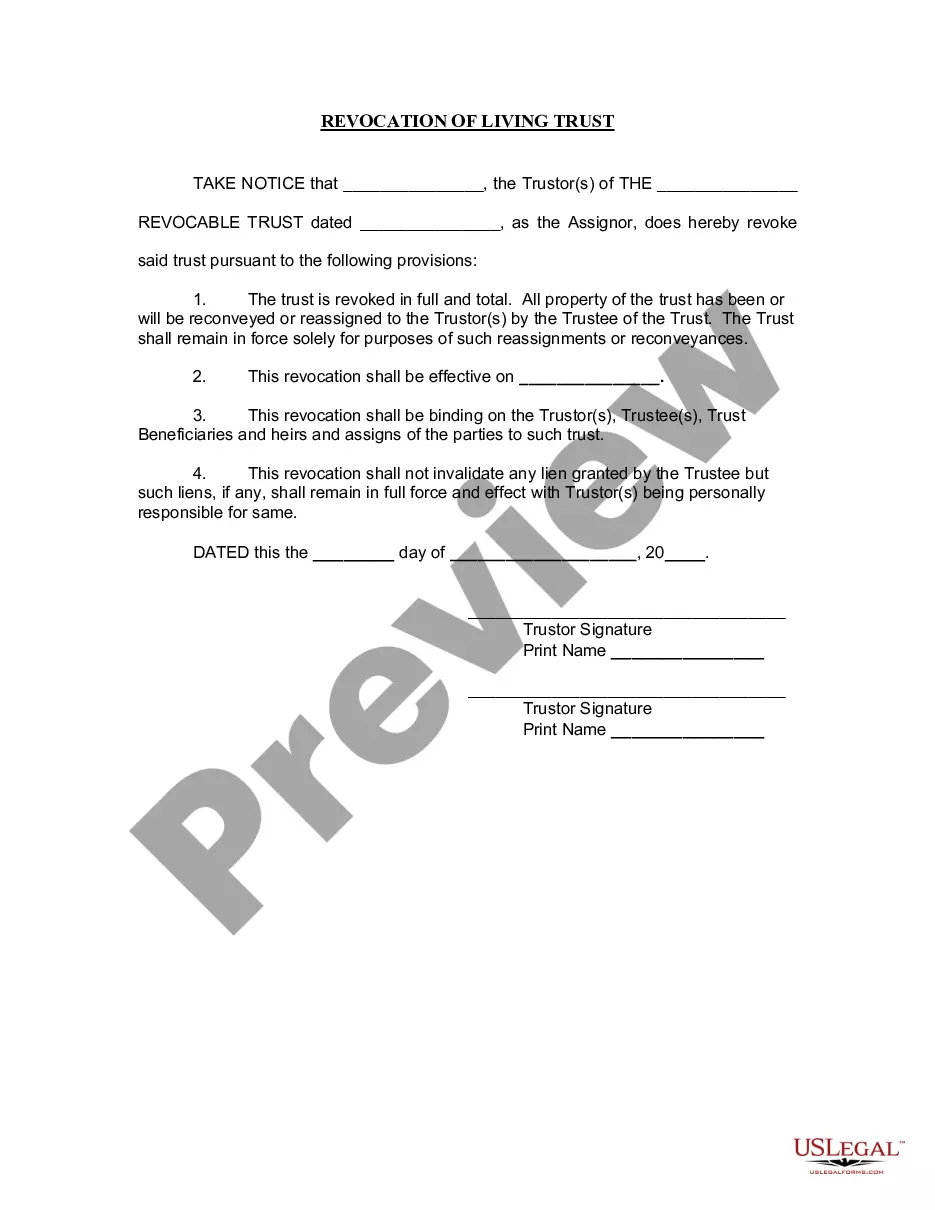

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

To create a travel profile in Concur, begin by logging into your Concur account. Navigate to the profile settings section, where you can input your personal details, travel preferences, and payment methods. Completing this profile is essential for generating accurate Utah Auto Expense Travel Reports later. By doing this, you streamline your travel experience and simplify expense reporting.

A travel expense report is a formal document that records all expenses incurred during business travel. It includes various costs, such as transportation, lodging, meals, and other incidentals. This report serves as a method for employees to request reimbursement for business-related expenses. For managing your expenses effectively, consider using a Utah Auto Expense Travel Report on the US Legal Forms platform, which simplifies the tracking and documentation process.

Travel expenses can include a wide range of costs associated with business travel. Typical expenses are airfare, car rentals, hotel stays, meals, and tolls. Meals can also be claimed, provided they adhere to IRS guidelines. Keeping a detailed Utah Auto Expense Travel Report will help you capture these expenses effectively and ensure you maximize your eligible reimbursements.

Creating a travel expense report involves several steps. First, you should collect all related receipts and documents. Next, categorize expenses into groups, such as transportation, meals, and lodging, and accurately fill out your Utah Auto Expense Travel Report with this information. Finally, submit the report to your employer along with the necessary documentation for prompt reimbursement.

Certain costs are not considered travel expenses, such as personal expenses or entertainment not linked to business activities. Examples include expenses for family members traveling with you, or costs for leisure activities during your trip. It's crucial to distinguish these from legitimate business expenses on your Utah Auto Expense Travel Report. This clarity ensures accuracy and helps maintain compliance with your company's reimbursement policies.

The purpose of the expense report is to provide a detailed accounting of incurred costs during business travel. It helps companies control spending, ensure compliance with policies, and reimburse employees accurately. A well-structured Utah Auto Expense Travel Report serves as a tool to improve financial oversight and simplify the reimbursement process. By capturing every detail, it minimizes potential disputes and supports better budget planning.

A travel expense report for employees is a document that outlines all expenses incurred while traveling for work. It includes costs such as transportation, lodging, meals, and incidentals. Employees must submit this report to their employer for reimbursement or record-keeping. Utilizing a Utah Auto Expense Travel Report streamlines this process and ensures transparent tracking of all travel-related expenses.

Yes, the IRS requires receipts for travel expenses to substantiate your claims. When you file your taxes, it's essential to retain detailed documentation that supports your travel expense report. If you're using a Utah Auto Expense Travel Report, make sure to keep receipts for lodging, meals, and transportation. This practice not only helps you claim the expenses, but also provides proof in case of an audit.

As of now, the mileage reimbursement rate for 2025 has not yet been released. Typically, the IRS announces any changes in the rate towards the end of the current year. Therefore, it's wise to check regularly as you prepare your Utah Auto Expense Travel Report in advance. Ensuring that you use the correct rate is critical for accurate expense reporting.

In Utah, there is no law explicitly requiring employers to reimburse employees for mileage. However, many employers choose to offer reimbursement for business-related travel to promote fair practices and maintain employee satisfaction. Keeping track of your mileage using a Utah Auto Expense Travel Report can simplify this process and ensure you receive any eligible reimbursements.