Utah Financing Statement

Description

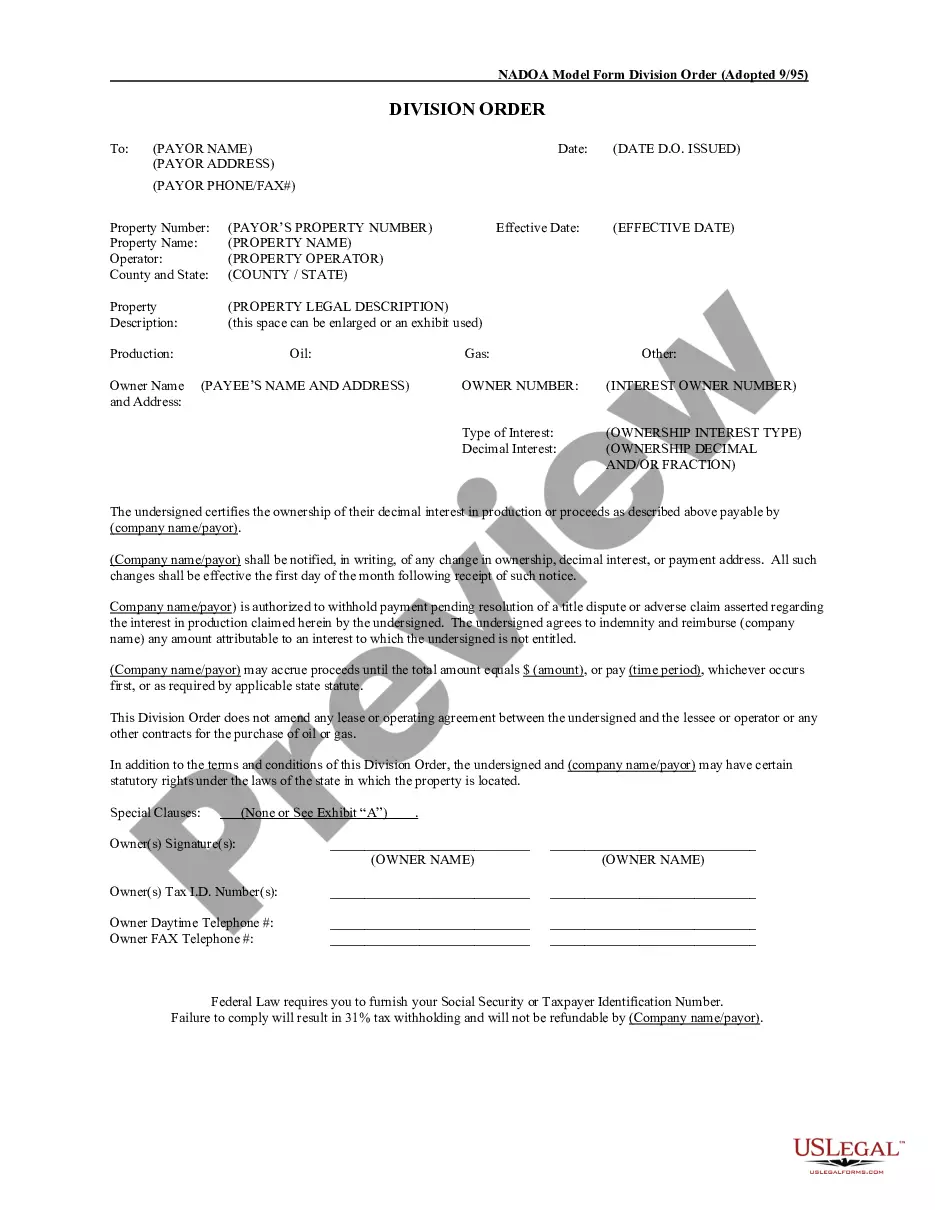

How to fill out Financing Statement?

If you intend to aggregate, retrieve, or create sanctioned document formats, utilize US Legal Forms, the largest selection of legal documents available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal use are categorized by groups and states, or keywords.

Step 4. Once you have found the form you require, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Utah Financing Statement with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Acquire button to obtain the Utah Financing Statement.

- You can also access forms you have previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

You should file a UCC financing statement in the state where the debtor is located. For a business, that typically means the state of incorporation or where its principal place of business operates. If you are dealing with tangible property, different rules may apply. To simplify this process and ensure compliance, consider utilizing US Legal Forms, which can aid you in identifying the correct filing procedures for Utah Financing Statements.

Financing statements should be filed with the appropriate state authority, often the Secretary of State's office, where the debtor is located. In Utah, this means submitting your filing to the Utah Secretary of State’s office. Filing correctly is vital to ensure the legal validity of your security interest and to protect your rights as a creditor. If you need assistance, US Legal Forms offers streamlined solutions to help you file accurately.

A financing statement is a legal document that provides notice to third parties regarding a secured party's interest in a debtor's collateral. In simple terms, it shows lenders that they have a claim to specific assets if the borrower does not meet their obligations. This document is crucial in business transactions to establish trust and transparency. For those in Utah, understanding how a Utah Financing Statement works can help you navigate your legal responsibilities.

Receiving a UCC financing statement indicates that a creditor has filed a notice of their security interest in your property. This filing helps safeguard their right to repayment in the event of default. It is essential to review the statement carefully, as it could affect your credit rating or current financial agreements. If you have questions about its implications, consider consulting a legal professional or using resources like US Legal Forms for guidance.

The financing statement can be filed with the Utah Secretary of State's office, either online or via mail. It becomes part of the public record, making it accessible for anyone who wishes to verify the security interest. Using the uslegalforms platform simplifies the process as it provides direct links and instructions for filing your Utah Financing Statement.

To file a Utah Financing Statement, you must file it in the state of Utah where the secured party resides or where the collateral is located. This ensures that the financing statement is enforceable against third parties. If you are unsure about the proper filing location, uslegalforms can help guide you through the necessary steps to ensure compliance.

A Utah Financing Statement is a document formatted to provide specific information about a secured transaction. It typically includes the names and addresses of the parties involved, a description of the collateral, and a unique identification number. You can expect it to be clear and concise, ensuring that all necessary details are present for proper filing and record-keeping.

You file a financing statement at the Utah Secretary of State’s office. This office provides the necessary forms and guidelines for submitting your financing statement correctly. Additionally, using US Legal Forms can simplify your experience, offering tools and templates that adhere to Utah’s filing requirements. Proper filing ensures your rights are protected throughout the financing process.

A financing statement on a title serves to record a security interest in collateral that is tied to a title, such as a vehicle or property. It identifies the parties involved and describes the collateral, establishing a legal claim. This acts as a notice to other parties of existing interests, which is crucial when transferring ownership. To handle this effectively, you can rely on resources from US Legal Forms for accurate guidance.

Indeed, a financing statement is a public document once filed with the state. This means that anyone can access and review the information contained within it, promoting transparency. It helps inform potential creditors about any existing claims against the collateral. Use platforms like US Legal Forms to ensure your filing is done correctly, minimizing complications from public inquiries.