Utah College Education Trust Agreement

Description

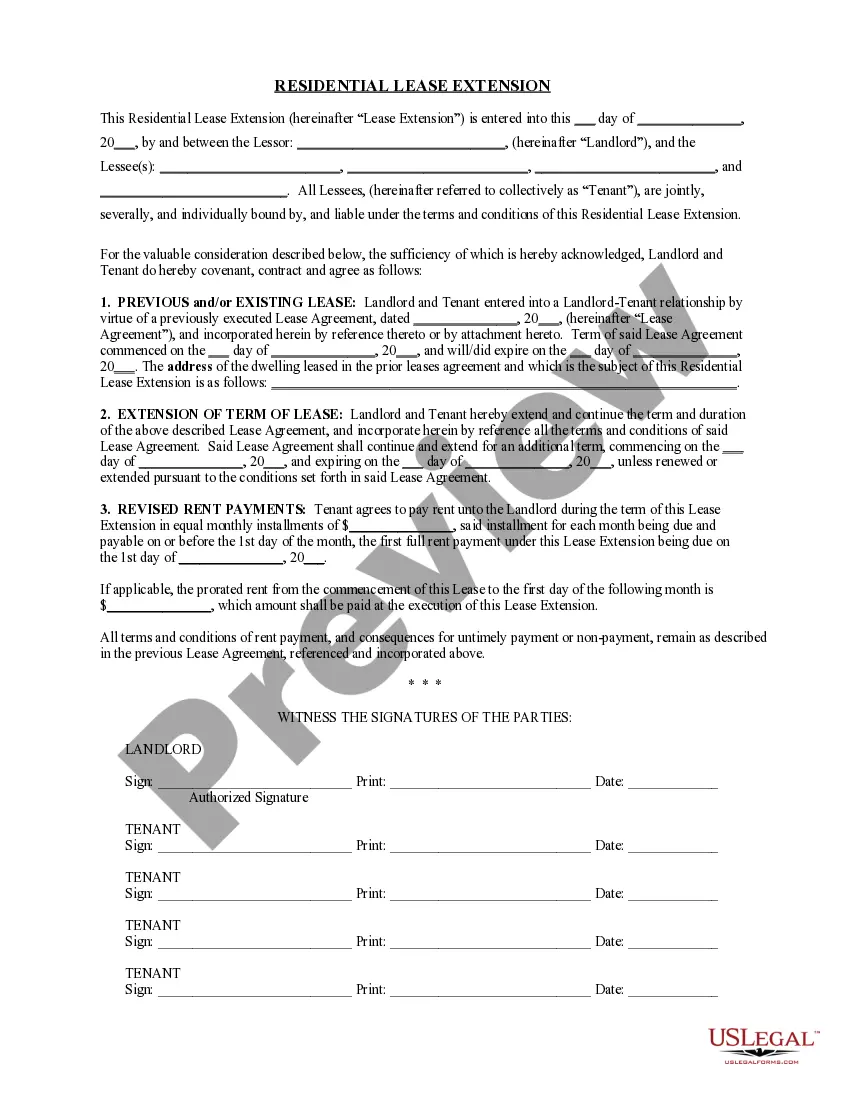

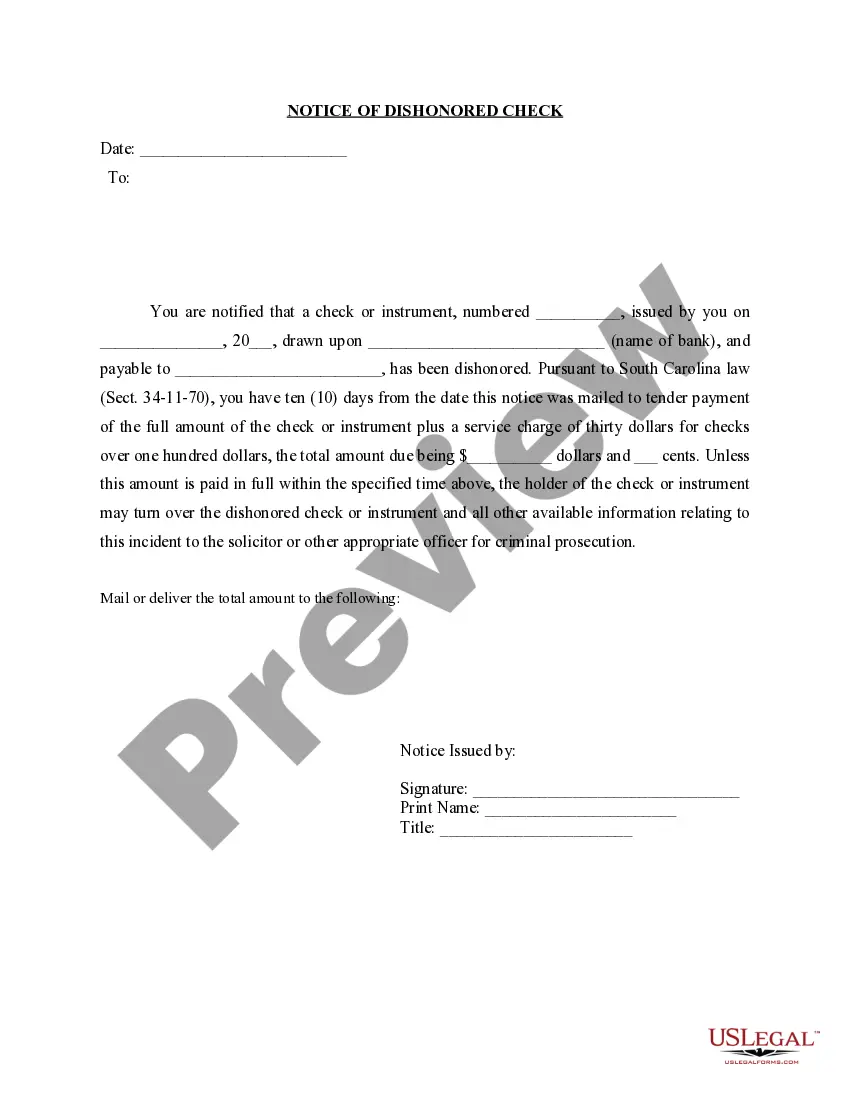

How to fill out College Education Trust Agreement?

Are you presently in a scenario where you require documents for both business or personal reasons almost every day.

There are numerous legal document templates available on the Web, but finding ones you can trust isn't simple.

US Legal Forms offers a vast array of form templates, such as the Utah College Education Trust Agreement, which can be tailored to meet state and federal requirements.

Once you locate the suitable form, click Buy now.

Select the pricing plan that you want, enter the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Utah College Education Trust Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to the correct region/state.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to locate the form that suits your needs.

Form popularity

FAQ

In Utah, a trust works as a legal arrangement where one party holds property for the benefit of another. The trust's creator, known as the grantor, establishes the terms and appoints a trustee to manage the assets. When using a Utah College Education Trust Agreement, the trustee ensures that the funds are allocated for the beneficiary's education as per the laid-out guidelines.

Yes, Utah requires that certain trusts file a state tax return, known as the Utah Fiduciary Income Tax Return. This applies to trusts that generate taxable income. When setting up a Utah College Education Trust Agreement, it’s advisable to consult with a tax professional to understand your tax obligations and ensure compliance.

One significant mistake parents often make is not clearly defining the objectives of the trust. Failing to outline specific terms can lead to confusion and disputes down the line. When creating a Utah College Education Trust Agreement, clearly articulate your goals to ensure the trust serves its intended purpose effectively.

Utah's 529 plan is known as the My529 plan. This tax-advantaged savings plan helps families save for future educational expenses. When you establish a Utah College Education Trust Agreement, you can complement this by contributing to a 529 plan, ensuring your child's education is financially secure.

In Utah, trusts must be created in accordance with state laws that govern their formation and operation. This includes specific requirements for drafting the trust document, appointing a trustee, and defining the terms of the trust. When establishing a Utah College Education Trust Agreement, it is crucial to ensure compliance with these regulations to avoid potential legal issues in the future.

Utah 529 is known for its strong performance, low fees, and flexibility, making it an attractive choice for many families. The Utah College Education Trust Agreement offers a variety of investment options, allowing you to tailor your approach based on your financial goals. Additionally, the user-friendly platform and resources available through providers like uslegalforms simplify the process of saving for education, enhancing the overall experience.

While many states have strong 529 plans, the best performing plan often varies based on individual needs and goals. The Utah College Education Trust Agreement is frequently recognized for its excellent performance and investment options, making it a top contender. Evaluating factors such as fees, investment choices, and state tax benefits can help determine the ideal plan for your family.

In Utah, the 529 tax benefit allows you to deduct contributions to your Utah 529 plan from your state income taxes. This feature enhances the appeal of the Utah College Education Trust Agreement, as it provides immediate savings while investing for education. By taking advantage of this tax benefit, you can maximize your savings and make a substantial impact on your child's educational future.

The Utah 529 plan consistently receives high Morningstar ratings, reflecting its strong management and diverse investment options. The Utah College Education Trust Agreement has been recognized for its performance and low fees, making it a valuable choice for families saving for education. By considering the ratings from independent evaluators like Morningstar, you can make more informed decisions about your investment.

To open a Utah 529 plan, you can visit the official website where the Utah College Education Trust Agreement is detailed. The process is typically straightforward and involves filling out an online application. You will need to provide personal information and select your investment options. If you require assistance, platforms like uslegalforms can guide you through each step to ensure a smooth experience.