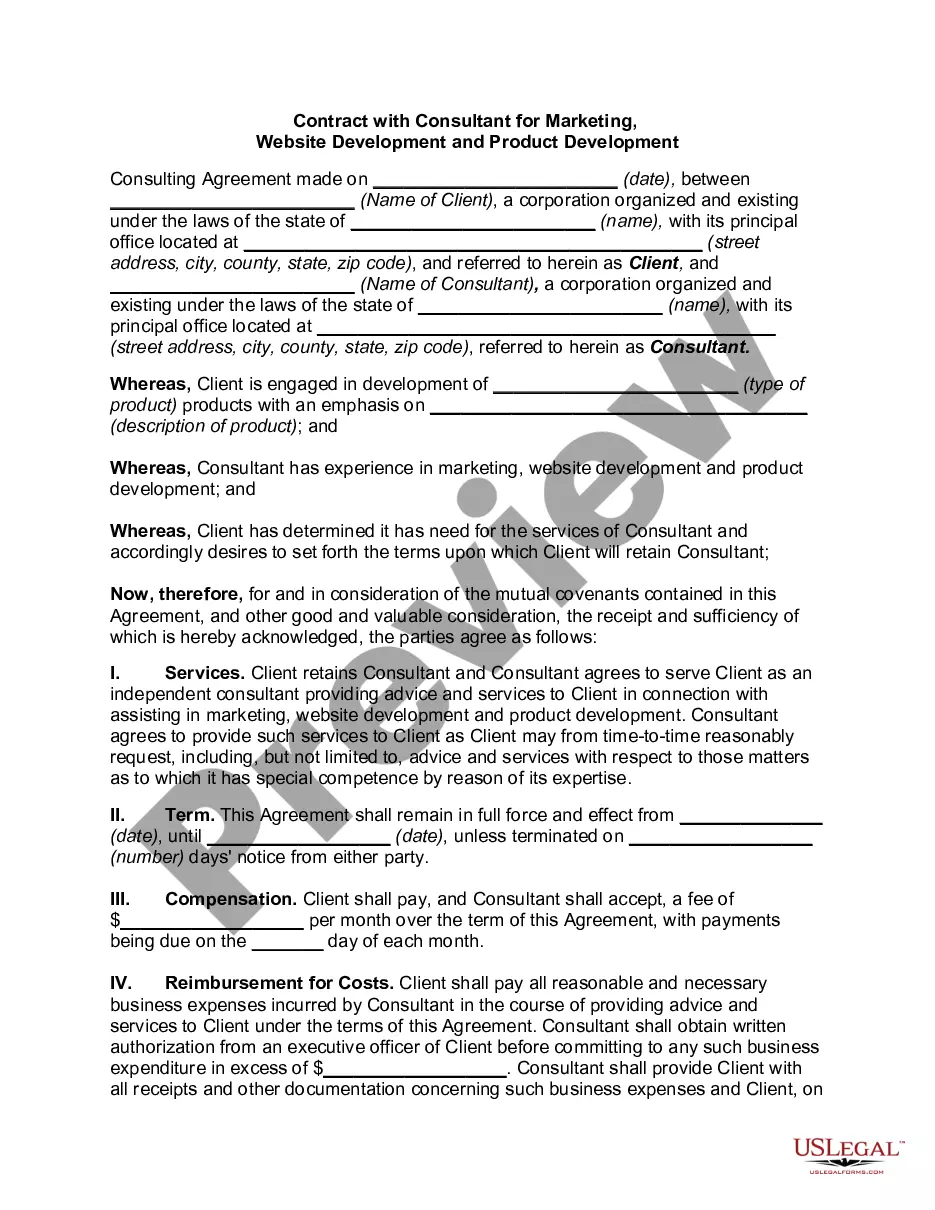

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

If you require to complete, download, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Leverage the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

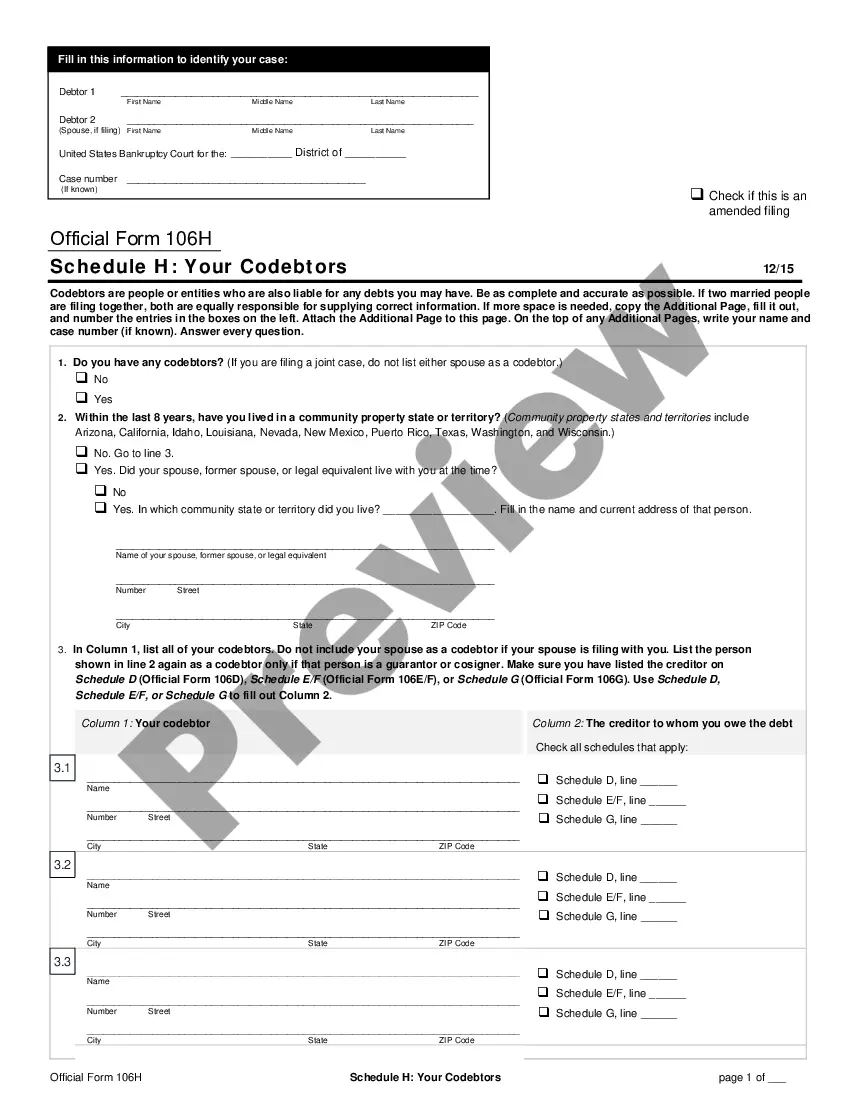

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Review option to browse through the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The current income beneficiary is the individual or entity receiving income from the trust during its term. In the context of the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding this role is critical for tax implications and the management of trust funds. It is important to review trust documents regularly to ensure compliance with current terms and responsibilities.

Income from a trust is typically distributed according to the terms set out in the trust document. This distribution can vary widely, especially when considering a Utah Assignment by Beneficiary of a Percentage of the Income of a Trust. Trust administrators must follow the guidelines in the trust to ensure accurate and timely distributions to beneficiaries.

Allocating trust income involves determining how income generated within the trust is distributed to beneficiaries. In relation to the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, this often requires careful planning and adherence to the trust's terms. It is wise to consult with financial advisors or use resources like uslegalforms to create a clear allocation strategy.

A common mistake parents make is failing to clearly specify distributions, which can lead to misunderstandings among beneficiaries. When contemplating a Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, it is vital to establish clear terms and expectations upfront. This clarity helps prevent family disputes and ensures that the fund operates smoothly for intended purposes.

Generally, the income generated by a trust is not taxable to the trust itself but is taxable to the beneficiaries. When dealing with the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, it's crucial to recognize that distributions to beneficiaries can shift tax liabilities. In most cases, the trust passes through its income to beneficiaries, who report it on their taxes.

Beneficiaries typically report trust income on their personal tax returns. When it comes to the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries must understand how distributions impact their tax obligations. Trust income is usually taxed at the beneficiaries' individual tax rates, making it essential to maintain accurate records and report that income properly.

Beneficiaries of a trust are generally taxed on the income they actually receive during the year. The taxation depends on the type of trust and whether the income is distributed or retained. With the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust, it’s vital to understand these tax implications for proper financial planning. To simplify your understanding, consider using USLegalForms, which offers resources tailored to trust taxation.

To report a beneficiary’s income from a trust, you need to use IRS Form 1041, which is intended for estates and trusts. The income distribution is usually reported on Schedule K-1, which goes to the beneficiary and the IRS. Understanding your responsibilities under the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust is crucial for accurate reporting. If you require assistance, USLegalForms can provide templates and guidelines to streamline this process.

The withholding rate for distributions made to foreign beneficiaries is typically set at a standard rate of 30% on certain types of income generated by the trust. However, tax treaties may adjust this rate, allowing for potential reductions. It’s essential to consider the implications of the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust when making these distributions. To ensure compliance, you might want to consult resources on USLegalForms designed for trusts.

In Utah, trusts that generate taxable income must make estimated tax payments under certain circumstances. When the trust's income exceeds a specified threshold, the trustee should calculate and submit these payments. It's important to stay compliant to avoid penalties related to the Utah Assignment by Beneficiary of a Percentage of the Income of a Trust. For detailed guidance, consider using USLegalForms to help manage your trust's tax responsibilities effectively.