An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

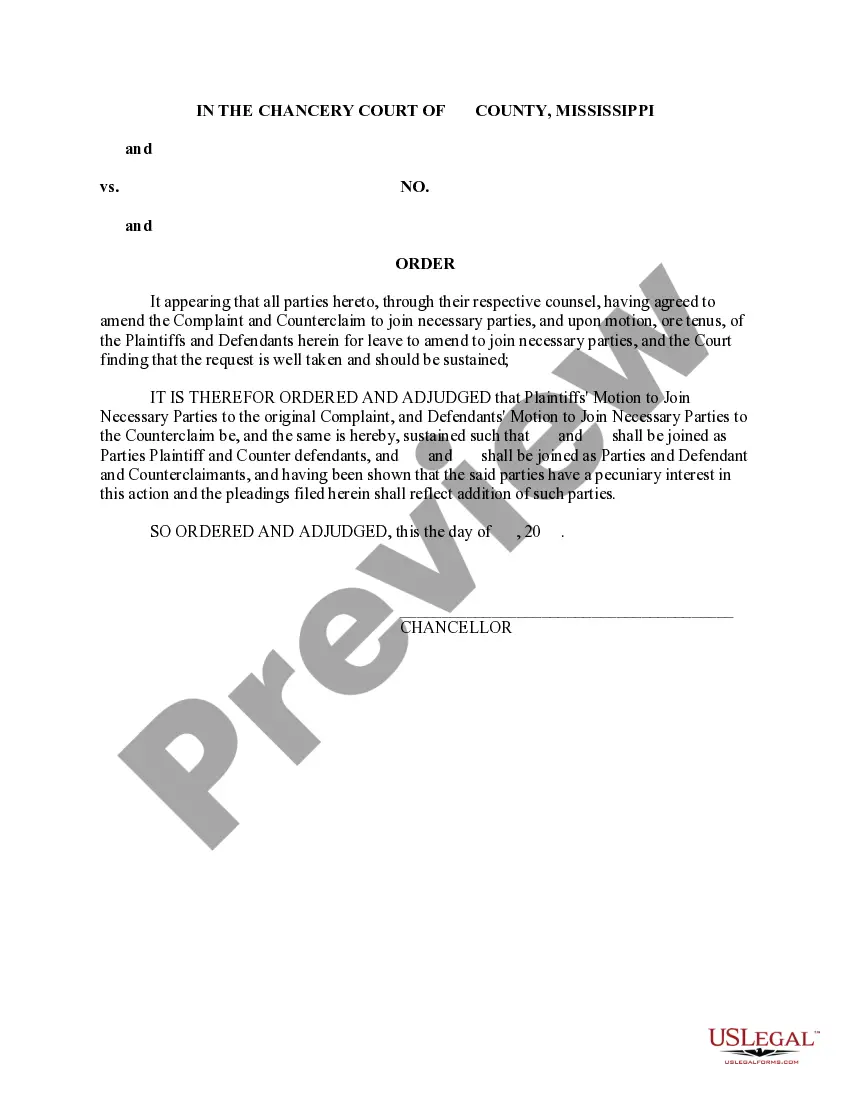

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

You can invest hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can effortlessly download or print the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary from our service.

First, ensure that you have chosen the correct document template for the region/area of your choice.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, print, or sign the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

- Each legal document template you obtain is yours permanently.

- To acquire an additional copy of a purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

The interest of a beneficiary under a trust is the legal right to benefit from the trust's assets. This includes receiving scheduled distributions or the right to the trust's remaining assets upon its termination. To ensure clarity around these interests, leveraging a Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a sound strategy, providing essential documentation and structure to the trust arrangement.

Beneficiaries' interests in a trust encompass various rights, including the right to receive distributions and the right to information regarding the trust's performance. These rights can vary based on the trust's terms and conditions. If you are in the process of establishing or modifying a trust, using a Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can effectively protect and outline these interests.

Beneficial interest in a trust refers to the entitlement of beneficiaries to benefit from the trust's assets and income. This interest is distinct from legal ownership, which remains with the trustee. By utilizing a Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, individuals can clarify and solidify the rights of the beneficiaries regarding their interests in the trust.

A significant mistake parents often make when establishing a trust fund is failing to clearly communicate their intentions and expectations to their heirs. This lack of transparency can lead to confusion or disputes later on. Therefore, it is vital to include a comprehensive Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure that the beneficiaries understand their rights and responsibilities regarding the trust.

A beneficiary interest in a trust refers to the right of an individual or entity to receive benefits from the trust. This generally includes the right to receive income generated by the trust assets or distributions of trust assets upon specific events, such as the trust's termination. Understanding the concept of beneficiary interest is crucial for anyone involved in the trust creation process, especially when drafting a Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

The new child custody law in Utah emphasizes the importance of co-parenting and the child's best interests. The changes aim to create a more equitable framework for custody arrangements. Understanding how these laws interact with trusts, especially in terms of the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, is crucial for parents seeking to secure their children's future.

In Utah, driving without registration can result in fines and potential legal consequences. The exact penalty depends on the circumstances of the violation, but typically involves a monetary fine. Staying compliant with state vehicle laws, including registration, can prevent complications that may affect your obligations under trusts, including those involving the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Utah Code 57-1-31 addresses the methods for conveying trust deeds and the process of trust notifications. This code ensures transparency and accountability in trust transactions. If you are considering the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, knowing these methods will help you navigate the legal landscape more effectively.

Utah Code 57-1-38 specifically governs the responsibilities and limitations of trustees in managing trust assets. It ensures that trustees act in the best interest of the beneficiaries while adhering to the terms of the trust. Understanding this code is critical for those involved in the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as it impacts trust management and beneficiary rights.

Utah Code 57-1-32 addresses the rights and responsibilities of beneficiaries under a trust. This code provides essential guidelines on how beneficiaries can manage and protect their interests. Familiarizing yourself with the Utah Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help ensure that your rights are upheld in any legal transactions.