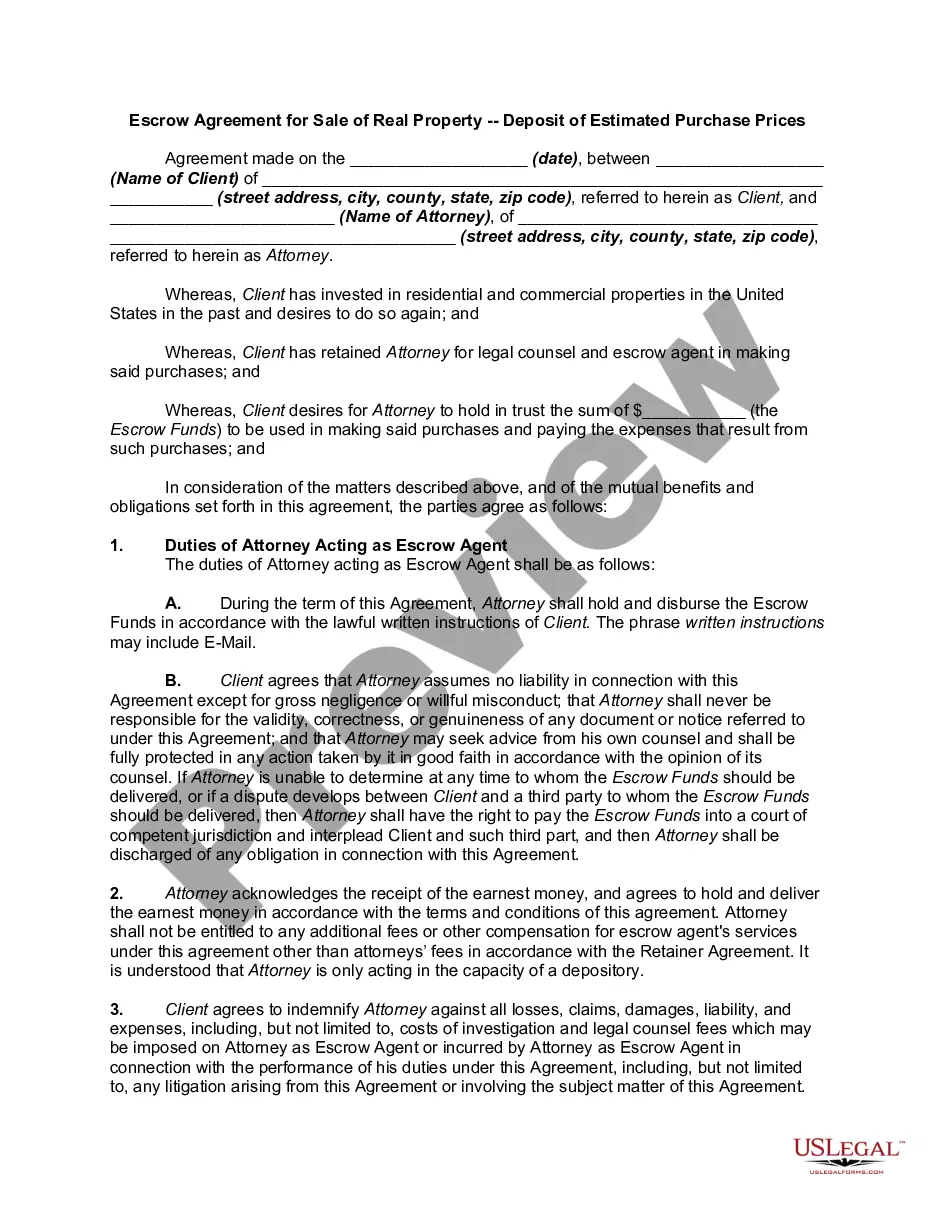

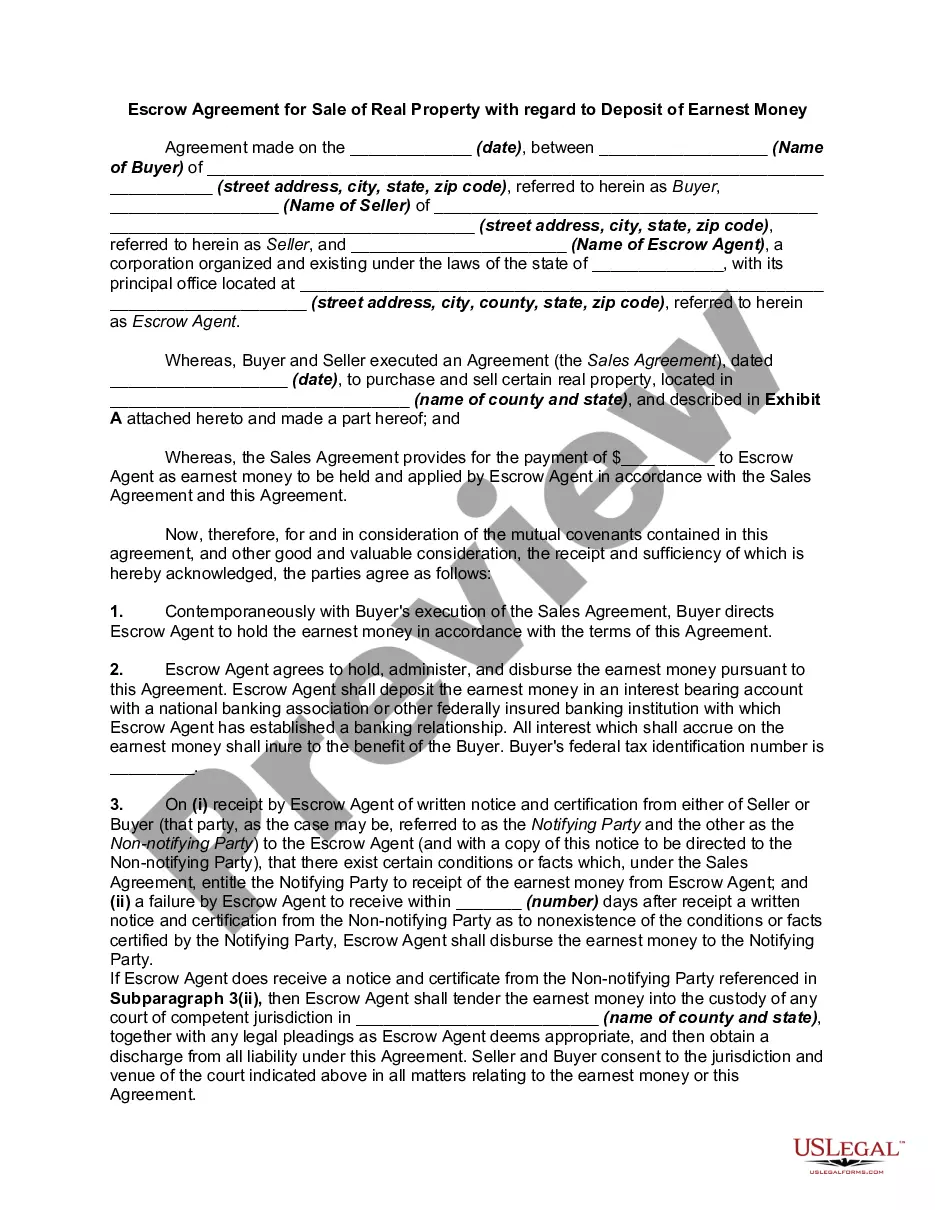

An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow in this form is to protect the purchaser of real property from having to pay for a possible defect in the real property after the sale has been made.

Utah Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action

Description

How to fill out Escrow Agreement For Sale Of Real Property And Deposit To Protect Purchaser Against Cost Of Required Remedial Action?

US Legal Forms - one of the largest collections of valid templates in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can locate the latest versions of documents such as the Utah Escrow Agreement for Sale of Real Property and Deposit to Safeguard Buyer Against Cost of Required Remedial Action in just a few minutes.

If you already have a subscription, Log In and download the Utah Escrow Agreement for Sale of Real Property and Deposit to Safeguard Buyer Against Cost of Required Remedial Action from your US Legal Forms collection. The Download option will appear on each document you view. You can access all previously saved forms in the My documents section of your account.

Next, select your preferred pricing plan and provide your details to create an account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your region/area.

- Choose the Preview option to review the document's details.

- Read the document description to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

Form popularity

FAQ

To obtain an escrow license in Utah, you must complete a formal application process through the Utah Department of Financial Institutions. This process typically requires submitting your personal information, proof of financial stability, and any necessary business documentation. Additionally, you may need to meet certain education and training requirements. By ensuring you meet all these qualifications, you can successfully navigate the licensing process.

Here's how to hold money in escrow:The buyer and seller agree to the terms of the transaction.Payment is sent to the escrow company.Seller ships the goods or provides the service to the buyer.Buyer accepts the goods or services.More items...

The escrow instructions define the events and conditions that must take place and the manner in which the escrow agent shall deliver or release to the beneficiary of the escrow the assets, documents, and/or money held in escrow. The escrow instructions are commonly contemplated by the escrow agreement.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

Reasons you can lose earnest money Two scenarios that may lead to the forfeiture of your good faith deposit are: Waiving your contingencies. Financing and inspection contingencies protect your earnest money if your mortgage doesn't go through or the house is beyond repair.

Escrow is the use of a third party, which holds an asset or funds before they are transferred from one party to another. The third-party holds the funds until both parties have fulfilled their contractual requirements.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

Earnest Money But what if your Buyer wants to place it into a title company's trust account instead? This is totally legal in the state of Utah. People can debate over which method they prefer, but that's not the point.

Is escrow safe? Escrow is generally a very secure process. However, one of the biggest risks in this process today is wire and escrow fraud. Hackers and cyber criminals have been increasingly targeting real estate agents and their clients due to the large sums of money in escrow.