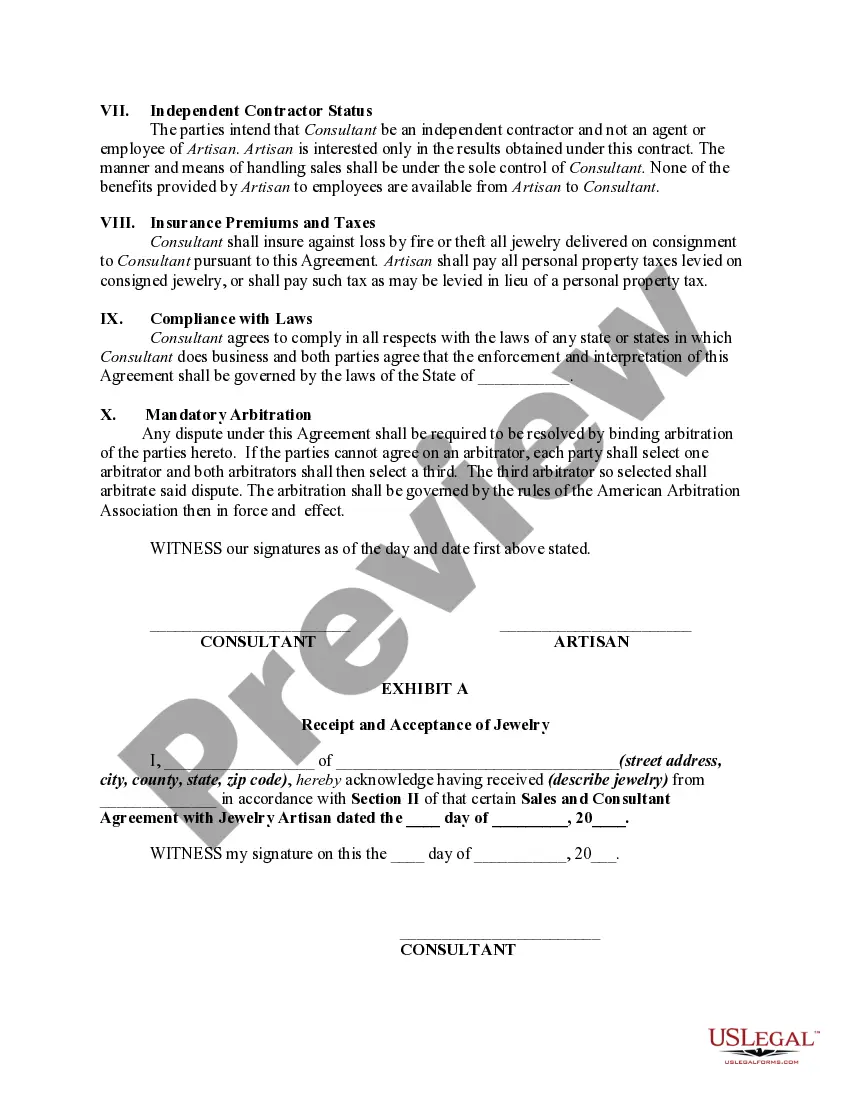

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Utah Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

Selecting the most suitable authentic document template can be challenging.

Clearly, there is a plethora of designs accessible online, but how can you locate the genuine form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your region/state. You can preview the document using the Preview option and review the document details to confirm it is the right one for you.

- The service offers a multitude of templates, including the Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, which can be utilized for business and personal purposes.

- All of the forms are verified by experts and comply with both state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Utah Sales and Marketing Consultant Agreement with Jewelry Artisan.

- Access your account to view all legitimate forms you have previously obtained.

- Visit the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

Yes, Utah has a system in place for online sales tax collection. Businesses selling products or services online must comply with Utah sales tax laws, including those operating under a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan. By understanding these regulations, you can ensure a smooth operation and avoid potential penalties.

In Utah, most professional services are not subject to sales tax. However, it's important to evaluate the specific services you provide under a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan. Consulting with a tax expert can help clarify which services may be taxable and how to proceed properly.

The frequency of filing sales tax in Utah typically varies based on your sales volume. Most sellers file annually or quarterly, but monthly filing may be required for high-volume sales. If you have a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, be sure to check the specific filing frequency that applies to your situation to remain compliant.

Utah Code 59-12-104 pertains to the sales tax regulations in the state. It details the collection of sales tax from certain sales transactions, including those governed by a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan. Understanding this section can help you navigate your tax responsibilities more effectively.

To file Utah sales tax online, you need to visit the Utah State Tax Commission's website. Once registered for an account, you can submit your sales tax return electronically. This process can be beneficial for individuals involved in a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, as it simplifies tracking and paying sales tax.

Yes, Utah provides an efile option for taxpayers. You can file your taxes online conveniently using the forms provided on the Utah State Tax Commission website. Utilizing the efile system can streamline the filing process, especially for those engaged in a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, making it easier to manage tax obligations.

Yes, if you earn income in Utah, you are generally required to file state taxes. This applies to income earned through a Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, as well as other sources of income. It is important to keep track of your earnings and consult with a tax professional to ensure compliance with Utah tax laws.

A sales agreement formalizes the sale of products or services by outlining the terms, conditions, and responsibilities of each party involved in the transaction. This document serves as a legal record that protects both the seller and the buyer by clearly stating the obligations and rights. A well-structured Utah Sales and Marketing Consultant Agreement with Jewelry Artisan often incorporates a sales agreement to streamline the sales process and mitigate risks.

A sales and marketing SLA requires the sales team to follow specific protocols for responding to leads and nurturing potential clients. It sets guidelines for lead quality, communication, and follow-up processes to enhance efficiency. By including such details in your Utah Sales and Marketing Consultant Agreement with Jewelry Artisan, you help foster unity between teams and boost sales success.

A Service Level Agreement (SLA) in marketing establishes measurable commitments between the marketing and sales teams. It outlines specific performance metrics, such as lead response times and conversion rates, ensuring accountability and alignment. Integrating an SLA into your Utah Sales and Marketing Consultant Agreement with Jewelry Artisan can drive better collaboration and improve overall results.