Utah Waiver of Lien

Description

How to fill out Waiver Of Lien?

If you want to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal templates available online.

Take advantage of the website's user-friendly and efficient search to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Utah Waiver of Lien in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each template you acquired within your account. Click the My documents section and select a template to print or download again.

Complete, download, and print the Utah Waiver of Lien with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms client, Log In to your account and click on the Download button to obtain the Utah Waiver of Lien.

- You can also access documents you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

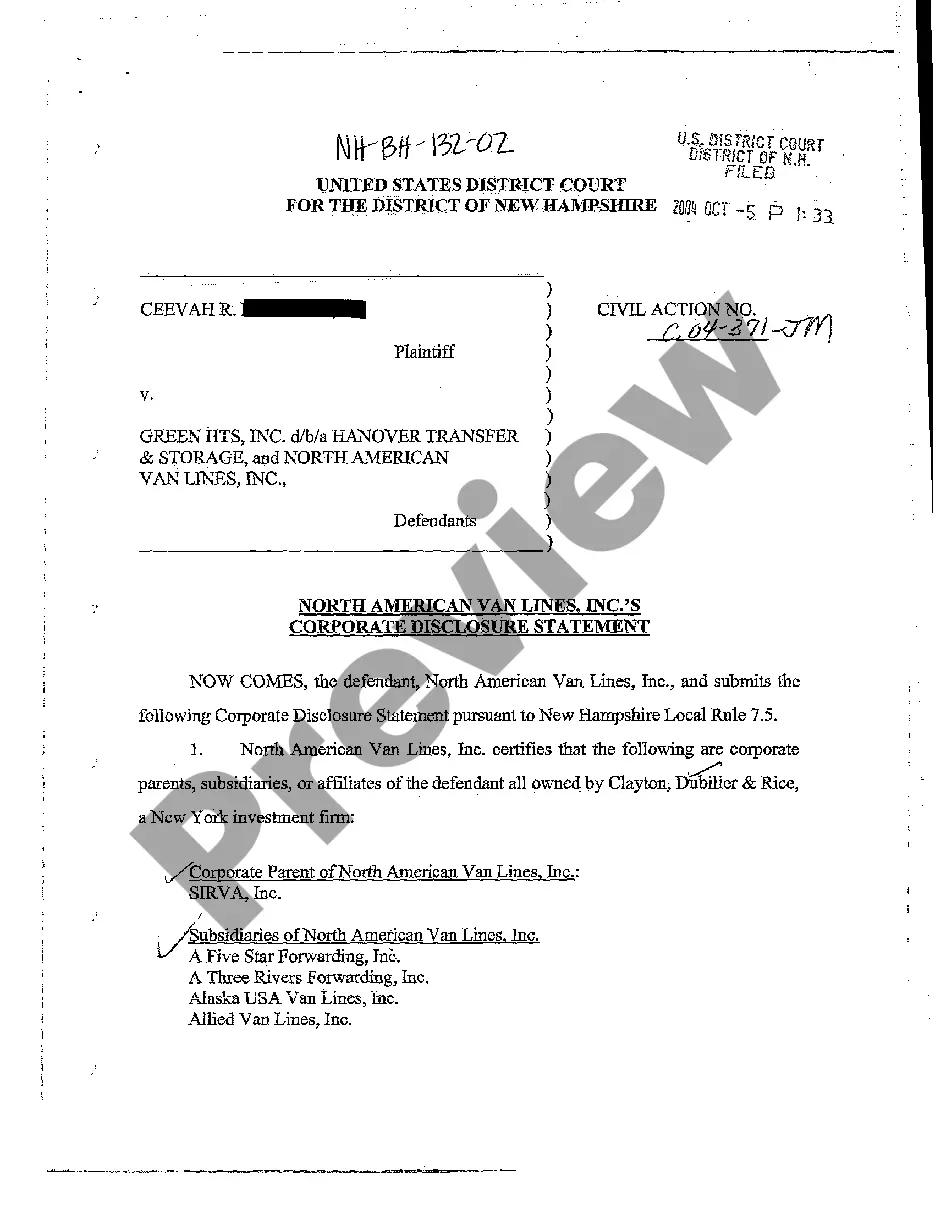

- Step 2. Use the Preview feature to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your information to sign up for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Utah Waiver of Lien.

Form popularity

FAQ

A lien is a legal claim or right against a property that ensures a debt or obligation is satisfied. In the context of construction, the Utah Waiver of Lien refers specifically to the waiver that contractors or suppliers may sign to relinquish their right to file a lien against a property in exchange for payment. Understanding the concept of a lien is crucial for anyone involved in real estate or construction projects. By using the Utah Waiver of Lien, you can ensure smooth transactions and protect your interests.

An unconditional release in lien agreements indicates that the claimant relinquishes their right to file a lien, assuming payment has been received. This type of release often serves to simplify transactions and offer peace of mind. In terms of the Utah Waiver of Lien, ensuring you have the correct release document is vital to protect your investments.

In Texas, a lien waiver form serves to release a claimant's right to file a lien against a property for unpaid labor or materials. The nuances of Texas lien waivers can differ from other states, such as Utah. For those navigating the Utah Waiver of Lien, understanding regional differences is essential to mitigate risks.

A lien waiver form is used to relinquish the right to make a claim against a property for unpaid debts. This form alleviates concerns for property owners and contractors regarding lien claims. By using the Utah Waiver of Lien, you protect your interests effectively.

Conditional lien waivers protect both parties by ensuring that payment has been received before the waiver is effective. In contrast, unconditional lien waivers assume that payment has already occurred, relinquishing any claims. Understanding these distinctions is crucial when dealing with the Utah Waiver of Lien.

In California, lien waivers generally do not need to be notarized. However, certain projects or agreements may require notarization for added security and formality. As you consider the Utah Waiver of Lien, it’s wise to check local requirements that may differ from California guidelines.

Yes, Utah provides statutory lien waivers designed to protect parties involved in construction transactions. These waivers help clarify payment obligations and ensure that contractors cannot claim a lien after receiving payment. Utilizing such waivers can greatly streamline the construction payment process.

A waiver of lien refers to the voluntary relinquishment of the right to claim a lien against a property. In the context of Utah Waiver of Lien, it is a tool used by contractors to inform property owners that they will not pursue a claim for payment after receiving specified funds. This practice promotes trust and clarity in property transactions.

An unconditional release waiver is a specific type of waiver that confirms a contractor will not pursue any future claims against a property after receiving payment. This is vital for ensuring that property owners can be confident about their financial obligations. In Utah, utilizing unconditional release waivers can protect both parties in construction contracts.

Many states across the U.S. have adopted statutory lien waiver forms, including Utah. These forms provide a standardized method for contractors and property owners to manage payments and claims. Utilizing these forms can significantly simplify the lien process and enhance legal compliance.