Utah Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

You can allocate time online searching for the legal document template that fulfills the state and federal criteria you need.

US Legal Forms provides thousands of legal documents that are evaluated by experts.

You can effortlessly download or generate the Utah Accounts Receivable - Guaranty from our platform.

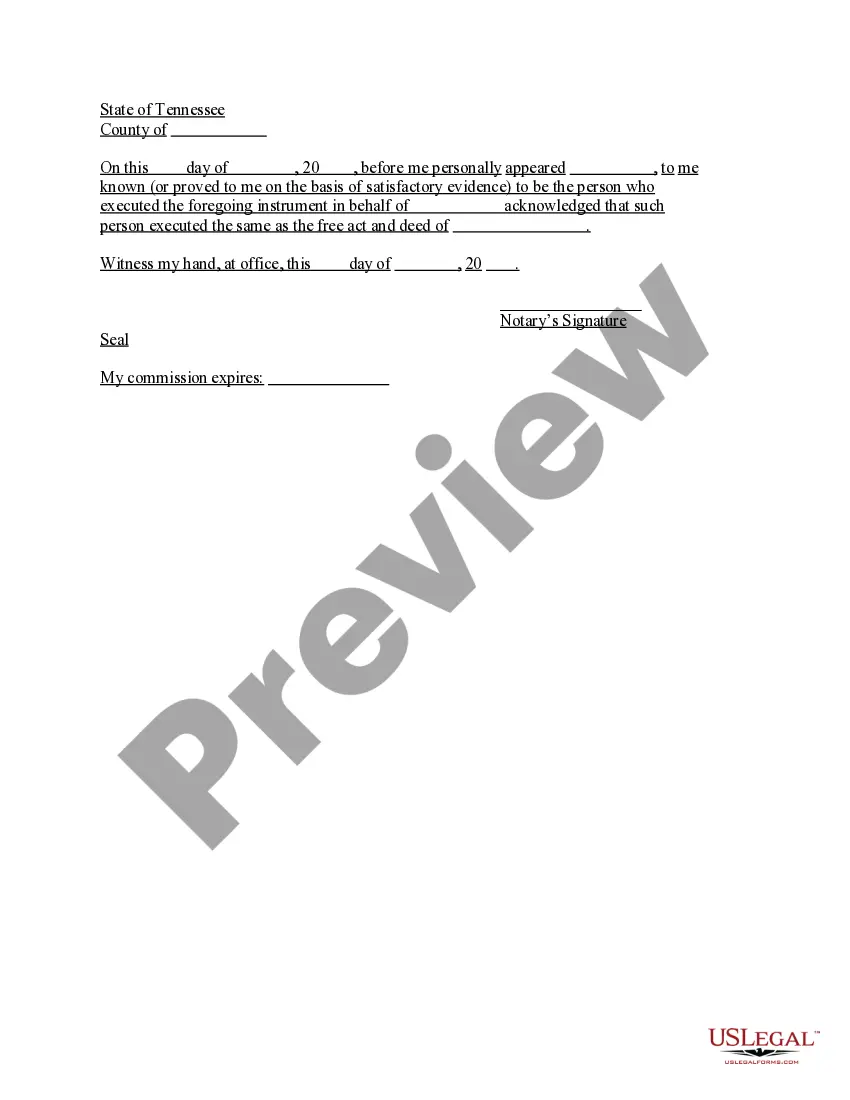

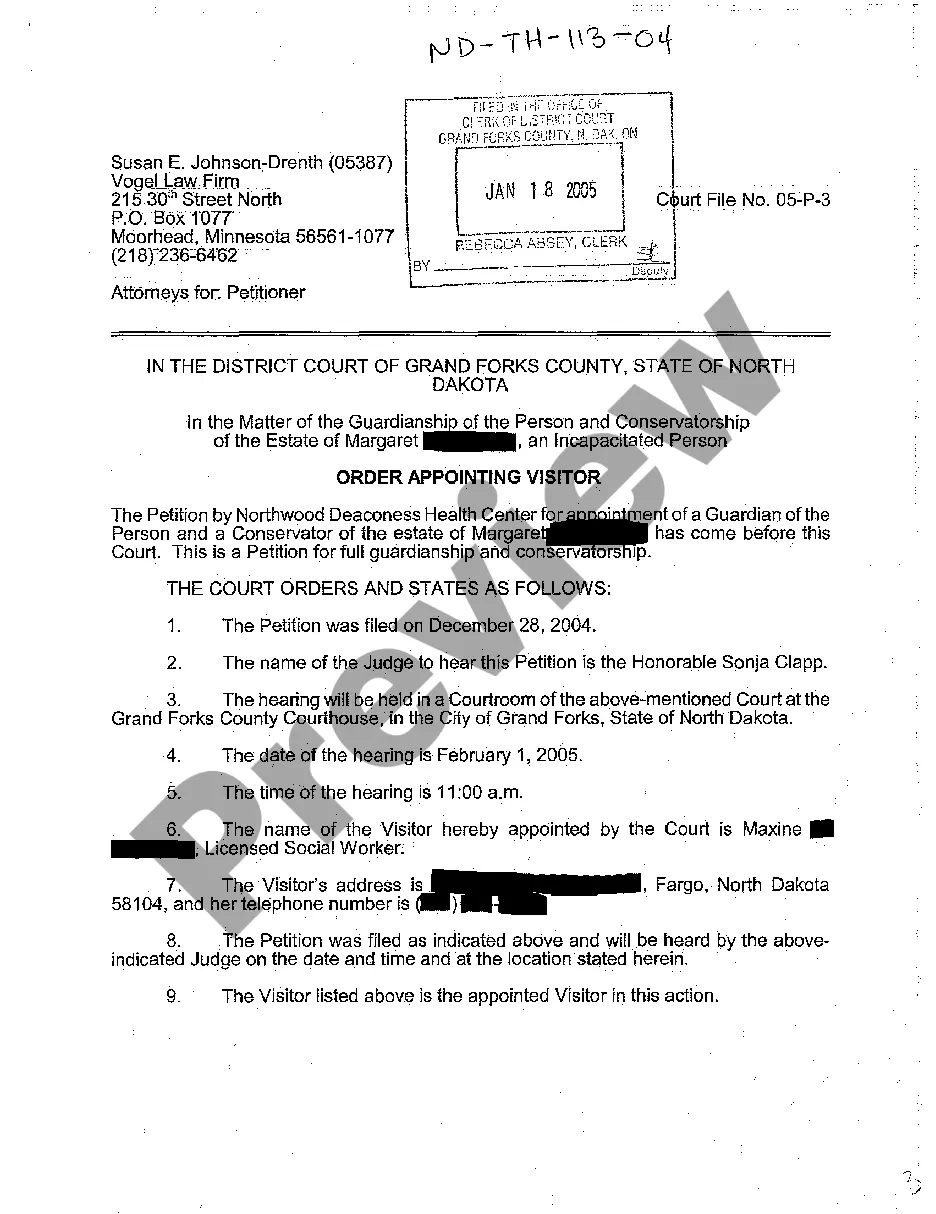

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, produce, or sign the Utah Accounts Receivable - Guaranty.

- Every legal document template you obtain is your own forever.

- To get another copy of any acquired form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/area of preference.

- Read the form description to make certain you have chosen the right form.

Form popularity

FAQ

Filing a UCC involves completing a UCC-1 form and submitting it to the appropriate state authority, typically the Secretary of State's office. You will need to provide details such as the debtor's name and the collateral, which can include your Utah Accounts Receivable - Guaranty. For a seamless experience, you can rely on US Legal Forms to help you navigate the filing process and ensure everything is completed accurately.

If you fail to file a UCC, you risk losing your priority over the debtor's assets, including their Utah Accounts Receivable - Guaranty. Without this filing, other creditors may secure their interests first, which can affect your ability to collect on debts. To avoid such complications, consider using US Legal Forms to guide you through the filing process and protect your financial interests.

1 filing typically lasts for five years from the date of filing. However, if you want to maintain your security interest beyond this period, you must file a continuation statement before the initial five years expire. This process is essential for protecting your Utah Accounts Receivable Guaranty. By staying proactive, you can ensure your interests remain secure.

Utah form TC 40 is a tax return form used by residents to report personal income and calculate taxes owed. This form is essential for ensuring compliance with state tax laws, and it plays a significant role in your Utah Accounts Receivable - Guaranty. You can easily obtain and file this form through the Utah State Tax Commission's website or by utilizing resources from platforms like USLegalForms to simplify the process.

Setting up a tax payment plan in Utah is a straightforward process. You will need to contact the Utah State Tax Commission to discuss your situation and the amount owed. They typically require a detailed financial disclosure, and having your Utah Accounts Receivable - Guaranty documentation handy can streamline the process and help you negotiate a manageable payment plan.

The Utah state number is a unique identifier assigned to businesses for tax purposes. This 14-digit number is essential for managing your Utah Accounts Receivable - Guaranty effectively. You can find this number on your business tax registration documents or by contacting the Utah State Tax Commission for assistance.

In Utah, a notice of claim must include specific information such as the name of the creditor, the amount owed, and details about the debt. This notice should be sent to the debtor, providing them with the opportunity to respond or settle the claim. Properly crafting a notice of claim is essential to ensure enforceability. For support in preparing your notices, look into the resources available for Utah Accounts Receivable - Guaranty.

Debts in Utah typically become uncollectible after four years, as set by the statute of limitations. This timeline starts from the last payment or acknowledgment of the debt. Understanding these timeframes can help you manage your finances more effectively. For expert assistance with your Utah Accounts Receivable - Guaranty, consider utilizing platforms like USLegalForms.

Yes, in Utah, Individual Retirement Accounts (IRAs) are generally protected from creditors. This protection helps ensure that your retirement savings remain intact, even in the case of a debt collection. It's important to be aware of these protections when considering your financial planning. For more detailed guidance on your specific situation, consider exploring resources related to Utah Accounts Receivable - Guaranty.

A debt becomes uncollectible once the statute of limitations expires, which is usually four years in Utah. However, factors like bankruptcy can also affect collectibility. If a debtor files for bankruptcy, the debt may be discharged, making it uncollectible. For managing your accounts, it's essential to keep track of these timelines to protect your interests in Utah Accounts Receivable - Guaranty.